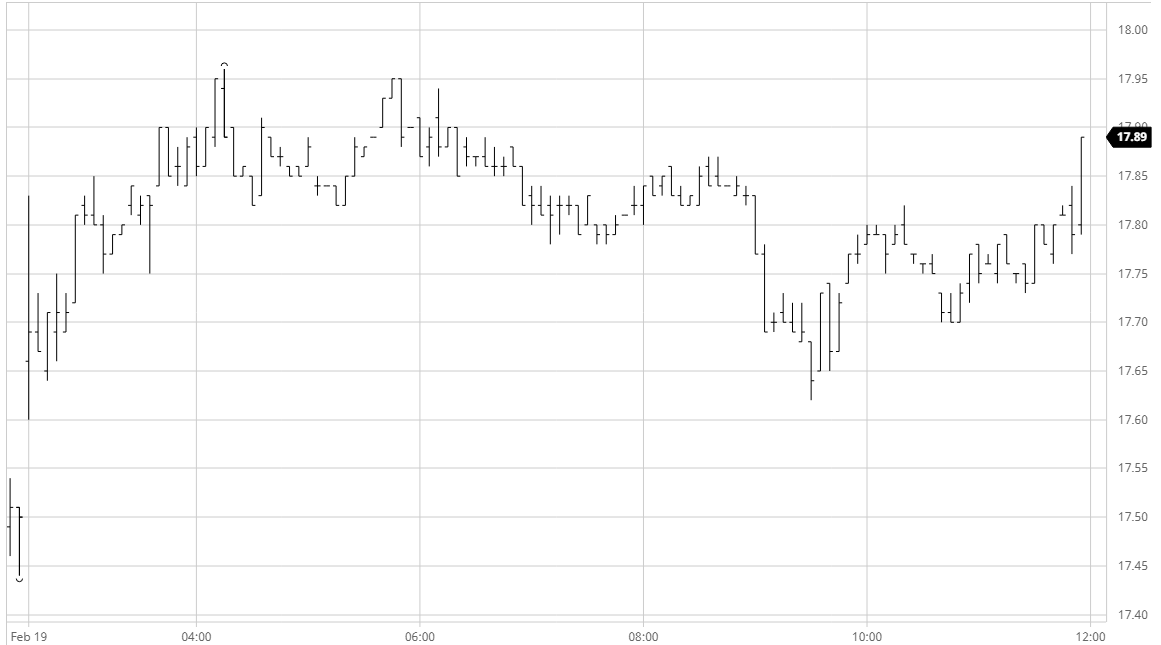

Sugar #11 Mar’21

Recent strength and incredibly strong technicals suggested that we would continue to see support from longs to put the weekly chart on a similarly strong footing and we got off to a very positive start as values gapped higher on the opening and immediately spiked upwards to 16.90 for May’21. With the initial burst of buying concluded we briefly set back from the highs however the retreat was remarkably brief and it was not long before we began to probe upwards once more with a series of small pushes sending May’21 through 17c to a new high mark of 17.04. Unable to sustain beyond 17c we eased back into the range to spend the rest of the morning consolidating the move, and though we were not rallying there was a distinct lack of selling on show with sellers running scared of another potential afternoon push higher. As US trades emerged there was a lack of progress and the market continued sideways and for the first time in a few days this seemed to encourage a little more selling to emerge overhead. A slip back towards morning lows was picked back up relatively quickly and we returned to continue meandering the range for the final couple of ours. Closing buying did pull prices up a little to end the week positively at 16.89 though we remained shy of the morning highs. Moving in to next week there will be strong focus on the March’21 expiry while from a flat price angle we will see just how much further the longs want to push while also considering whether the higher levels bring any additional producer interest with the potential for additional Indian exports becoming more viable.

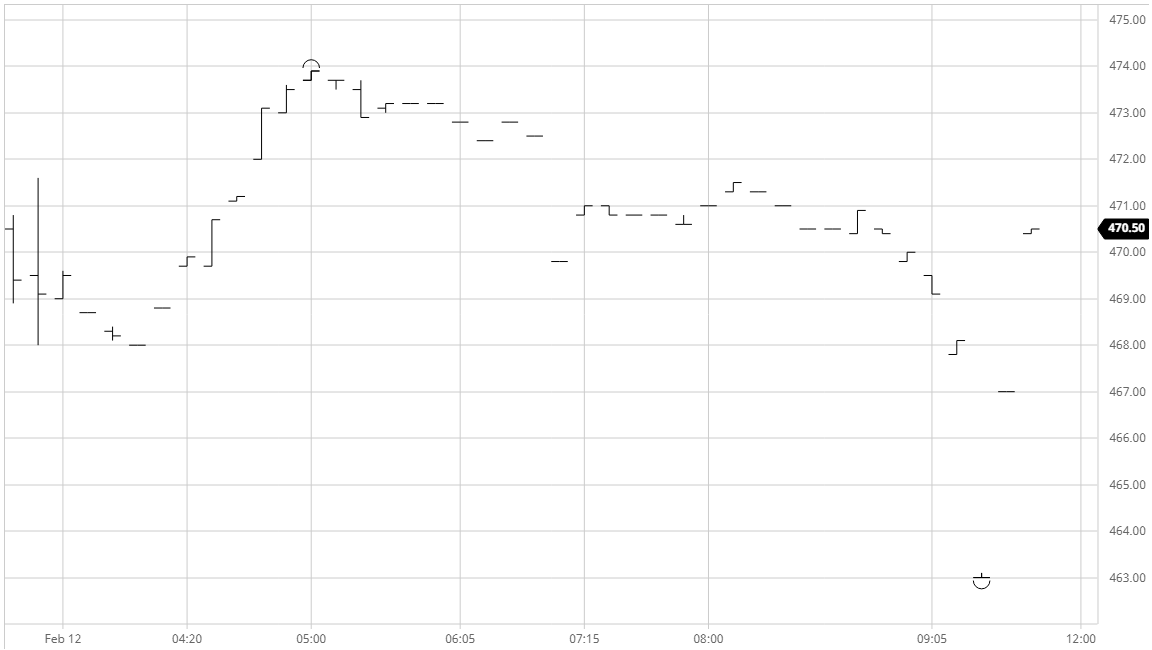

Sugar #5 May’21

The market jumped immediately higher this morning in reaction to the already firmer No.11 contract with May’21 trading up to $480 during the opening exchanges. Soon after there was a further spike upwards as a few buy stops were triggered to take us to $484.80 though with plentiful white premium selling around above the market selling was immediately triggered which meant that if you had blinked you would have missed the top couple of dollars altogether. With sentiment and technical strength running in tandem we continued to be steady within the confines of the early range, and again USD weakness was aiding both ours and the wider commodity environment to encourage underlying support. Spread values widened out a touch with the board moving how one would expect following yesterdays flat performance and we saw May/Aug record an intra-day high at $21.00 while May/Oct’21 reached $38.30 at one stage before easing back. White premiums recorded highs on the morning spike with May/May’21 briefly at $110, Aug/Jul’21 at $105 and Oct/Oct at $95 though in all cases there was good selling seen at these levels and the values rested a little below throughout the rest of the session. The afternoon saw flat price values continue within the established range with the bias becoming a little more positive again through the final couple of hours. Closing values were to the upper end of the range with May’21 settling at $481.40 to conclude a strong week, though having left a gap beneath $475.00 some corrective action may be required before any sustainable long term upward continuation can occur.

ICE Futures U.S. Sugar No.11 Contract

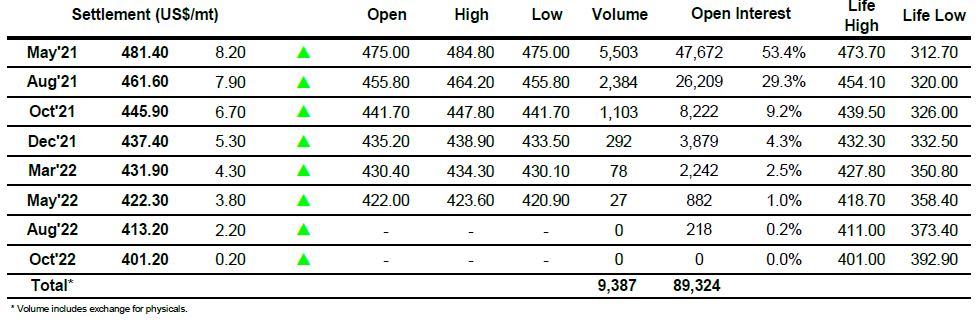

ICE Europe Whites Sugar Futures Contract