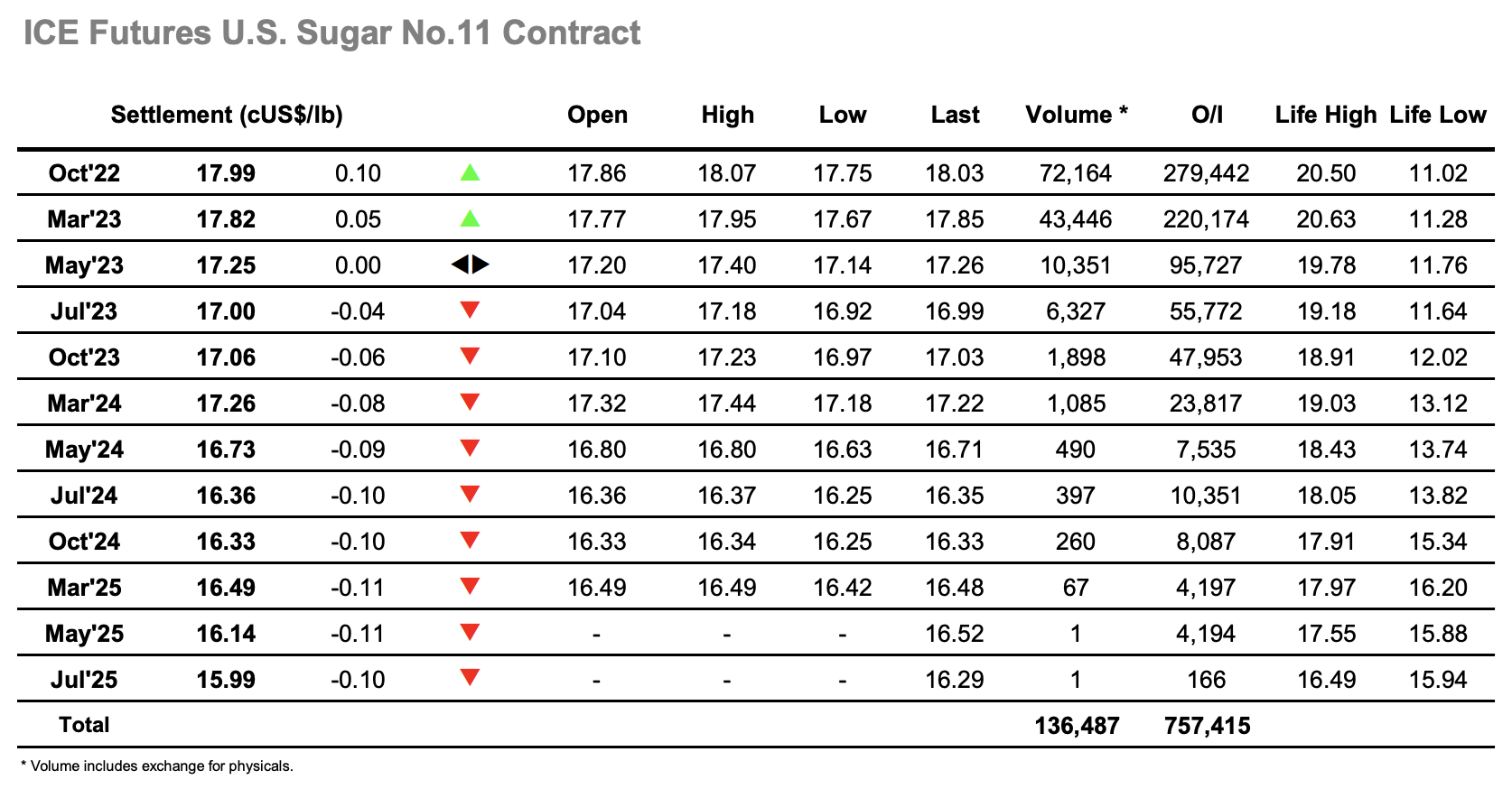

A weaker opening saw Oct’22 trading as low as 17.75 during the early stages, though with consumer scales in place the market did not slip any further before a sharp recovery back above 18.00 ensued against short covering. There remains little reason to be positive at present with any rally through the 18’s proving to be short-lived, and so to see the market pull back into the range was largely expected, many traders continuing to stand aside even though we have an expiry coming at the end of this morning. With the macro mostly weaker and the BRL also weakening into the 5.20’s the market was in something of a malaise, only the spreads showing any real activity as Oct’22/March’23 dipped to 0.07 points before finding some afternoon support. The index roll does not commence until next week though clearly some rolling interest from elsewhere has emerged ahead of expiry, with an aggressive push higher taking place later in the afternoon to combine with a flat price rally and take the differential back out to 0.18 points. The final hour played out right around 18.00 to maintain the centre of the broad trading band in which we continue to reside, settlement being made at 17.99 as a largely uneventful day concluded.

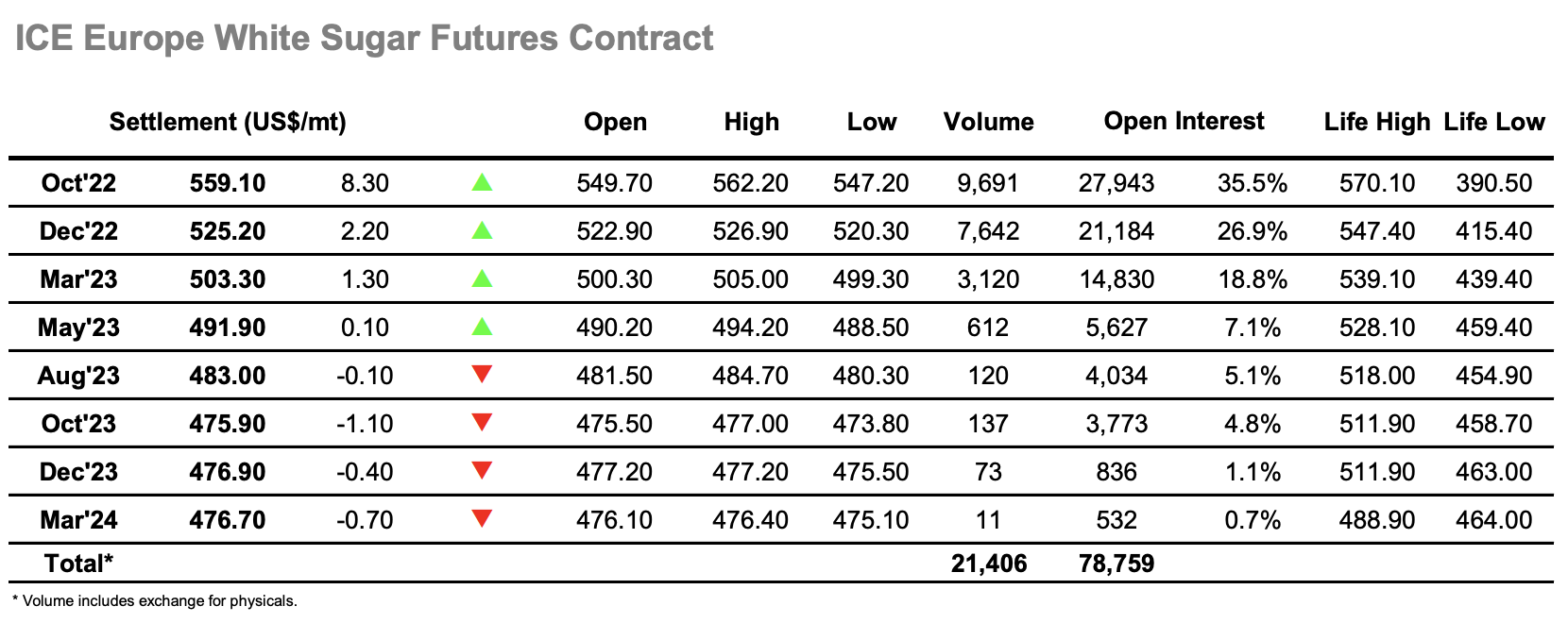

A quiet start saw prices trading a little lower across the board, but by mid-morning the picture was changing at the front of the board with buying emerging for the Oct/Dec’22 spread. Despite the market having few reasons to be positive with the macro picture and fundamental outlook for the longer term being generally unsupportive, the spot month was having none of it and with the spread pushing back above $30 the Oct’22 saw the flat price surge up to $560.00. With no other positivity in the world of sugar today there was some selling emerge to send Oct’22 back down by a few dollars, however with the spread remaining well supported consolidation followed through into the afternoon. This provided the basis for another push upward on which the outright value pushed beyond Tuesdays $560.00 mark to reach $562.20, in the process spiking the Oct/Dec’22 spread to a barely credible high at $40.10. Neither level proved to be sustainable as we moved through the latter stages with the spread pushed back to $33.00 and in the process pulling the outright value back to the upper $550’s. Settlement was positive at $559.10 with Oct/Dec22 ending at $33.90, though there remain obstacles to overcome in the form of the Jul and Aug highs if we are to challenge the $570.10 contract high mark.