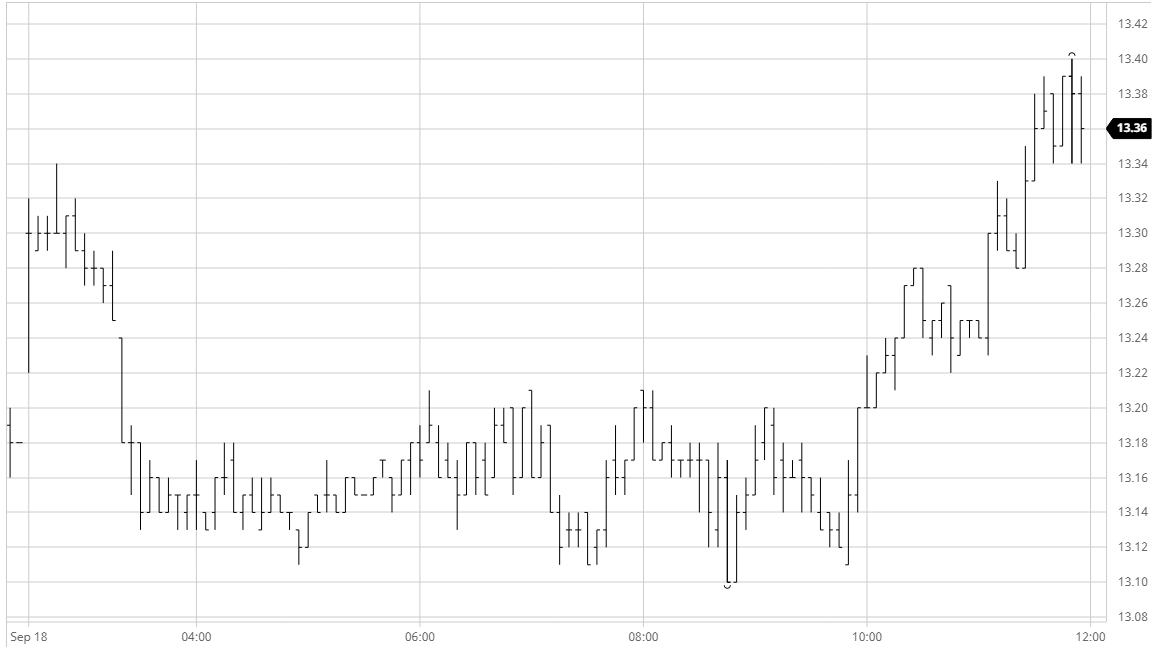

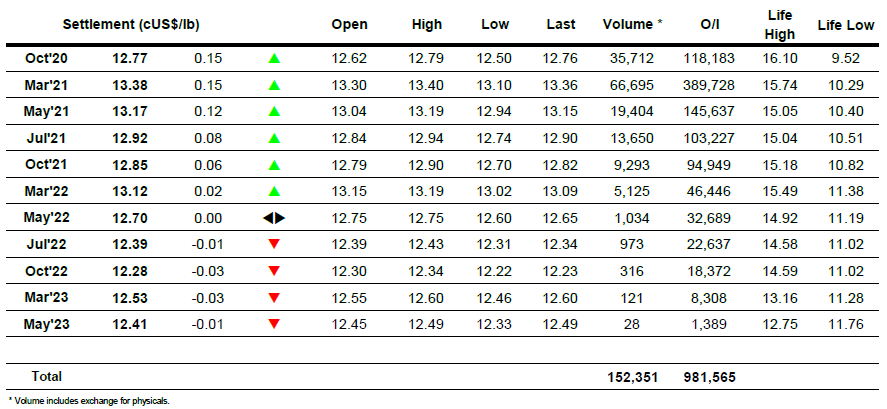

Initial stability saw March’21 pushing up above 13.30 however as the buying began to dry up so prices found a bit of a vacuum beneath and slipped back into deficit. A long period of very slow sideways action then ensued which lasted long into the afternoon, many of the longs seemingly happy to consolidate the gains ahead of the weekend and proving reluctant to push upward into the overhead producer selling. The situation only changed during the final couple of hours as some fresh spec and algo interest appeared to take prices upwards once again and ensure a strong technical conclusion to the week, working through the morning highs to reach 13.40. The spreads meanwhile remained far calmer than recent days with Oct/March continuing in a tight range either side of -0.60pts throughout. Producer selling did limit the move to the same area which provided congestion at the back end of August, the weakening USDBRL back towards 5.35 potentially encouraging more selling in from the producers for 2021 positions. The positive technical close provides a platform for the specs to try higher towards the August highs once again, but with producer returns improving on the currency move it will be interesting to discover their appetite for the push next week.

Mar 21 – Sugar No.11

There was early buying for the market as traders looked to maintain the recent strength with an immediate push upwards however the buying soon faded and prices slipped quite quickly with Dec’20 not finding any real support until the 366.00 area. A long period of sideways action then ensued as prices struggled to break far away from the lows with both spreads and white premiums also remaining quiet and holding narrow trading bands, near to parity for the Dec/March spread while the Dec/Oct WP was trading back beneath $90. After such a strong technical recovery over the course of the week the specs bided their time before stepping back in to haul the market back upwards during the final couple of hours, with their action taking prices back upwards towards the morning highs. Settlement was established a dollar beneath the morning high at 371.50, providing a positive conclusion that the longs with no doubt look to build upon next week.

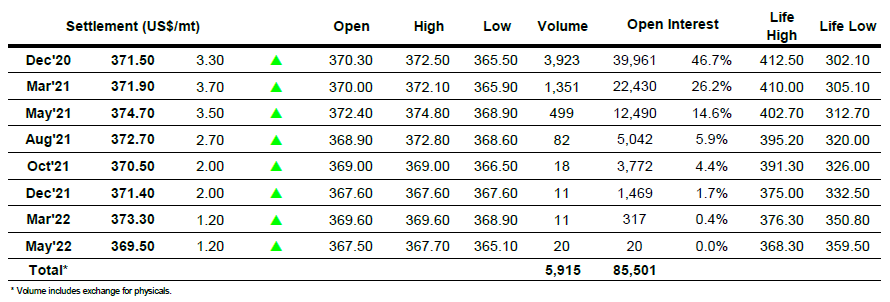

Dec 20 – White Sugar No 5

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract