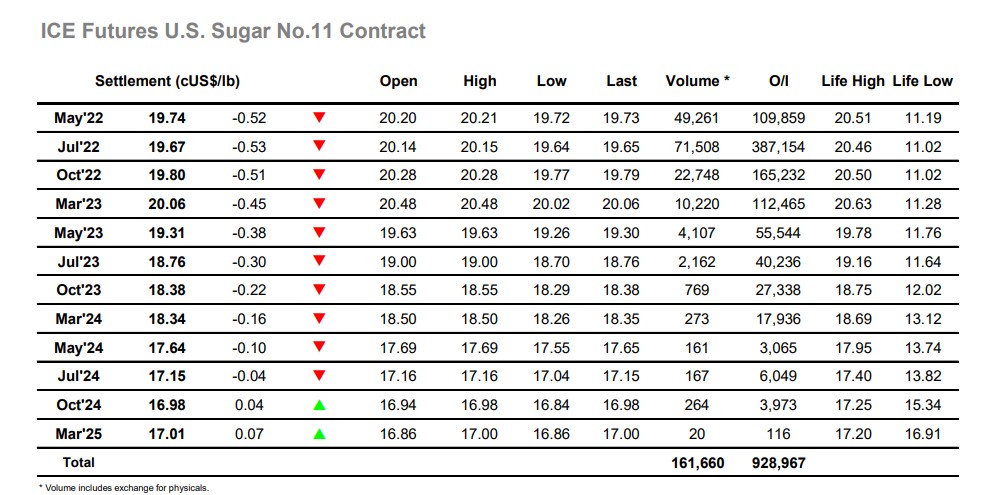

A 55k jump in the raw sugar net speculative position to 187k lots was enough to push the market lower today. This figure represents the market as at close of business last Tuesday where we settled at 20.2c/lb, roughly where the market opened today. With the increase in speculator buying clear for all to see, after a brief period of rangebound trading the market broke lower and by mid-morning we began to test the 20c mark. Three consolidated pushes of selling across the afternoon were enough to force the market lower, and we finally closed the day 52pts lower in the spot May’22 contract at 19.74. Continued strength in both the BRL (4.67) and global energy markets (crude at $107) puts Brazilian ethanol parity at over 25c sugar equivalent, however, being in off crop and with the trade flows currently showing as oversupplied the dip lower could be a sign that the market is attempting to resolve the surplus. Port congestion in Santos could be key to the short term movement in prices and availability, more can be read in the article here