Sugar #11 Jul’21

Any questions that yesterday’s performance had raised as to the upward merits of this market were quickly answered as buying sent prices surging upward on the opening with the momentum continued through the first hour to reach 16.56 basis Jul’21. There were stories on the newswires last night speculating as to the lower Brazilian crop for the 2021/22 season and this may well have been the motivation as following a brief pause the buying returned to push beyond the recent 16.62 high mark and target the Jul’21 contract high at 16.73. By the end of the morning we were hovering just beneath this level awaiting the spec impetus that the US morning so often brings, and right on cue it arrived to push through and send Jul’21 to a new high mark at 16.80. It was only at the higher levels that a little more producer selling was uncovered, the lack of which had been obvious given the low volume seen as we had rallied, and prices entered a consolidation pattern at the top of the range with buyers holding back from pushing again too soon. Breaking from this band we unexpectedly headed south with some long liquidation triggered as we worked back to the 16.50 area, though there never seemed any threat that we would completely wipe the day’s gains out. The macro was proving mixed and some were attributing the slide to the influence of lower crude values, however prices quickly turned around and dispelling the myth that the two products are joined at the hip we returned to be holding the lower 16.70s during the final hour. Values remained firm through the closing stages and though we did not revisit the highs the Jul’21 settlement level at 16.72 has reinvigorated the technical picture which will be pleasing to the bulls.

Sugar #5 Aug’21

With No.11 values already higher we surged out of the traps this morning to reach $460 in the opening minutes. With last nights late reversal already eradicated this set the tone to continue pushing upward and though progress became more gradual the modest buying was able to send the front month towards $462 before the morning was out. Though the flat price was buoyant there were somewhat mixed signals emerging from the nearby spreads as they struggled to maintain their initial gains and from morning highs at $8.30 for Aug/Oct’21 and $1.90 for Oct/Dec’21 both returned to unchanged levels. The afternoon saw an increase in the upward momentum with the flat price pushing on to $465.70 with specs once again keen to maximise the upside, though still the spreads lagged while white premium values were also losing ground due to the greater strength of No.11. The day took a twist when a retreat from the highs prompted long liquidation from day traders and sent the market sharply back down to the $456.00 area while at the same time sending the Aug/Oct’21 spread back in to $5.50, however once the selling concluded we were pulled back up through the vacuum by some very light buying to be well poised within $3 of the morning highs starting the final hour. The closing stages saw prices hold this same area, sending us out positively with an Aug’21 settlement level at $462.10

Nearby white premium values were weaker throughout today ending at $93.50 for Aug/Jul’21 while Oct/Oct’21 closed at $89.50, though Mar/Mar’21 remained steady at around $84.50.

ICE Futures U.S. Sugar No.11 Contract

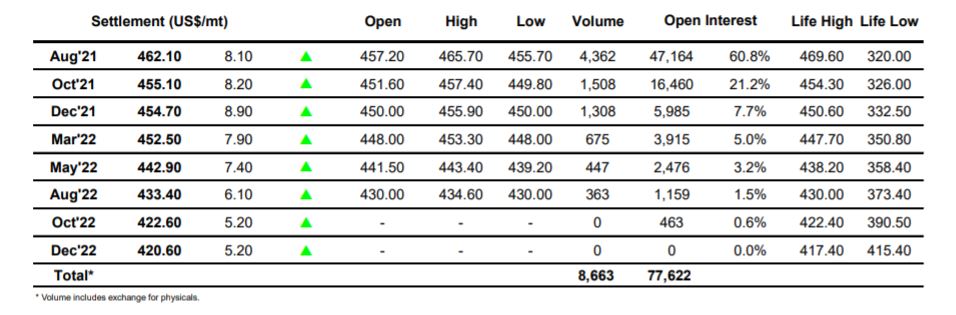

ICE Europe Whites Sugar Futures Contract