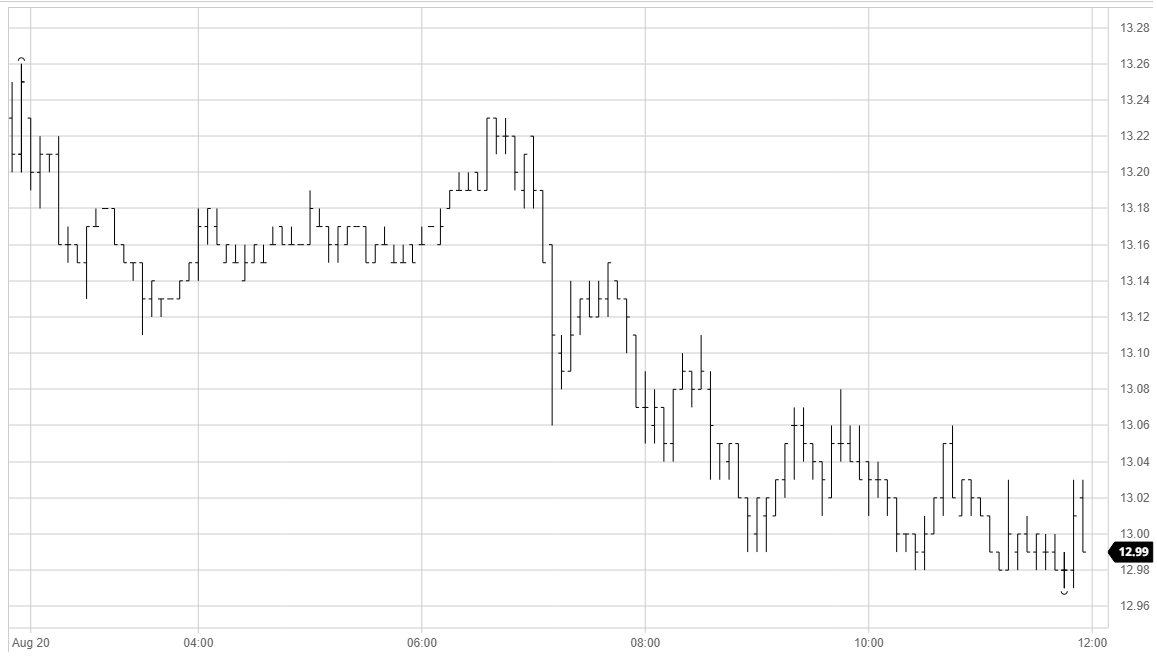

One of those fun days in the Brazilian Real, and the NY#11 prices today were driven by the world’s most volatile currency. In a day dominated by commercials, the strong dollar brought a large fresh volume of shorts to the market. After 9 a.m. BRT, with the uncertainties regarding the presidential veto for public workers pay raises, USDBRL surged violently on the open, and continued to rise until the first intervention of the BCB to curb the rise. At its peak, the BRL de-valued more than 2% with respect to the greenback. Prices surged to an astonishing level, above 1,700.00 BRL/mt (considering max pol premium), which prompted producers to hedge a significant part of their crops and, possibly, even divert some more of their ethanol production to the sweetener instead. 22/23 was particularly affected, which again emphasizes the current state of backwardation. With no such action occurring on the LDN #5 whites, we had the ARBs rising, on average, by 1.5% today.

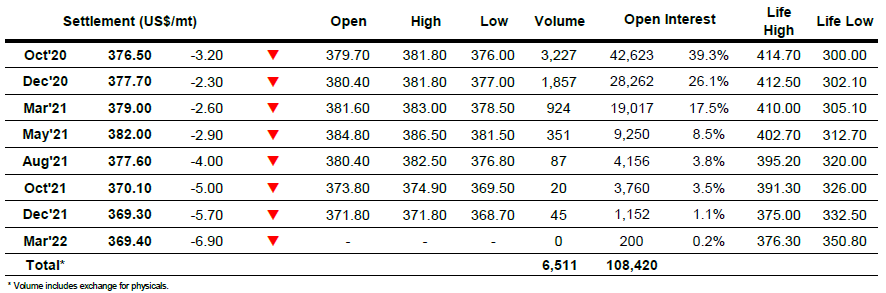

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

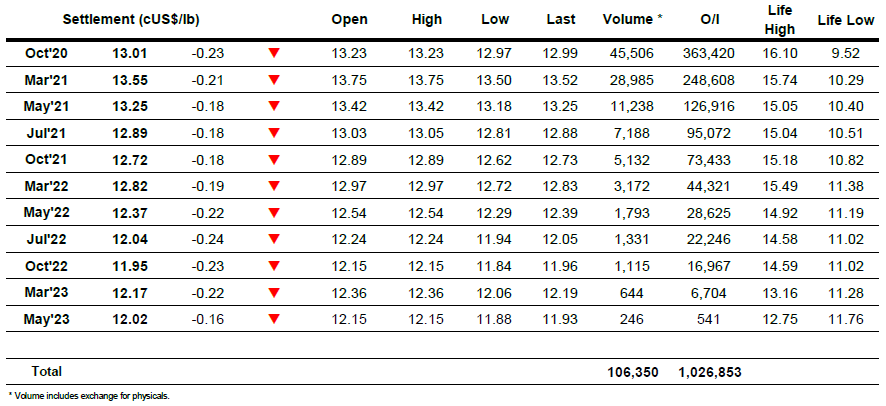

ICE Europe White Sugar Futures Contract