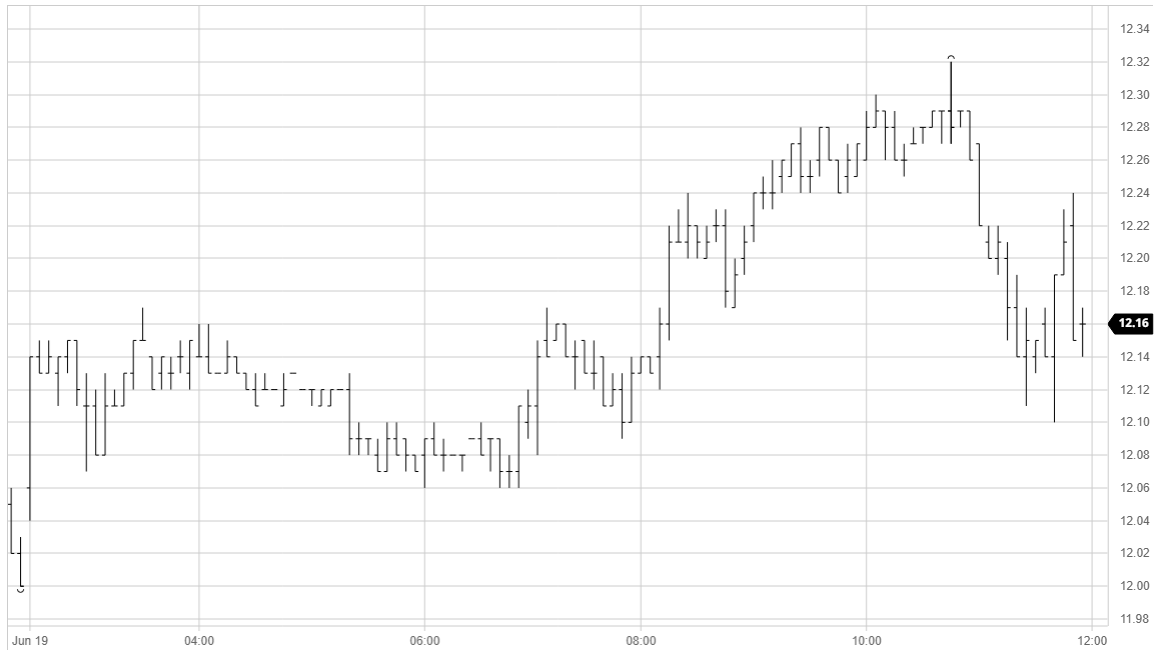

• Last night’s poor finish was quickly forgotten as buyers emerged to bring the market in around 10 points high, maybe due to the showing of crude and the wider macro or possibly because the specs simply do not want October to slip back beneath 12c again. Whatever the reason it provided the basis for some steady morning trading within a narrow 13 point range as we awaited the arrival of US traders and the associated increased afternoon volume. A push back to morning highs initially faltered however the specs were determined to end the week positively with some steady afternoon buying taking Oct’20 up to 12.32. This placed it right in amongst the recent highs with the past three sessions all seeing high marks between 12.29 and 12.33, and with the final hour seeing values fall away into the range once more so it became 4 days in a row that we have seen highs within this 4 point band. With producer pricing clearly resolute in the 12.30 area and BRL remaining weaker than of late in at around 5.30 it may take some fresh news if we are to make a break from the range next week.

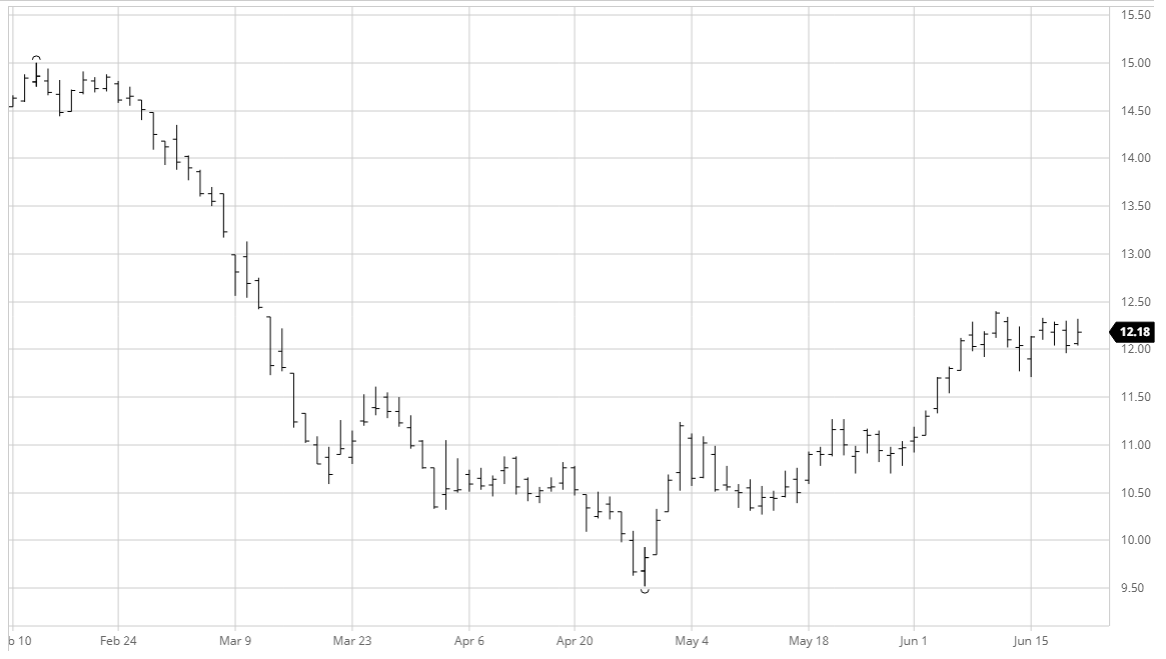

• London whites continue to falter with Aug’20 today giving back further ground. Given that whites carry a proportionately more sizable fund long it is likely that this is partially against long liquidation though questions are being asked as to whether this represents a shift in the fundamental picture. Aug/Jul’20 WP was weak throughout and end the day around $102.50.

SB Oct’20 – Sugar no.11 Futures

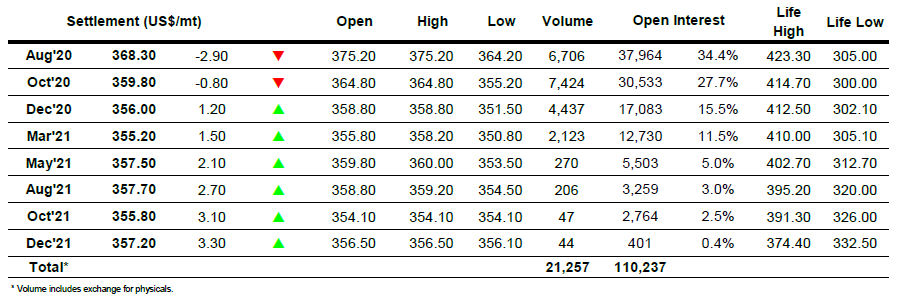

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract