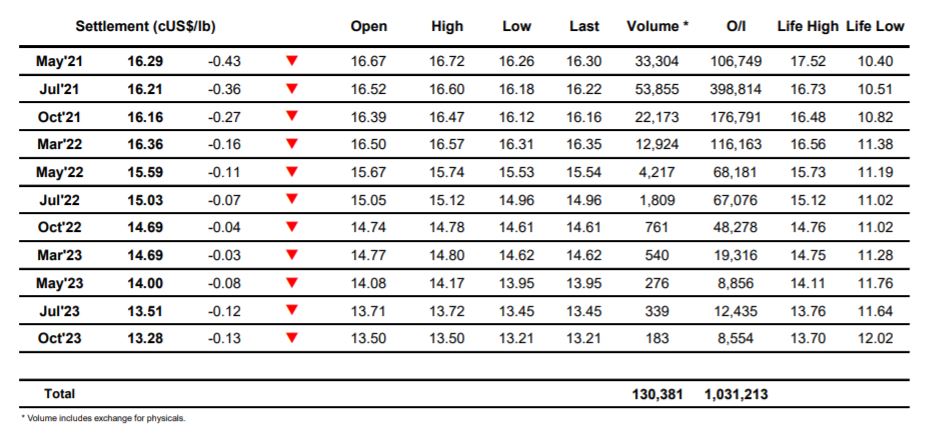

Sugar #11 Jul’21

A choppy opening saw Jul’21 slip as low as 16.44 however buying quickly emerged and the early stages were then played out very near to unchanged levels. Another dip followed that sent the price back to 16.39 and though we again stabilised the market was now holding closer to 16.50 with some selling for nearby spreads preventing prices from moving back into credit. The macro was generally quiet and with the COT showing that as at last Tuesday the net speculative long had risen to 169,711 lots (and with a good deal more added between Wednesday and Friday) there was less impetus from the specs, maybe an indication that we have done enough for the time being, or at least until the overbought technical are allowed some cooling. The subsequent sideways pattern which continued well into the afternoon suggested the whole day would remain one of featureless consolidation so it was with some surprise that we experienced a sharp correction down to 16.18 as some long liquidation took place from the shorter term speculators. The decline sent the already weaker spreads in a little further with May/Jul’21 reaching back into 0.07 points while Jul/Oct’21 was slightly harder hit as it moved all the way back into 0.05 points. Buying crept back in to pull values away from the lows and it seemed that we would end mid-range until a burst of MOC activity sent us back down to match the earlier 16.18 mark and ensure the first truly negative conclusion for a couple of weeks. Whether this leads to further correction remains to be seen however the nature of today’s spread action certainly suggests a cooling of the upside for the time being.

Sugar #5 Aug’21

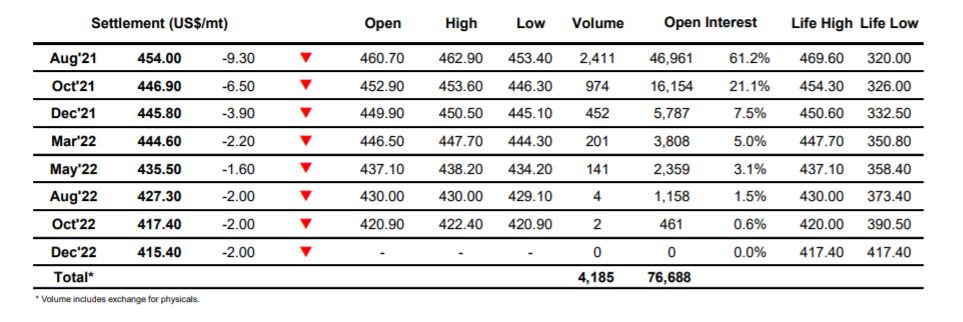

The session commenced a little lower and following on from the dramatic gains achieved over the last week or so we encountered further selling which sent Aug’21 down to $457.60 over the course of the first hour. This weakness impacted upon the nearby spreads and premiums which were between $1 and $2 lower than overnight values, however gradually some light buying did begin to emerge to stem the decline and enable values to stabilise in the lower half of the morning range. With so little volume and a quiet macro we relied upon the No.11 to get things going but though we saw a brief push upward early in the afternoon it lack substance and we soon resumed the sideways pattern once more. An unexpected push lower midway through the afternoon increased activity as some of the recently added spec longs headed for the exit, while at the same time it also drew in increased selling for the nearby spreads with Aug/Oct’21 losing ground and trading in to $7. An attempt at consolidation followed however any recovery was undone during the closing stages with aggressive MOC selling pushing Aug’21 down to $453.40 with a settlement level established just above at $454.00. Essentially this merely undoes Friday’s gains and gives the market opportunity to unwind some overbought indicators though the weaker spreads and white premiums may suggest a lack of continuing upside confidence which could lead to further cooling/consolidation.

As mentioned the nearby white premium values were a little weaker today with Aug/Jul’21 ending at $96.60 and Oct/Oct’21 at $90.50, though Mar/Mar’21 regained Fridays losses to end near to $84.00.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract