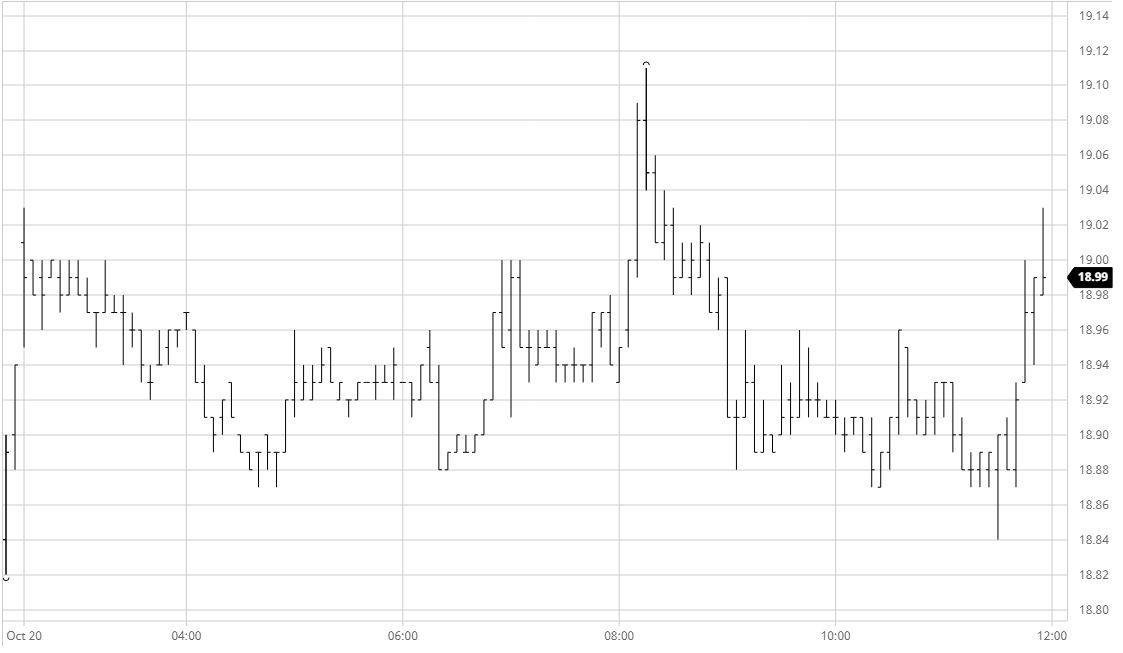

Sugar #11 Mar’22

The usual array of pricing and hedge lifting which comes with a fall in the market lent support during the early part of the day however the price topped out just above 19c and with the buying easing so the price gradually eased back to overnight levels. Recent sessions have seen a good deal of spec liquidation and no doubt the addition of fresh shorts from the faster moving sector / small traders however today presented a somewhat calmer environment in which we appeared content to consolidate and reassess. Having sat comfortably in the 18.90’s for several hours there was a short-lived spike to 19.11 (short covering?) during the early afternoon before the status quo resumed with another prolonged period spent with March’22 edging along in the 18.90’s. Interestingly given the recent losses we were also seeing support for the March’22 spreads as buyers stepped in at the lower levels, and with March/May’22 reaching 0.26 points and March/Jul’22 out to 0.49 points there seemed little prospect that the specs would fight the support and challenge yesterday’s 18.82 low despite the close proximity. The latter stages saw a nudge down to 18.84 fail to gather any momentum before some further short covering appeared to take prices away from the lows on the close. March’22 concluded an inside day at 18.97 though whether this represents the start of some bottoming or a mere pause remains to be seen.

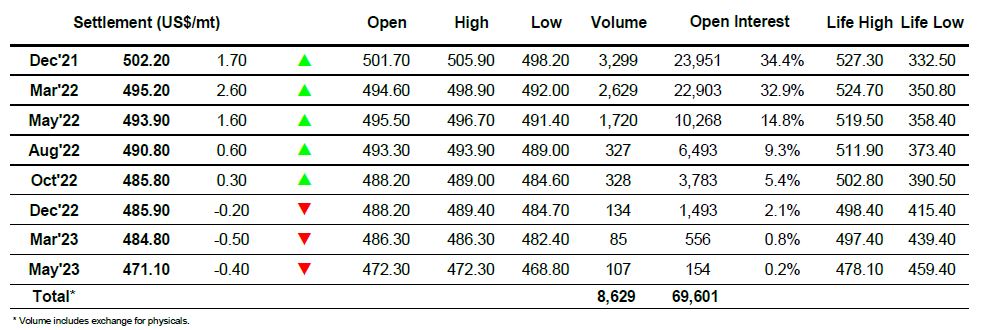

Sugar #5 Dec21

There was only light volume on show for the opening however it had a significant impact as Dec’21 surged from $501.70 to $505.90 before slipping back down towards the lower end of the range with the buying concluded. This presented the opportunity to explore the $500 support area and though no stops were uncovered we did nudge through the psychological mark a couple of times as we extended the current move to $498.70. The most supportive element in recent days has remained the macro picture which continues to be relatively steady, and though we are making contrarian moves as some of the spec longs withdraw the wider world is clearly discouraging a more significant liquidation. Though Dec’21/March’22 was a little weaker on the day it continued to find buying in the $6 area, its resurgence of late another factor in preventing the current decline from gathering extra pace. Another light push down extended the range to $498.20 during the afternoon but the situation was otherwise unchanged and we then resumed sideways, albeit without climbing far from the lows. Some further short covering during the final 20 minutes sent prices back above $500 to match levels seen in the early part of the day, with Dec’21 settling higher at $502.20.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract