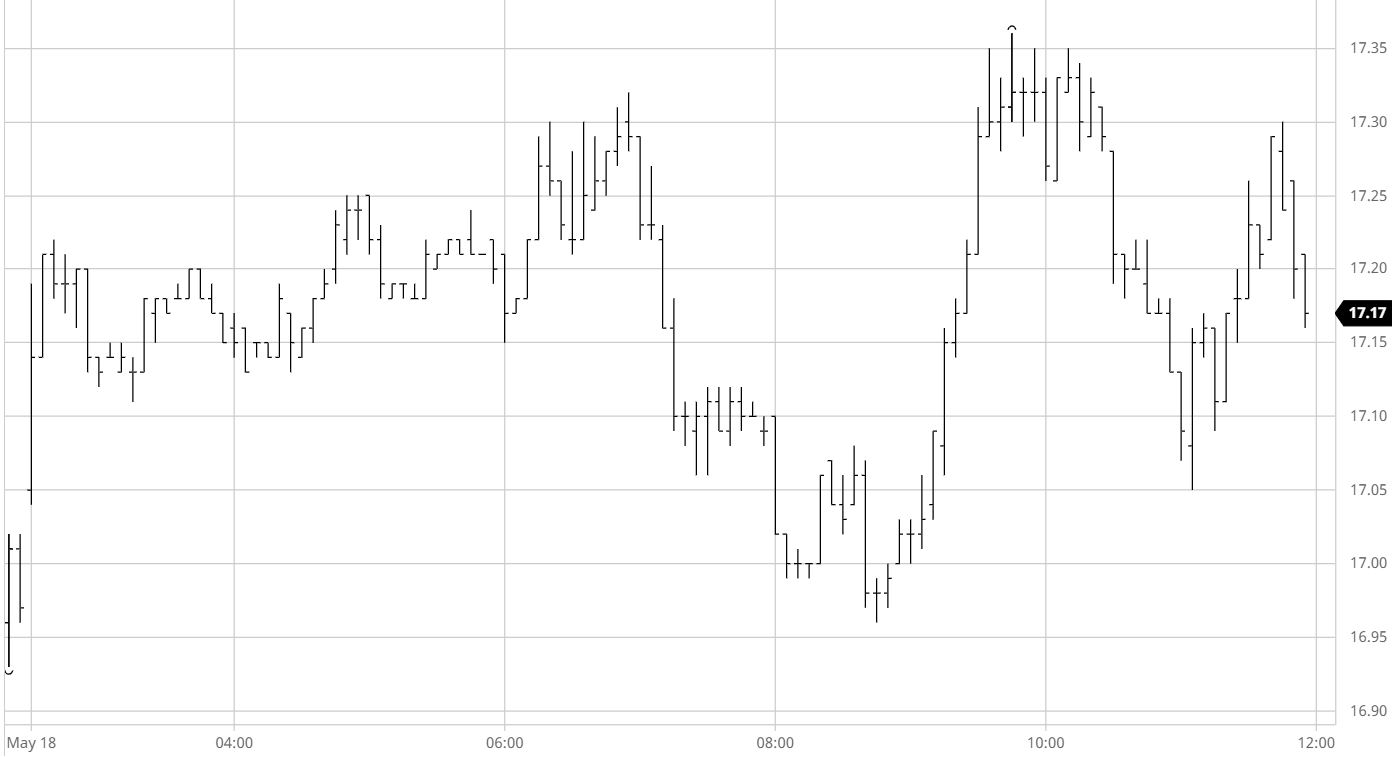

Sugar #11 Jul’21

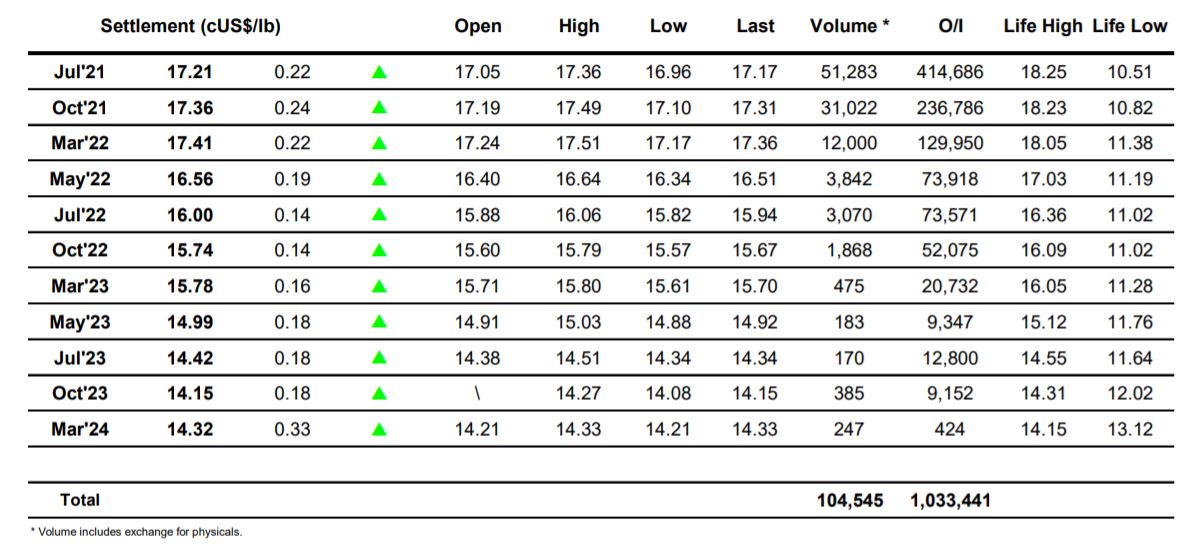

Macro positivity on the back of a weakening USD was providing a higher call and though morning trading was rather quiet and unspectacular we managed to steadily build upon the initial gains to reach the 17.30 area ahead of the US morning. Any longs harbouring hopes that the funds would build upon this platform were dashed as selling emerged to send prices back towards the opening lows, and with some light liquidation from day traders following in reaction we saw the market move into a small negative with a low recorded at 16.96. The decline had been unexpected in the context of the macro but having set a lower tone so too was the sharp recovery that followed with day traders and algo’s pushing in some new longs while also forcing any shorts to be whipped back out of their positions as Jul’21 pushed quickly to new session highs in the 17.30’s. These levels held for a while however with a reluctance from the specs to chase any further north so the market cooled once more and headed back to the low 17’s against some long liquidation. Volume picked up to better levels than recent days though this was largely down to the spreads with Jul/Oct’21 seeing more than 20,000 lots change hands though not moving by very far from its starting value of -0.14 points. The final hour saw values continue within the range, ultimately ending the day firmer at 17.21 but doing little to suggest that without macro direction we wont simply see more of the same in the coming days.

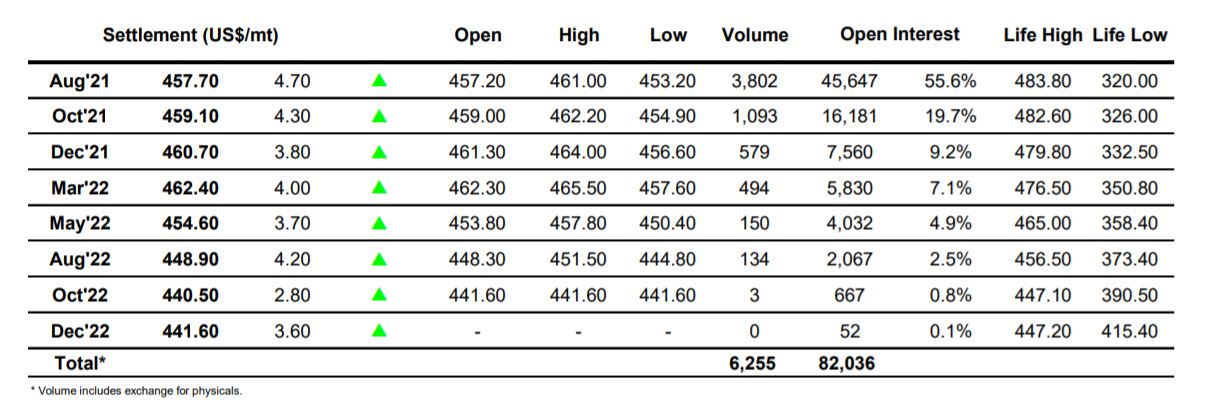

Sugar #5 Aug’21

The market gapped higher on the intra-day charts with a firm opening up to $459.00 and then settled down to quietly consolidate these gains, supported by a weaker dollar and resultant strength across the entire macro. In slow trading there was no change until our early afternoon when the start of the US day drew in a little selling which set us on a gradual retreat to fill in the overnight gap. For a while the retreat suggested that the market was unwilling to follow the macro herd however having filled the gap a sharp turnaround suggested otherwise with a 30 minute surge taking Aug’21 to a new session high at $461.00 before pausing. Having stalled the lack of sizable buying then led values to slide back into the range and on continuing low volumes we remained this way for the rest of the afternoon, eventually ending positively at $457.70 for Aug’21. With spreads little changed on the day the whole thing session like a rather choppy non-event which leaves the market looking set to continue broadly sideways.

White premium values were a little lower to end the day with Aug/Jul’21 at $78.25, Oct/Oct’21 at $76.50 and March/March’22 at $78.50

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract