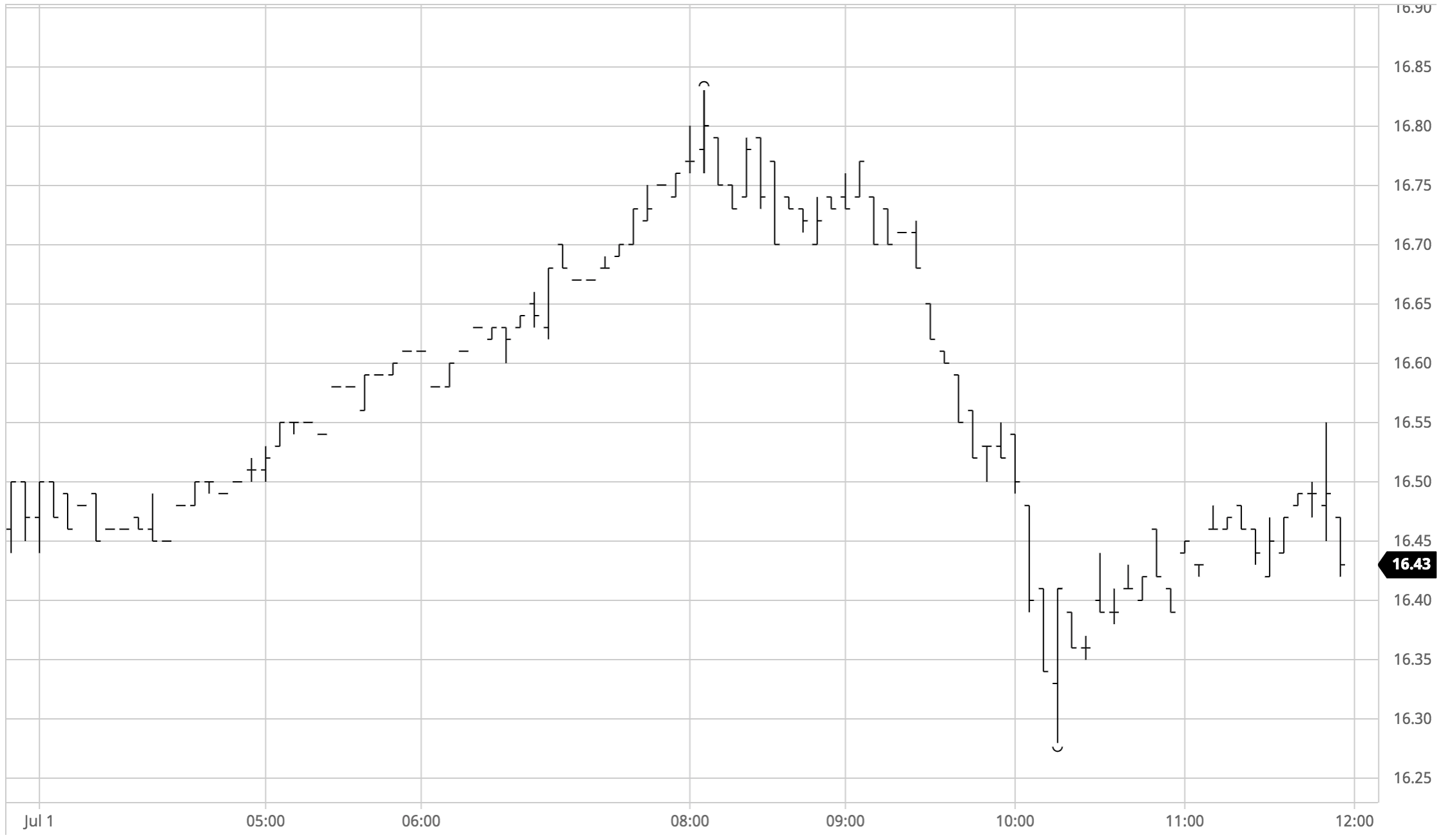

Sugar #11 Oct’21

· The market continued its recent technical strength with an immediate push up through 18c this morning, and though consolidation followed this provided a solid footing from which to try and look upward to the 18.23 contract high. Though fund buying is more limited during the morning there was sufficient interest coming through to take the price onward into the teens ahead of the US day and the arrival of the wider spec world soon brought with it the level of increased buying needed to break upwards. With producer selling remaining limited to light scales there was little resistance on route to a new contract high at 18.49 from where we saw a period of consolidation as traders took their foot off the gas. There seemed little that would stop the move yet from nowhere with other commodity markets under pressure we were faced with long liquidation, and this selling hit into a vacuum as over the course of an hour Oct’21 slumped all the way back to 17.73. As would be expected after a week and a half of effort the specs are by no means ready to let go of the situation and the latter part of the day saw them dig is to ensure we pulled back up to 18c, though settlement could not achieve this psychological mark and we ended at 17.94. The failure to sustain the highs may allow the technical situation to cool a touch though further volatility remains a strong possibility.

· As anticipated the Jul’21 expiry saw 2,587 lots (131,426t) tendered with Viterra the deliverer and Wilmar receiving Brazilian sugar through Paranagua.

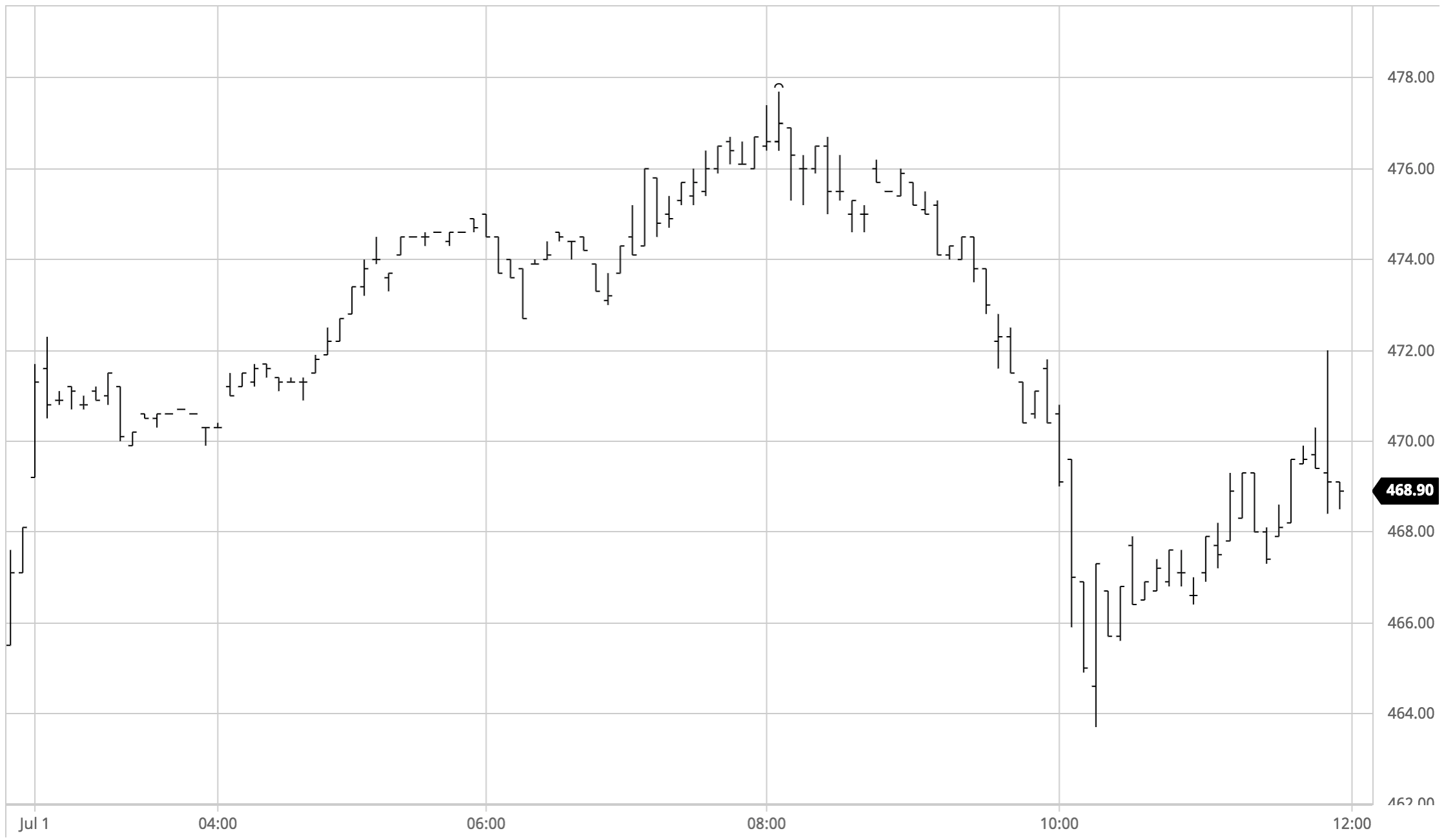

Sugar #5 Oct’21

A most remarkable opening for the whites saw values surge in the opening minutes to reach $457.30 for the Aug’21 contract before falling back to the $450 area with continuation buying proving to be rather limited. Oct’21 meanwhile reached $472.30 to show more modest initial gains however with the bulk of Aug’21 volatility coming against the spread movement we saw the Oct’21 show rather more stability from which it was able to build and push onward later in the morning. Recent strength has reinvigorated the technical picture and though we have entered overbought territory on a short term basis the desire from specs to re-enter into longs and maximise the potential led us through the June highs and brought the co0ntract high mark at $482.60 back into focus. By early afternoon we had extended the gains to $477.70 and things seemed well set to continue however some weakness in the wider macro began to undermine the confidence (overbought factor maybe) and as long liquidation kicked in so values quickly plunged with Oct’21 filling the overnight gap on its way back down to $463.70. With the washout over things settled during the final couple of hours, trading back into the range where some choppy MOV activity eventually left us settling at $469.60.

· White premium values made further steps higher today. Closing values showed Oct/Oct’21 up at $74.10, March/March’22 at $75.20 and May/May’22 at $89.90.

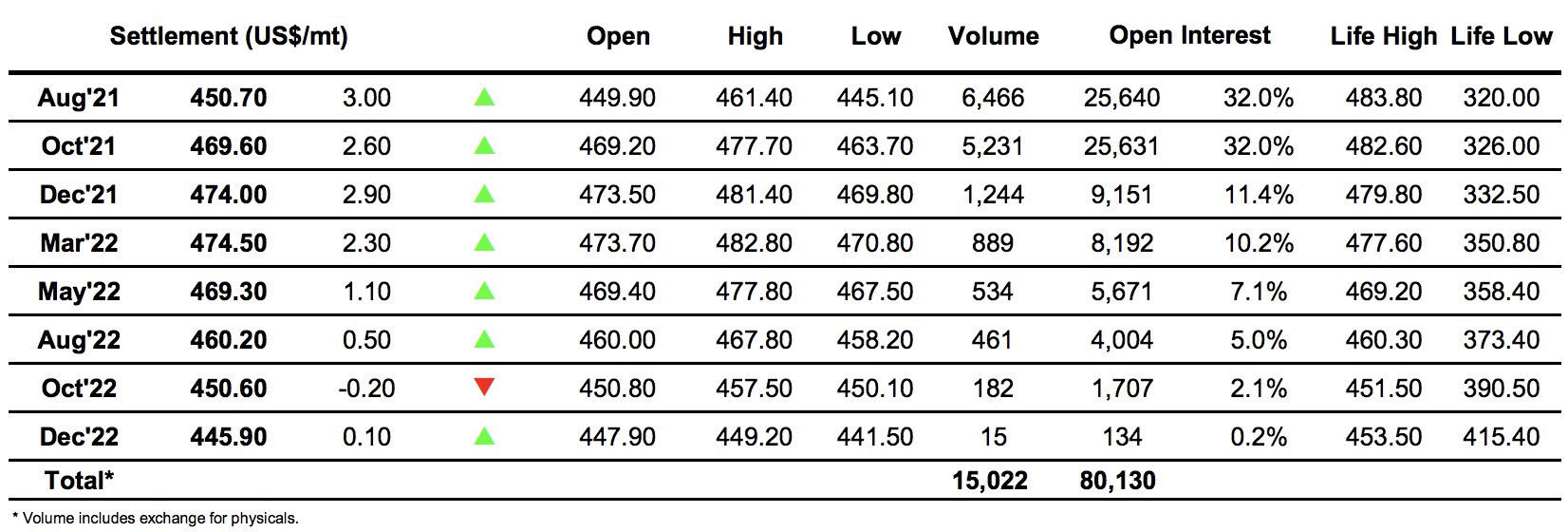

ICE Futures U.S. Sugar No.11 Contract

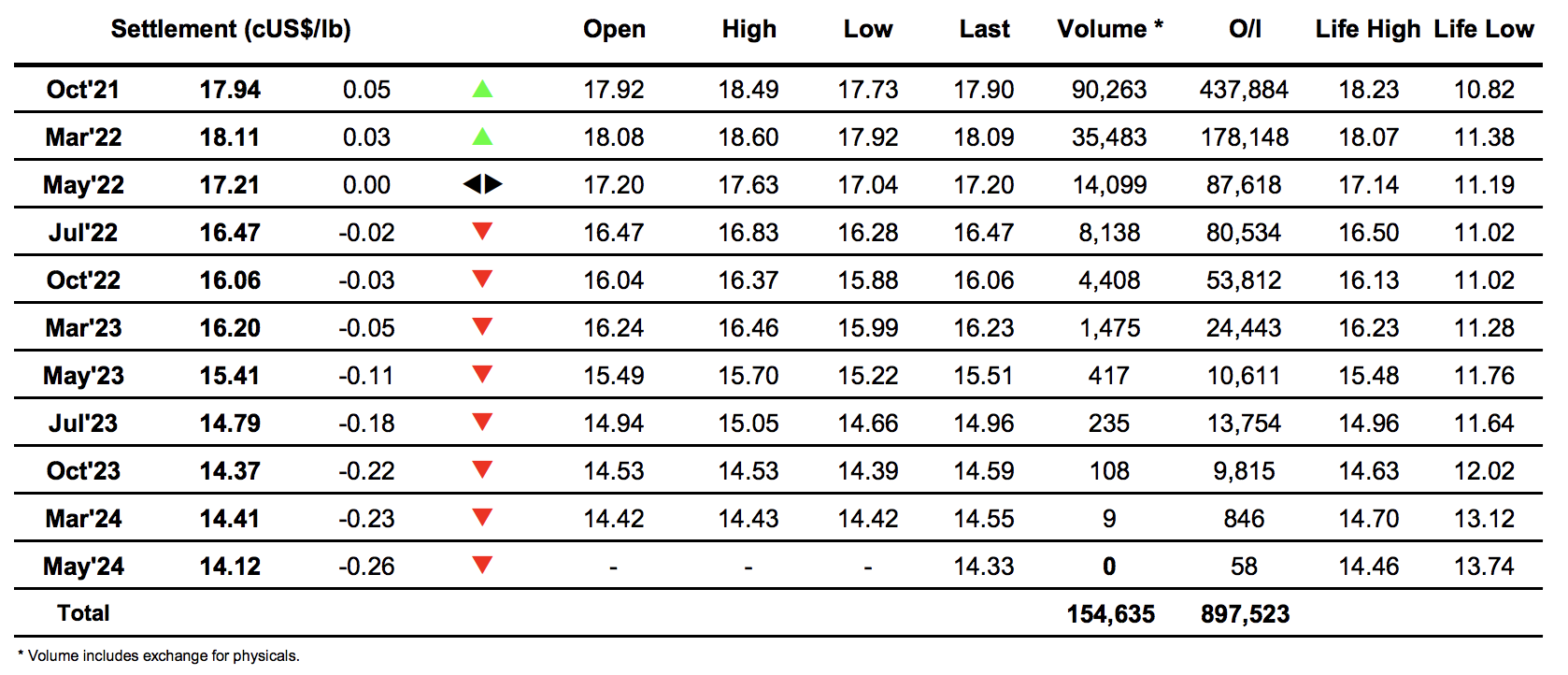

ICE Europe Whites Sugar Futures Contract