Sugar #11 Oct’21

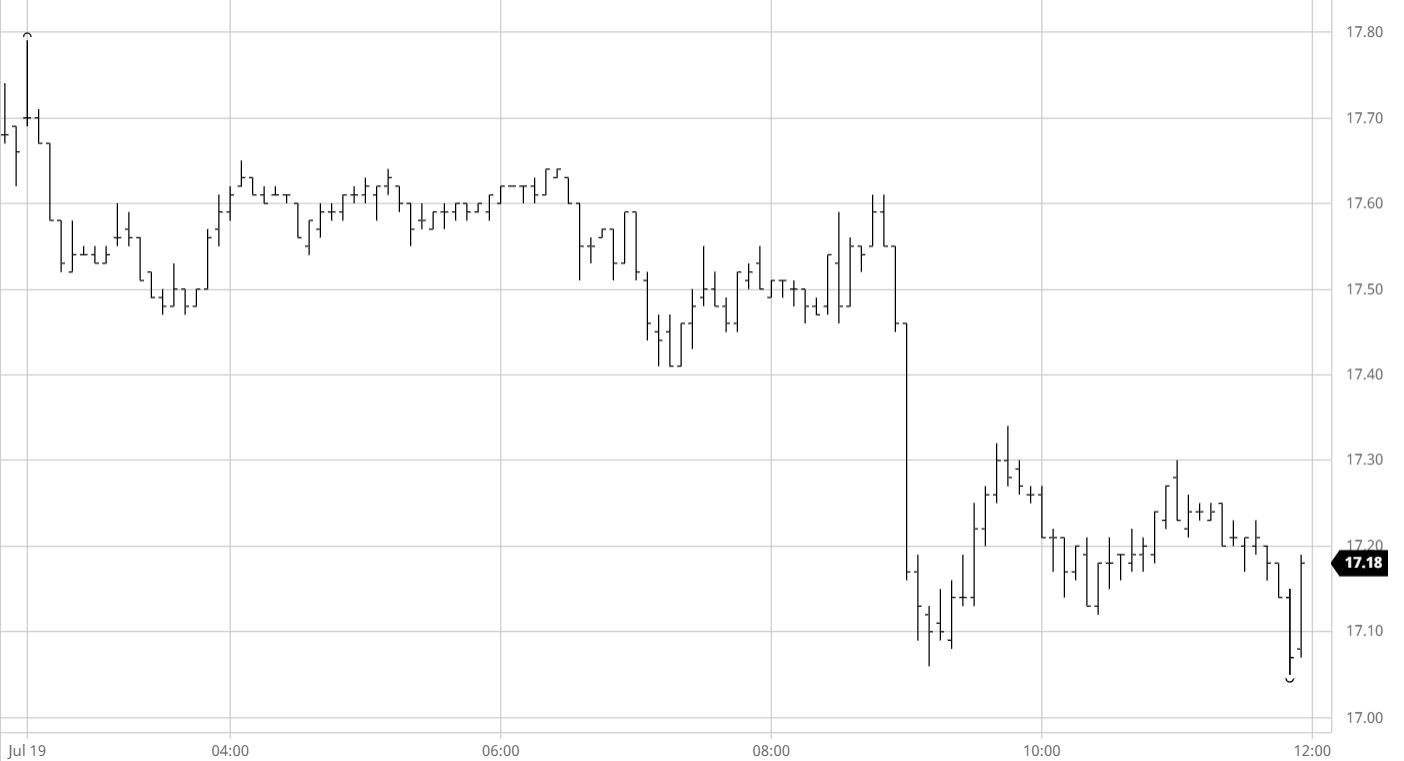

Oct’21 traded quickly upwards to 17.79 following this morning’s opening before plunging towards 17.50 on very low volume with buyers few and far between once the initial “at market” activity had been concluded. Activity remained calm with both producers and consumers largely absent at current levels as both look for moves toward opposite ends of the wider 16.50/18.50 range in which we find ourselves, leaving values to enter a calm consolidation pattern centred around 17.60 for the duration of the morning. Though the range widened down to 17.41 as the US morning got underway there remained very little excitement with prices then quietly maintaining the lower end of the range for the next couple of hours. In the background there were some wobbles taking place within the macro, most notably for crude which was around 4% lower on the day, and having seemed like we were disregarding such factors we suddenly reacted in spectacular style. Oct’21 was pushed down beneath 17.40 on just a few hundred lots however the move triggered a host of spec liquidation against sell stops with almost 7,000 lots changing hands as the price plummeted down to 17.06 over the course of the next 15 minutes. A bounce back to 17.30 against some profit taking proved to be short-lived and for the final couple of hours we saw activity settle down at the lower end of the range. A boisterous close seemed to be driven by further macro weakness as we found aggressive MOC selling which sent Oct’21 to a new session low 17.05 with settlement established only just above at 17.07, and though end of day position squaring sent the price back into the teens going out the picture is suddenly less rosy having undone the efforts of the bulls from late last week.

Sugar #5 Oct’21

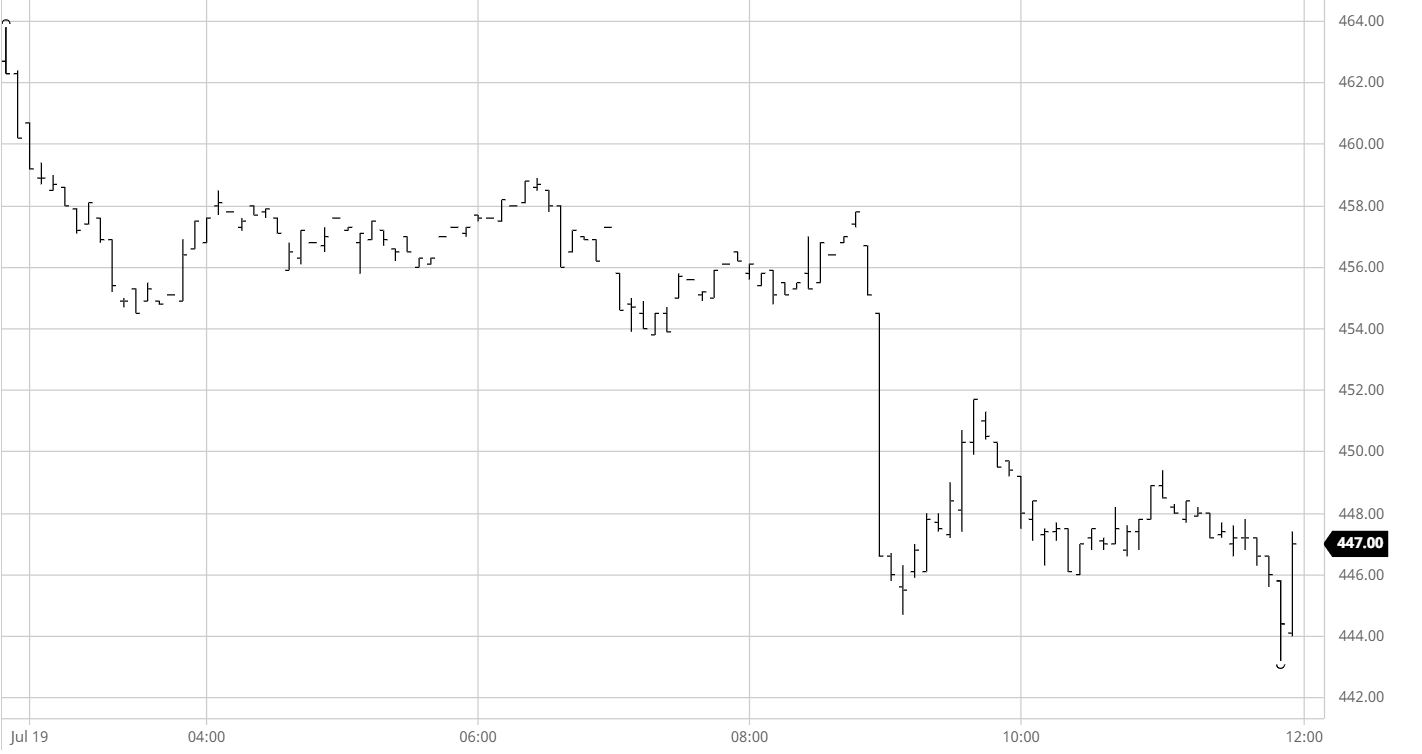

The resurgence of last Thursday/Friday was long forgotten as Oct’21 commenced trading at $460.70 in response to lower No.11 values but then continued downward on very light volumes to reach $454.50 a mere 45 minutes after we had opened. Such significant early losses had an impact on the white premium with Oct/Oct’21 giving away several dollars to be valued at around $68.00 although with calm restored both it and the flat price were able to settle into the range to check sideways for the rest of the morning. There was little change during the early part of the afternoon save for a slight downward extension of the range however a spectacular collapse then changed everything with spec selling into a relative vacuum seeing Oct’21 all the way down to $444.70 before bouncing by several dollars against short covering and some opportunistic consumer pricing orders. The fall also had an impact upon nearby spreads with Oct/Dec’21 reaching a -$9.80 discount while the headline Oct/Oct’21 premium recorded an intra-day low beneath $65.50. With the washout over we saw prices look to hold with defensive support preventing any prospect of a look at last weeks $442.00 low mark, though with the damage done any recovery was capped to leave prices still struggling at the bottom end of the range. New session lows were seen on the call as Aug’21 traded down to $443.20, and with settlement only just above at $443.80 a test of $442.00 seems inevitable.

As stated the white premium values lost significant ground today and we closed with Oct/Oct’21 at $67.50, March/March’22 at $73.50 and May/May’22 at $86.80.

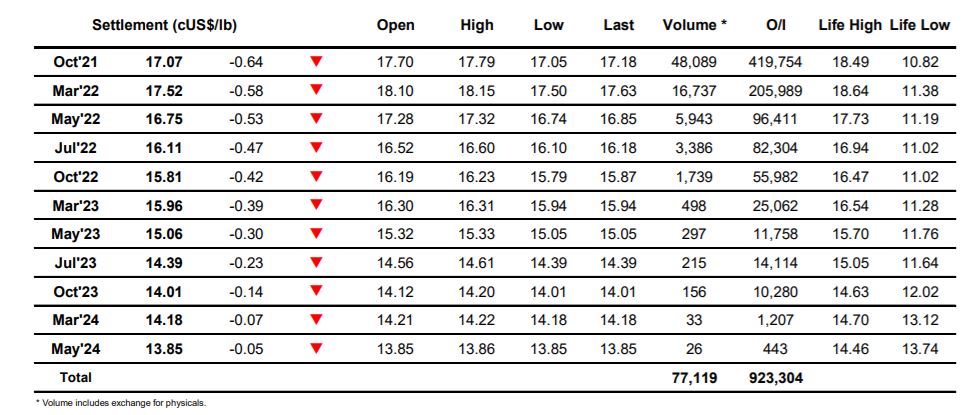

ICE Futures U.S. Sugar No.11 Contract

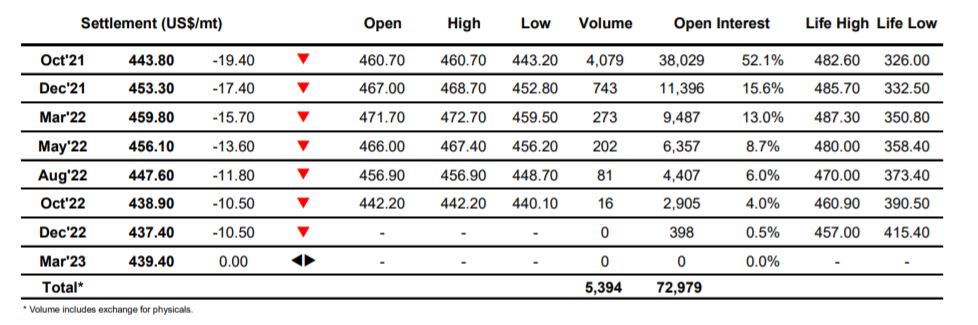

ICE Europe Whites Sugar Futures Contract