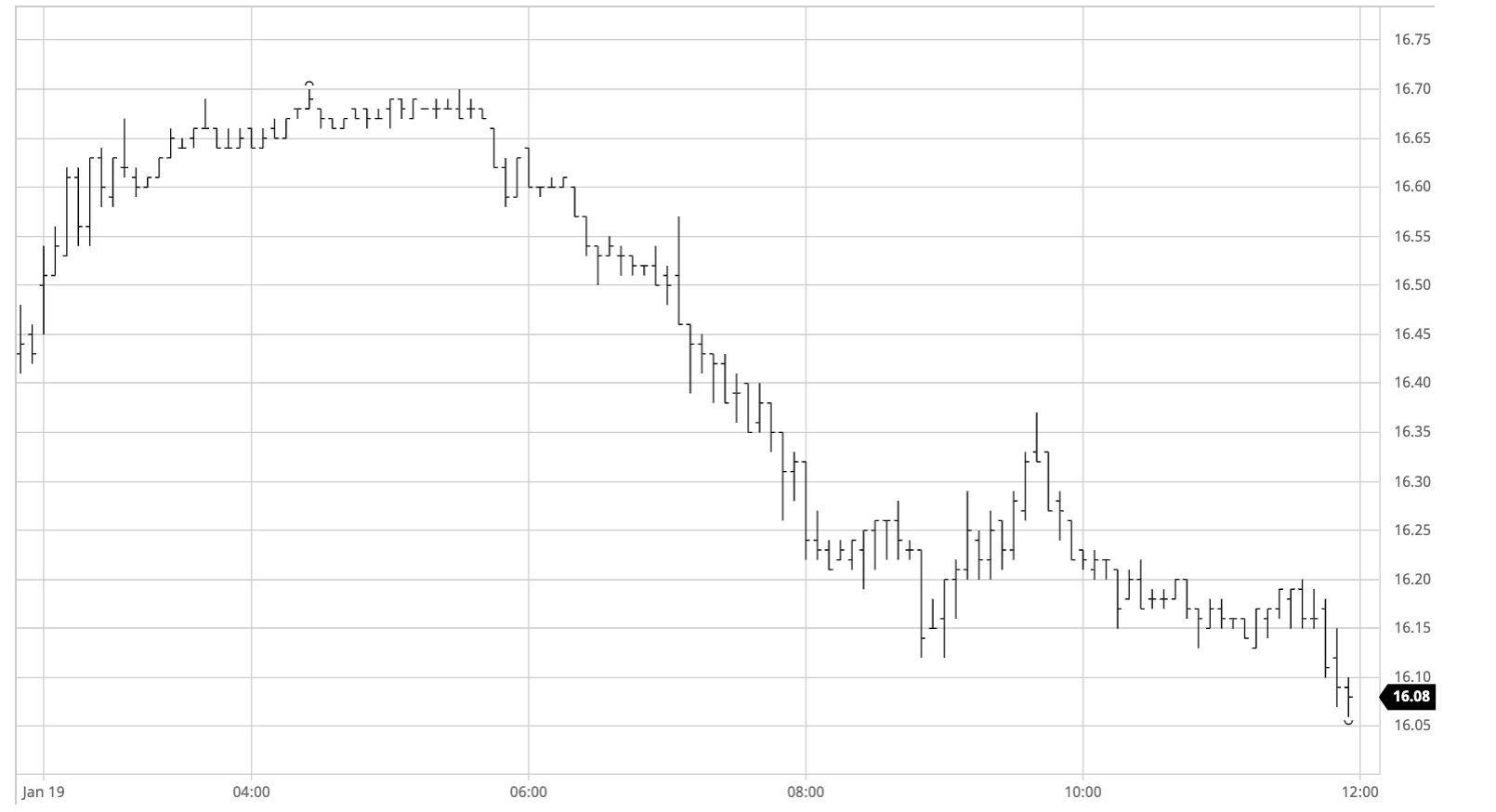

Sugar #11 Mar ’21

The sharp increase in white sugar values while No.11 was closed yesterday was providing a significantly higher opening call, however in the event we were only able to partially match the expectation with March’21 quickly reaching 16.62 before edging up a little further to record a high of 16.70 by mid-morning. Increased selling ahead of the 16.75 contract high mark was playing a part in the rally stalling though volume had also thinned out with relatively thin quantities seen from the long side, sufficient to hold the market but lacking the necessary substance to push higher. As the US morning approached so the market began to wobble a little with selling being lowered to push back down towards previous settlement levels, action which while by no means critical to the long term picture was sufficient to undermine any confidence for today at least. The lack of consumer pricing at these high levels meant that it was tough to reverse the direction of the decline and while a little more buying was beginning to appear at the lower levels it was not until a double bottom had been recorded on the intra-day charts (16.12) that we saw a bit of a bounce. The recovery could not be sustained however and once some short covering had been concluded we slipped back to be within touching distance of the lows once again heading through the final hour. A final burst of selling during the closing stages sent prices to new session lows and painted a negative picture going out though with support having been found recently between 15.50 and 16c it may simply be that we are retreating to the range following the extension higher last Thursday.

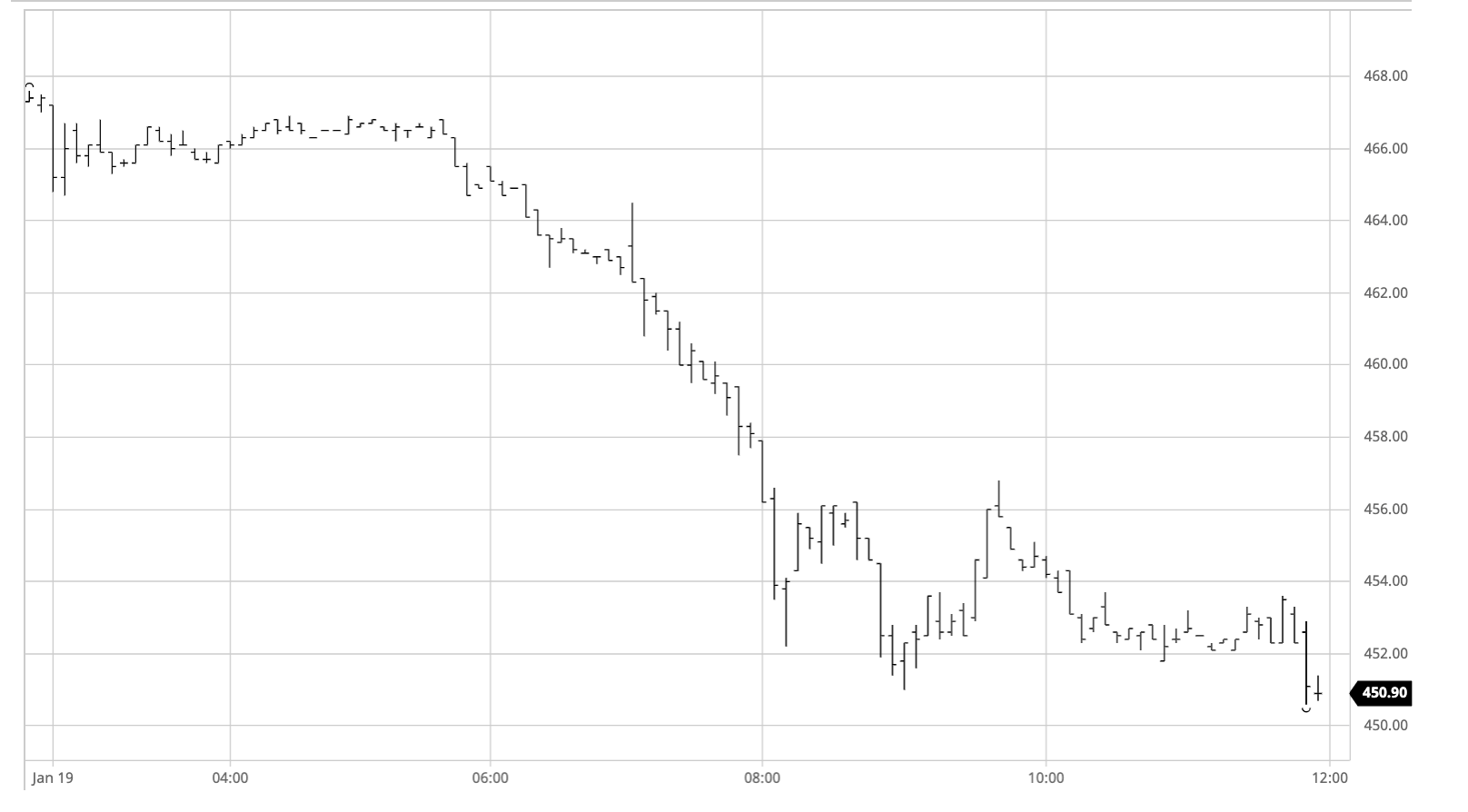

Sugar #5 Mar ’21

Having made significant gains to record new life of contract highs while No.11 was closed for the long weekend yesterday it was not surprising that we began today on the back foot with No.11 having only partially caught up these gains on their opening today. This saw March’21 trade back down to $464.70 with early white premium gains that put both March/March’21 and May/May’21 at over $100 soon attracting selling from refiners (and maybe opportunists within the trade) to be pushed back from their initial highs, however consolidation followed with the market holding the mid $460’s for the rest of the morning. The early afternoon saw signs that the market may wobble with some heavier selling appearing for the spot March’21 both outright and through the spreads and so it proved to be the case as we began a slide which lasted for three hours, culminating in a low of $451.00. This decline saw increasing pressure upon the white premium with March/March’21 trading back beneath $95 while the March/May’21 spread was back into $15 before having some support appear. The buying allowed values to lift back up by a few dollars however the recovery was not sustained and as we moved through the final hour we were back within touching distance of the lows. MOC selling emerged to end the day weakly with March’21 touching $450.60 on the call, though the recent extension and overbought technical mean this may simply be a question of the market correcting with support seen in the $440’s basis the recent former highs.

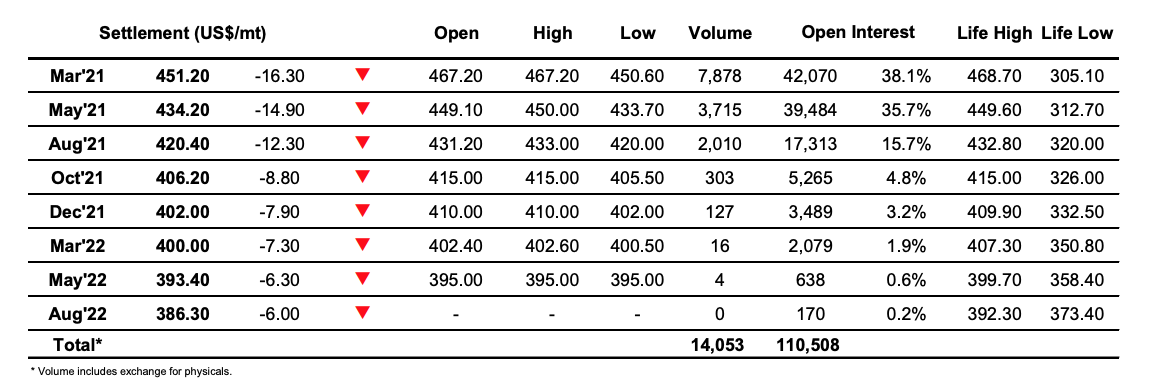

ICE Futures U.S. Sugar No.11 Contract

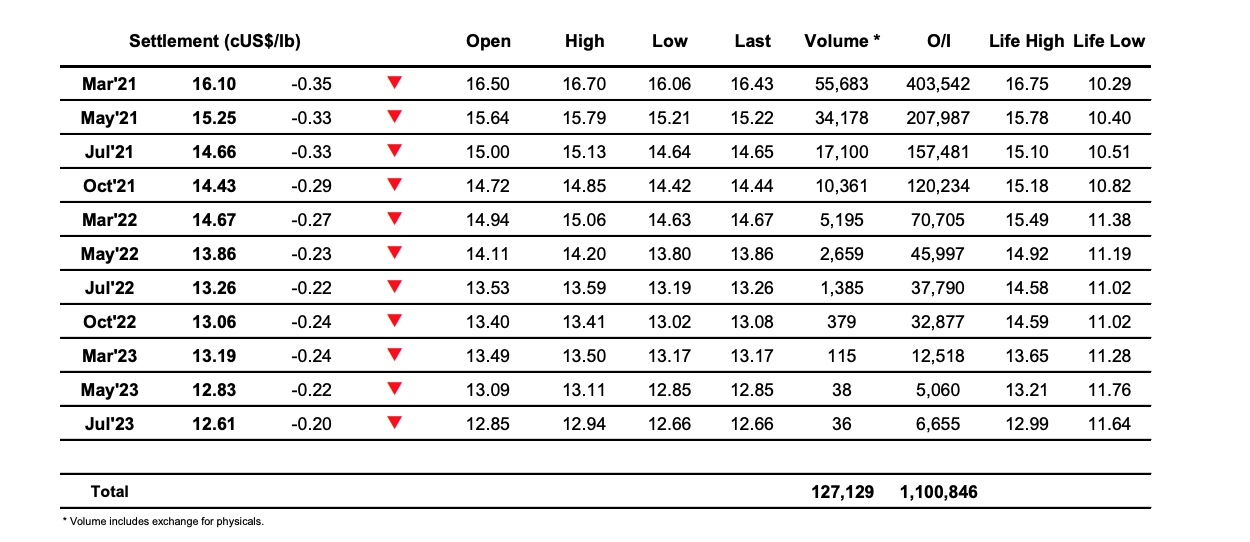

ICE Europe White Sugar Futures Contract