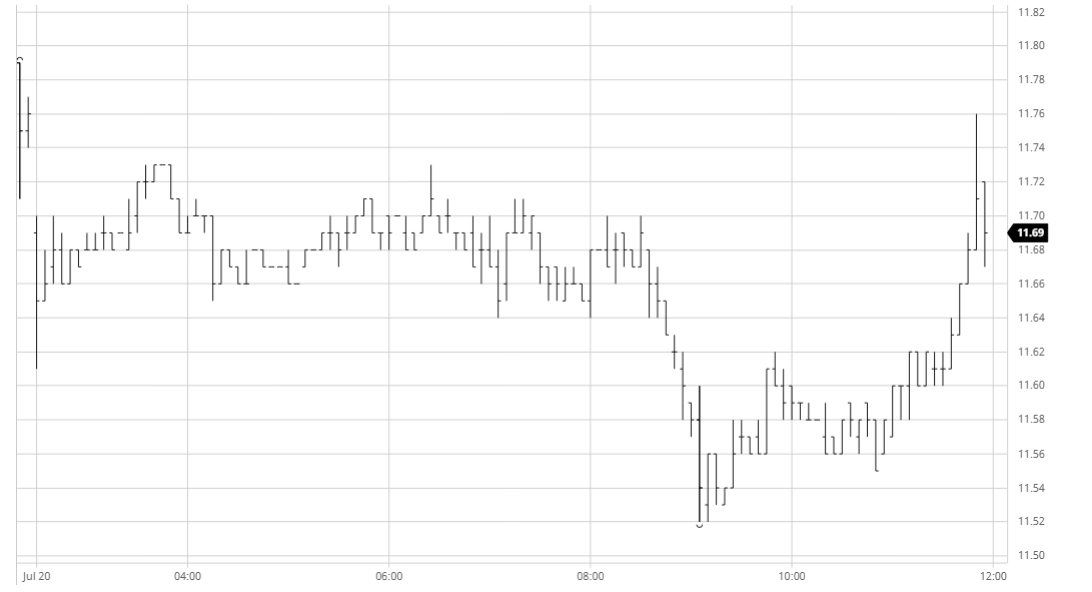

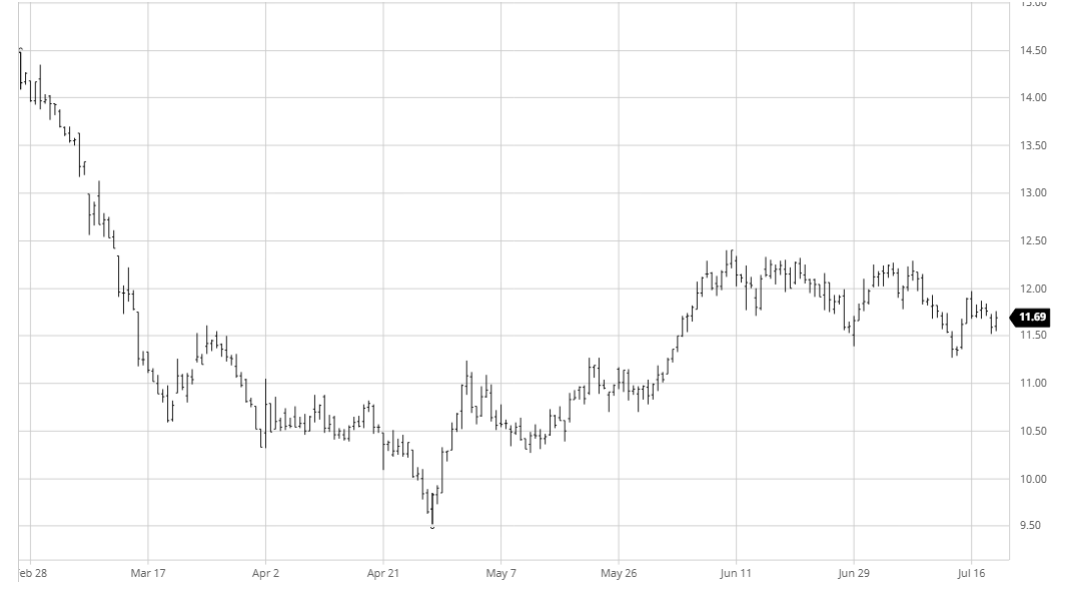

The disappointing nature of the market during the second half of last week continued during the morning with prices edging along within a narrow range against continuing low volume. A relatively modest reduction in the fund long to 71,627 lots as at last Tuesday had been expected, and with the recovery on Wednesday suggesting that the specs are probably closer to 80,000 long as a live position and content to maintain it there was little sign of any meaningful movement. The status quo was maintained into the early afternoon against a backdrop of a mixed macro and flat currencies, and though there was a brief flurry of spec selling when the market broke beneath the 11.61 morning low the limited volume meant that the move was limited and prices soon attempted to stabilise once more. It remained quiet until the closing stages when some defensive action from longs pushed Oct to a daily high at 11.76, and though settlement prices were very marginally below Friday’s closing values it means little within the current range.

SB Oct – Sugar No.11

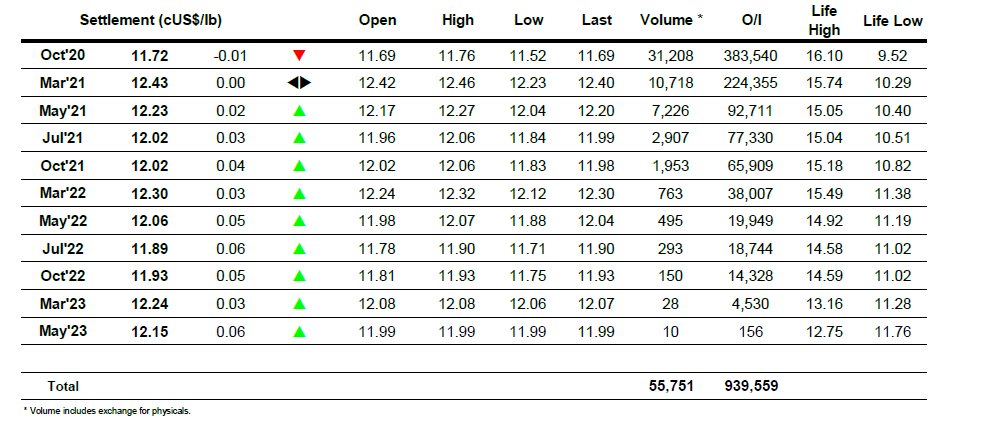

ICE Futures U.S. Sugar No.11 Contract

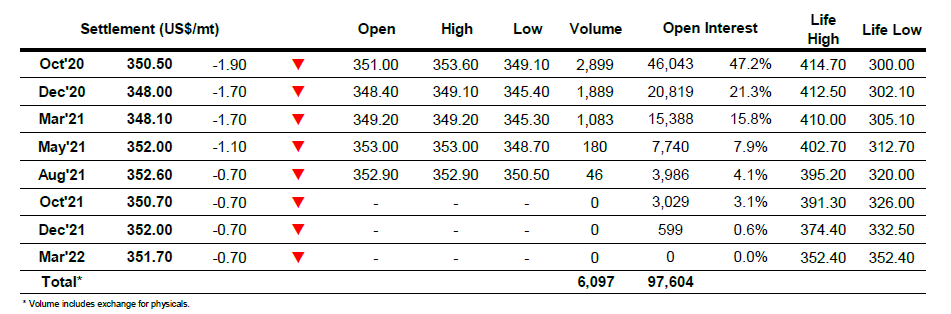

ICE Europe White Sugar Futures Contract