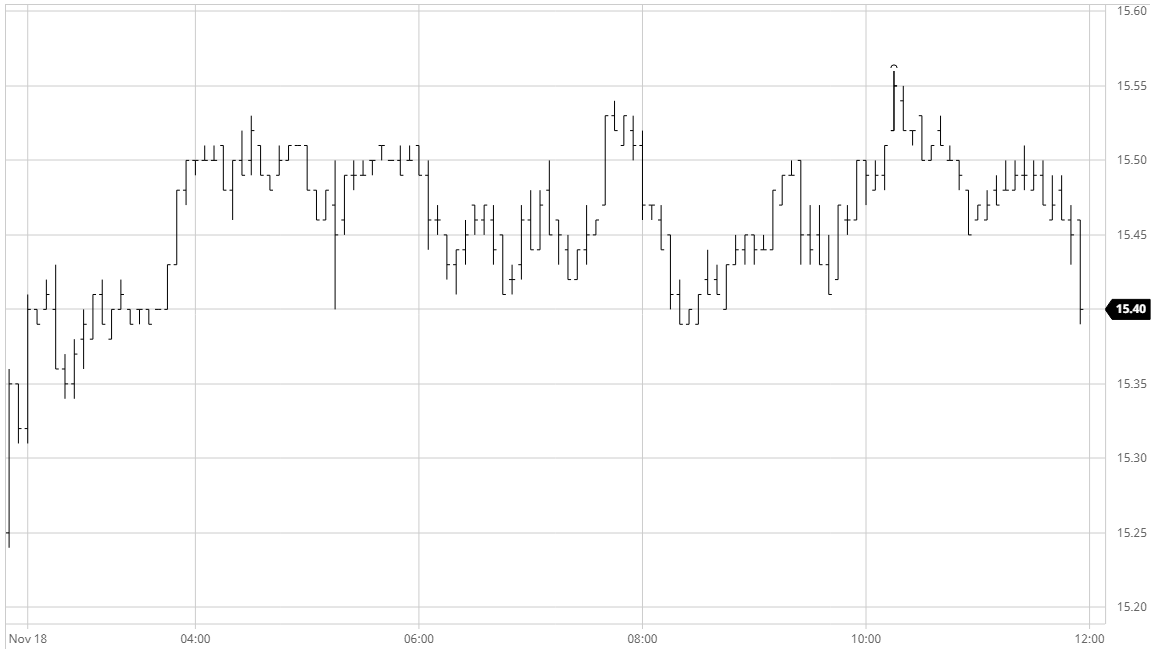

Mar 21 – Sugar No.11

An unchanged opening led the way into some light buying which nudged March’21 upward to 15.52 before stalling against the same scale selling which provided resistance yesterday. In continuing low volumes the failure to climb encouraged some light selling to the fore which caused a slow retreat to a low of 15.22 over the next three hours, though despite the weakness we never really looked like losing too much ground. Nearby spreads were also a little weaker on the decline with March/May’21 back to 0.87 points however here too the weakness was better attributed to a lack of buying then any meaningful selling. Afternoon activity proved no better than the morning as apathy reigned for a second successive session and for several hours we held a tight band in the lower half of the day’s range. Selling during the final 30 minutes pushed prices back towards session lows and though some late position squaring pulled the settlement levels away from the lows we remained showing double digit losses to end a very slow session.

March 21 – Sugar No. 5

The failure to build upon the strong start to the week saw a second consecutive session of slow sideways trading, consolidating above the former $410.00 resistance in diminishing volumes with specs appearing content to stand back for the moment. This lack of direction has sucked much of the day trading away from the market and with outright prices static so the spreads became particularly quiet with March/May’21 maintaining a miniscule 0.60c range over the course of the session. White premium values did pull back up their own range with March/March’21 back out to $79 and May/May’21 around $89 though here the gains were mainly down to the flat price movements with very little volume actually changing hands. Premium values slipped back into their range during the latter part of the session as some light selling sent us back towards daily lows before some MOC buying emerged, pulling prices back up by a dollar at the death to end an extremely dull session.

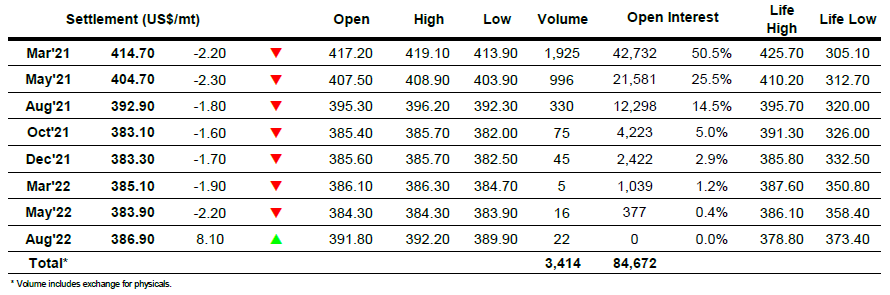

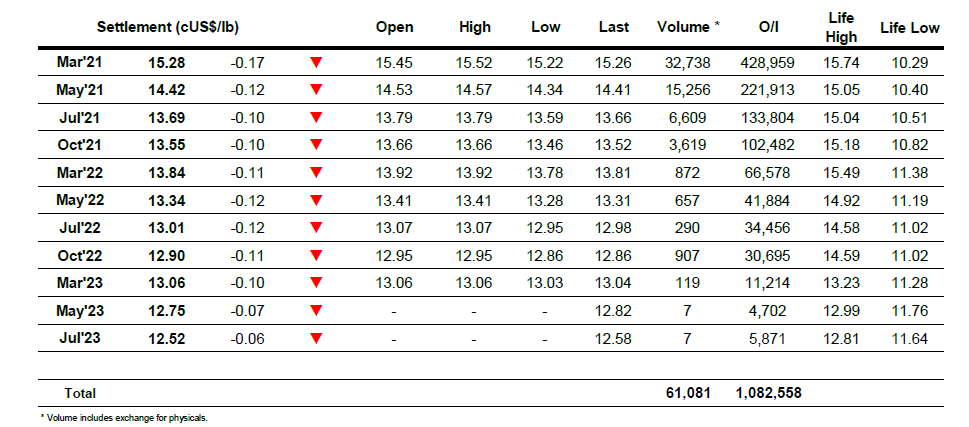

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract