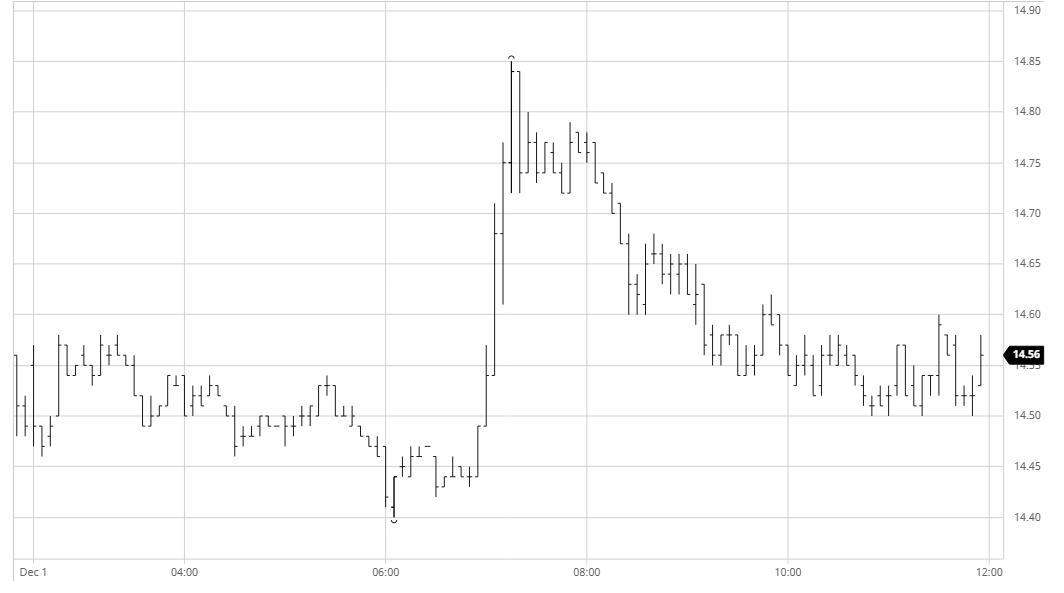

Mar 21 – Sugar No.11

The latest in a series of poor performances got the week of to a negative start yesterday and with all upwards momentum seemingly lost for the time being we saw some continued struggle this morning as March’21 drifted down to a low of 14.40. The decline seemed set to continue until the market was shocked back into life as newswires reported news that the Indian Government has rejected the subsidy out of hand, bringing a degree of spec buying back into the equation as we drive sharply upward to 14.85, though it was fair to say that selling was limited on this move with the already quiet Brazilian producers reluctant to move as the USDBRL traded towards 5.25. Longs were hoping that this would provide the platform to push higher once more however once the spec buyers retreated so the market came back into the range, maybe interpreting the news as being no change from the status quo. March’21 spreads came in for particular punishment on the decline with aggressive selling sending the March/May’21 in from 0.74 points to 0.55 points, leaving the March’21 unchanged while the rest of the 2021 positions maintained double digit gains. The outright picture remained quiet during the final stages which left March’21 closing little changed, a disappointing end to a day which maybe shows that further correction could follow

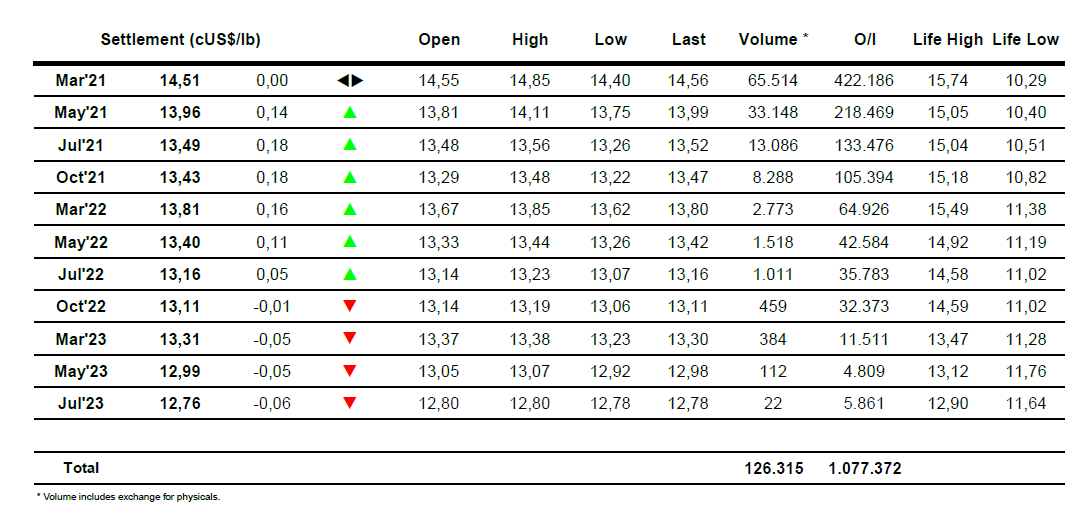

March 21 – Sugar No. 5

The day got off to a slow start with nearby values edging lower though maintaining levels above the recent $395.80 low mark recorded yesterday. There was barely any volume changing hands for most of the morning and it came as something of a surprise therefore when news that the Indian Government has rejected the subsidy out of hand gave the market the necessary boost to instigate a rally. March’21 quickly reached up to $404.50 though to have achieved a rally of some $8 on a volume of around 250 lots says much for the lack of liquidity currently present in the market. Despite the rally there was little joy for the nearby spreads with March’21 remaining in net deficit to the rest of the board throughout the day and maybe this lack of strength was a sign that the rally would not maintain with values steadily slipping back down into the range over the course of the afternoon. The final stages saw prices continue sideways, just beneath $400 for March’21 to represent a disappointing conclusion to a wide ranging “inside day”

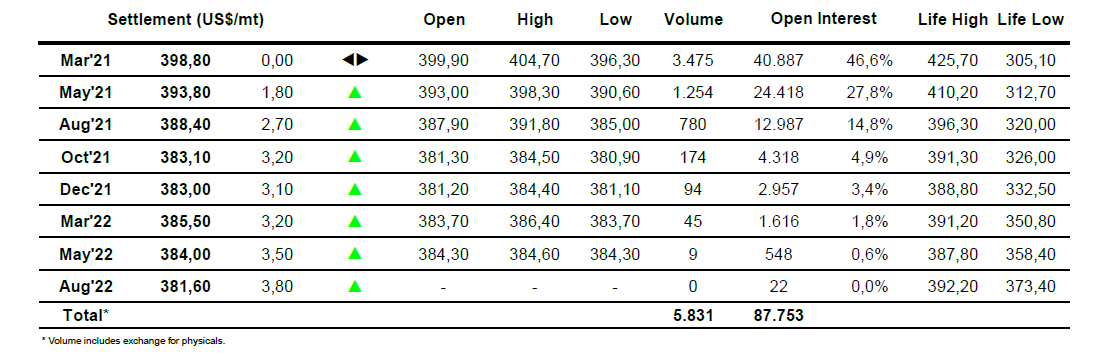

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract