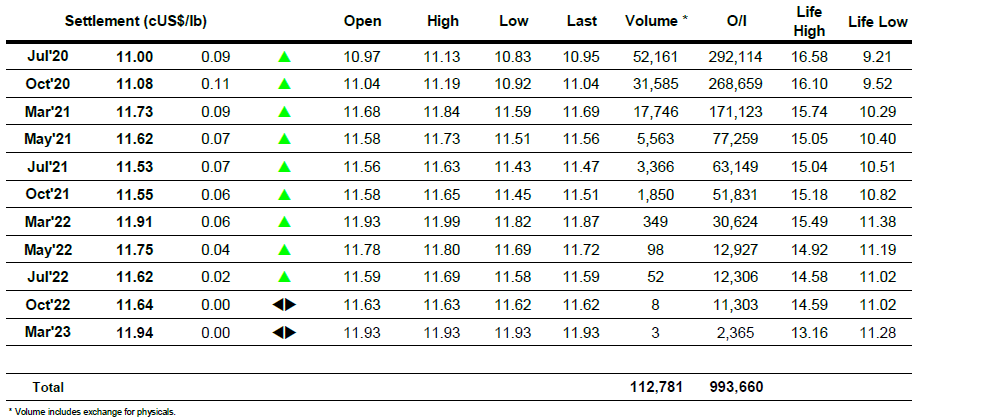

We commenced the new month with the COT showing that the funds have returned to a net long position, albeit only by a meagre 5,600 lots, a position that has likely changed little in recent days with the market continuing within the same broad range. The opening leap was therefore something of a surprise as Jul’20 quickly traded up to 11.13 before settling into a consolidation pattern despite a lack of fresh news and the recent spec driver (Crude) being in debit. The gains began to erode mid-session and spec selling quickly followed to send prices down into the mid 10.80’s however an equally sharp rally followed soon afterwards, most likely on short covering, which provided the platform for a fresh look at the session highs. In keeping with the fickle nature of today’s market these highs proved to be short-lived and we instead returned to sit within the middle of the range. All the while we were seeing a transformation in the nearby spreads as Jul/Oct widened all the way back out to -0.11 points from an early high of -0.01pt, maybe showing some nervousness ahead of the index roll which will commence at the back end of the week. There was a brief push back up to 11.03 ahead of the close with trading either side of 11c on the call ensuring a Jul’20 settlement at that precise figure.

N.o 11 Futures

ICE Futures U.S. Sugar No.11 Contract

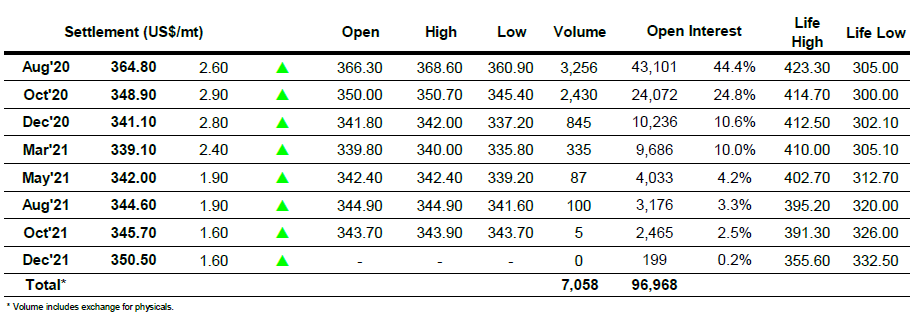

ICE Europe White Sugar Futures Contract