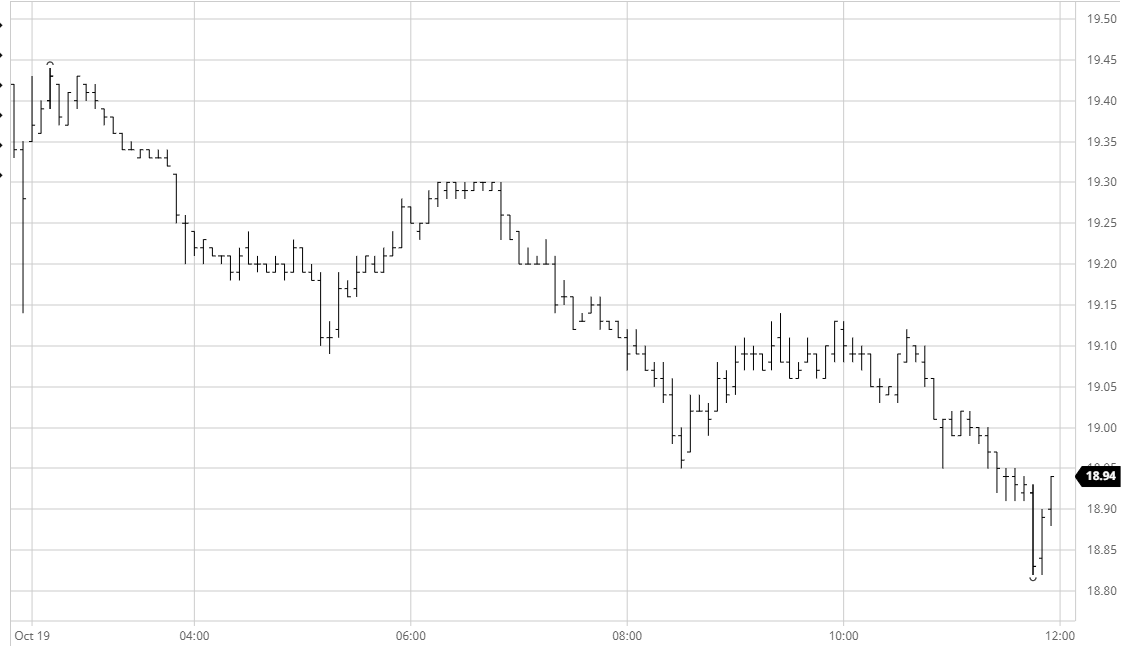

Sugar #11 Mar’22

A mildly firmer start to the day came as no surprise to most with yesterday’s decline encouraging some physical activity, leading the hedge lifting to combine with consumer pricing during the early stages. As this pricing was concluded so the attitude started to change, and though the slide was gradual we found ourselves holding only a few points ahead of yesterday’s 19.14 low just two hours into the day. This presented the obvious temptation to look for sell stops below however none were uncovered as an initial shove only saw the price dip to 19.11 before the resulting short covering took us back into the range at 19.30. The start of the US morning presented the opportunity for the wider spec community to show their hand and it quickly became clear that the faster moving traders were determined to further explore the short side as March’22 was pressed continuously to eat through consumer scale and trigger some light stops in the 19c area, reaching 18.95 before some covering kicked in. This was not the end of the matter however and following a period of relative stability the price was pushed back south of 19c ahead of the final hour. The shorts primed the situation by edging the price to new lows ahead of the close and then through more ammunition at it during the final 15 minutes. A low was recorded at 18.82 prior to the call with settlement made at 18.87 to provide further negative technical signals. Some covering on the post-close led March’22 back to 18.94 but that did not disguise what was another poor performance.

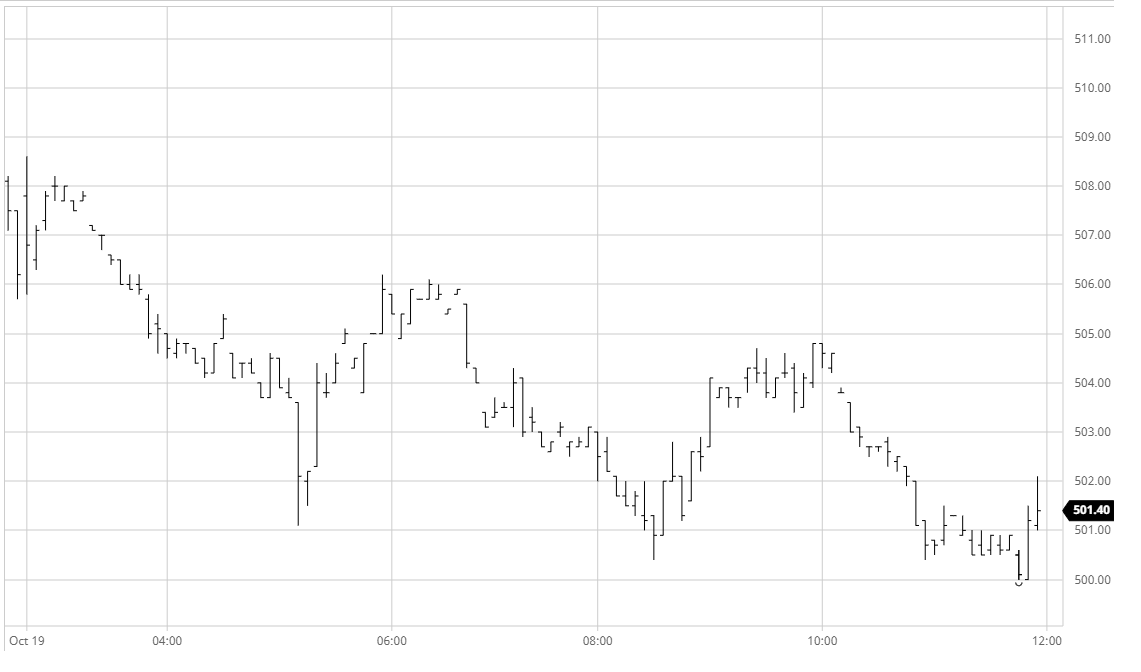

Sugar #5 Dec21

The negative performance yesterday yielded only very light overnight physical interest and having topped out at $508.60 early in the session the market soon resumed its downward path with Dec’21 slipping back to the $504 area. A few sell stops were then triggered to send the price briefly to $501 however with support showing in the $500 area basis the late September/early October lows we bounce back into the range with smaller traders scurrying for cover amongst the thin liquidity. Despite the failure to break outside of the ongoing broad range the market was seeing far better volume of late, notably for outright prompts with spread activity rather limited. The order flows led nearby values to swing around the lower half of the range as we moved through the afternoon with values picked up from a new daily low $500.40 before returning to match these levels as we moved into the final hour of trading. Within the movements it seems that specs are starting to move some interest forward to the March’22 contract with just four weeks until the Dec’21 expiry. This factor meant that though the March’22 chart was showing more vulnerability than Dec’21, a continuing support for the spot at $500 combined with a firmer Dec’21/March22 spread at $6.50 enabled the white premium value to firm with March/March’22 clearing the recent $75 barrier and extending towards $77. New session lows were recorded at $500.00 precisely as we headed into the close with Dec’21 settling at $500.50 as it gamely holds on to technical support.

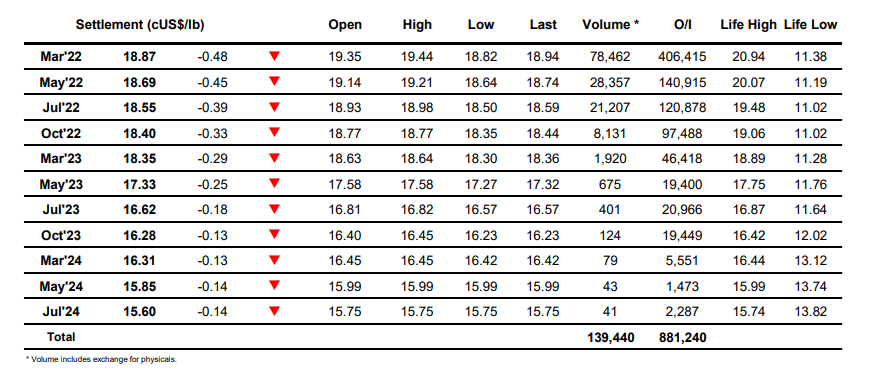

ICE Futures U.S. Sugar No.11 Contract

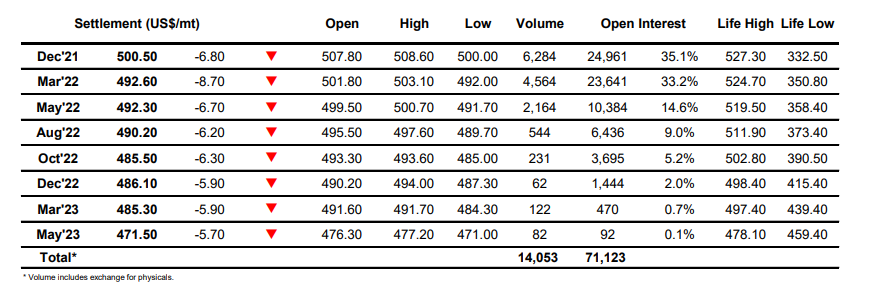

ICE Europe Whites Sugar Futures Contract