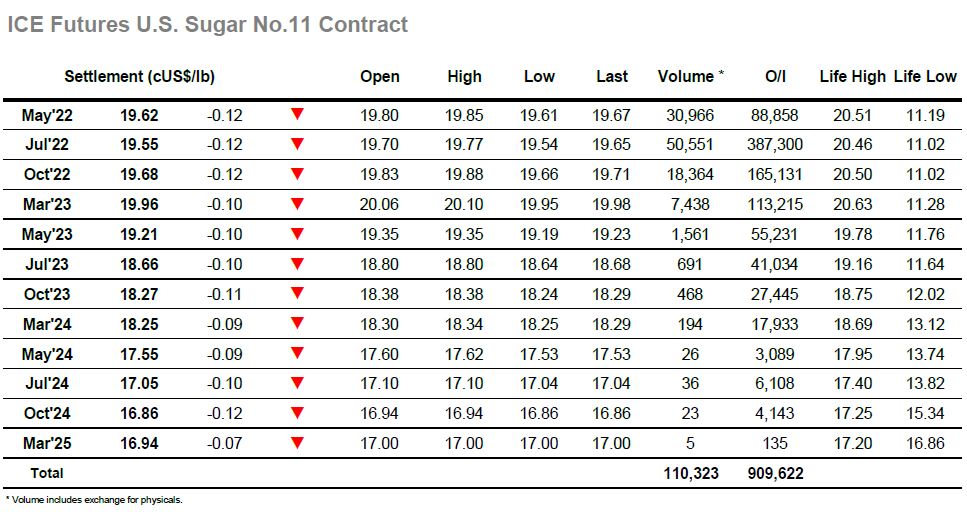

The pullback in values yesterday left the front of the board back below 20.00c, and though there was some small initial buying against physicals it soon petered out to leave prices edging along within a tight band for the duration of the morning. The start of the US Day brought its customary increase in volume with some light spec interest leading nearby prompts to gain around 10 points, though with no macro support of any note and a good deal of disinterest the market simply held the gains for a period before slumping to new session lows as the longs were liquidated. There was little other interest in the flat price which continued within the narrow range for the duration of the session, with only some moderate spread activity pully volumes up to a vaguely respectable level. With the macro creaking a little there was some fresh selling during the closing stages which led to marginal new session lows, ending the day weaker once more with settlement at 19.62 for May’22 while Jul’22 closed at 19.55.