Sugar #11 May’21

Last night’s weak conclusion and the continuing macro weakness that followed raised questions as to the resilience of No.11, however a rather muted opening period failed to provide much guidance as we simply moved sideways having matched the 15.81 low mark. Little changed until US traders came online, increasing the level of spec activity and bringing some selling to the fore that had enough substance to punch through to new lows. Across two waves of selling the May’21 contract slipped down to 15.55 though with the macro rather more neutral and some of yesterdays sweeping losses for the energy sector being recovered there was a reluctance to continuing pushing aggressively. Inevitably there was some profit taking against shorts which pulled prices away from the lows but despite this we could not find a way to make the spread recover and moving through the later afternoon May/Jul’21 continued near to its 0.27 point low mark which will have been of concern to the longs. The upward pattern of the final couple of hours was maintained into the close with a combination of defensive buying and some pre-weekend position squaring ensuring a May’21 settlement level at 15.76, away from the lows though still technically weak which suggests that further challenges may lay ahead.

Sugar #5 May’21

Last night’s weakness will have raised concerns for longs that we may be about to break to the downside, however there were no immediate fireworks this morning with the first three hours spent holding a tight range between $454 and $456. It was only when US based traders arrived and began to pressure the No.11 that we too found selling start to emerge and over the next couple of hours May’21 was pushed through the monthly lows with a couple of light sell stops noted as we extended down to $450.00. With a relatively neutral macro picture today the selling eased during the latter part of the session and allowed values to pull back away from the lows, although with buyers hardly chomping at the bit the recovery topped out above $453. Approaching the close we were waiting to see which direction the market would be pushed and when the time came it was the bulls who once again stepped in to defend the technical picture and ensure at the very least to keep May’21 above the $452.20 recent low. To this end they were successful with settlement at $453.40, though it will still not look great for the weekly charts and seems will need macro assistance if we are not to test these lows again next week. White premium values held firm again today and we head into the weekend with May/May’21 at $106.00, Aug/Jul’21 at $99.50 and Oct/Oct’21 at $91.00.

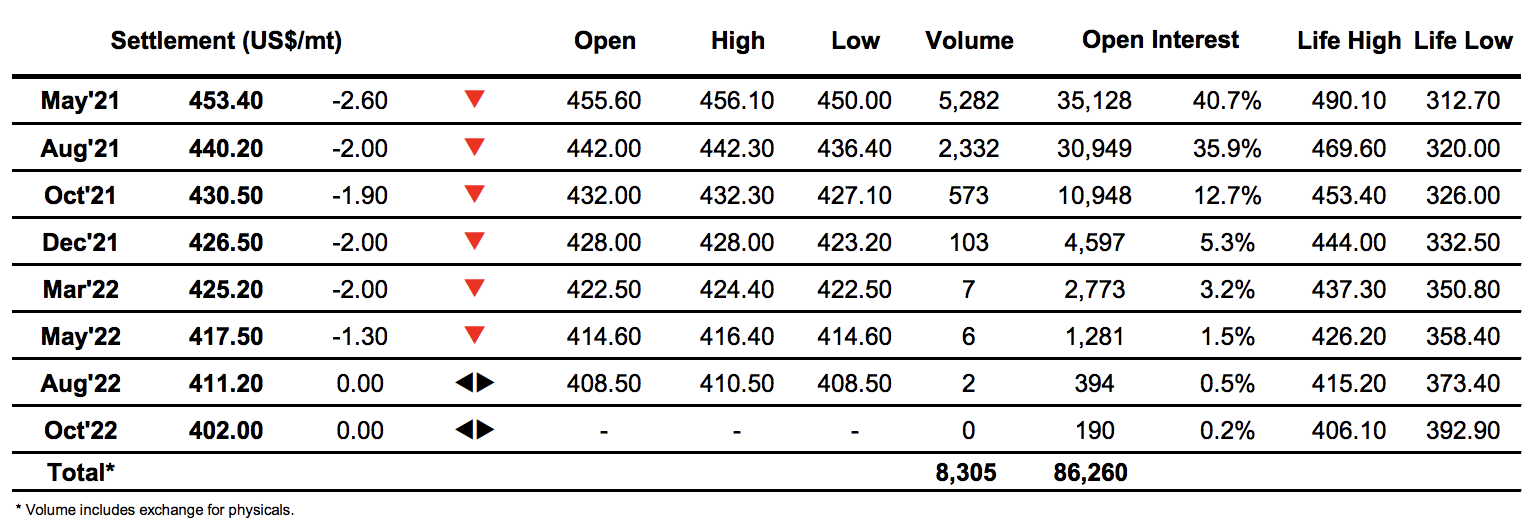

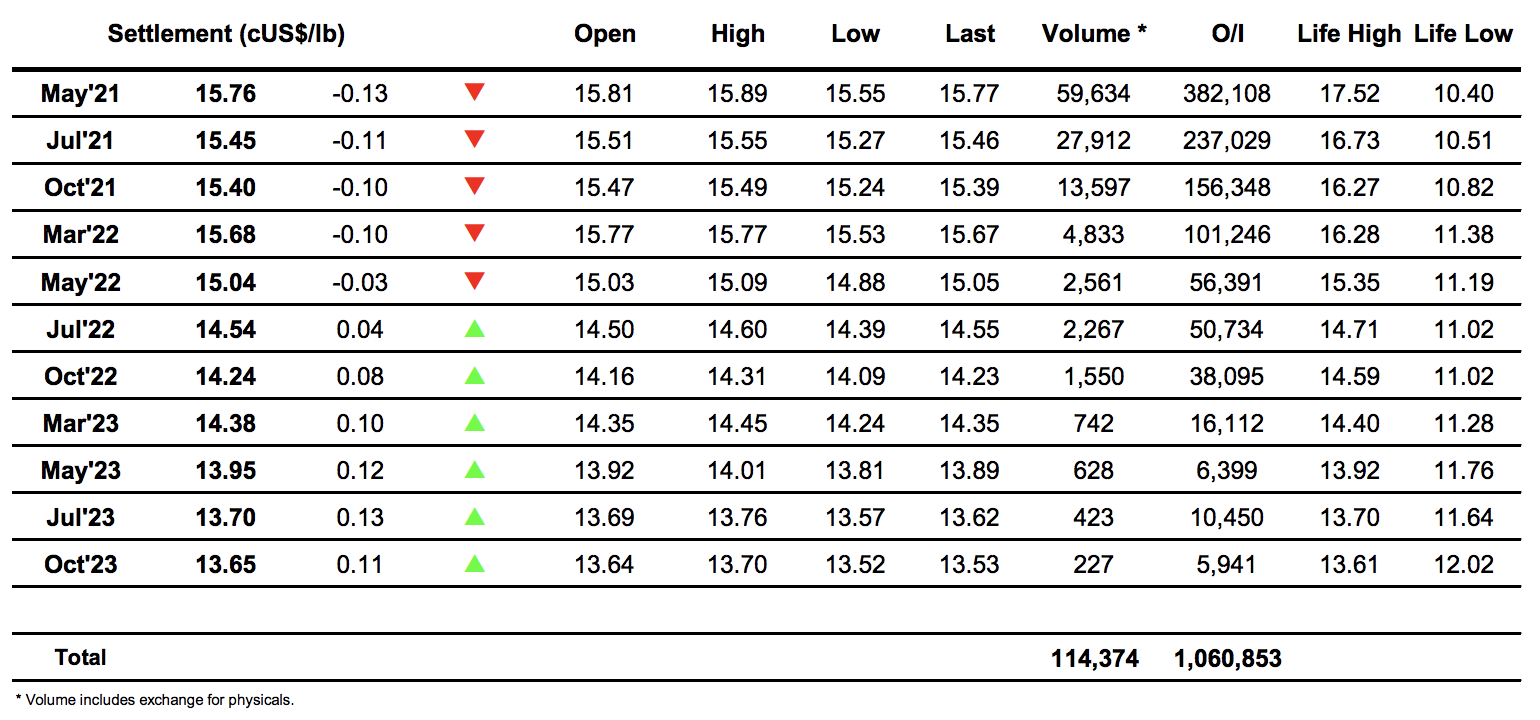

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract