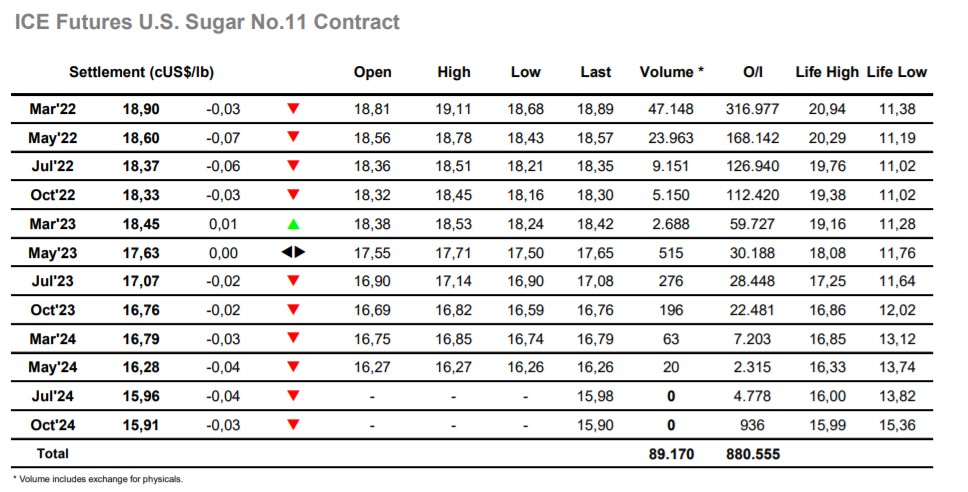

Sugar 11 Mar’22

The day started weakly as March’22 traded down to 18.70 as concerns over yesterday’s decline encouraged sellers back to the fore. While the market did not meltdown there was a lack of enthusiasm from buyers through the rest of the morning which left prices struggling to recover sufficient ground to fill the overnight gap. With the macro picture showing weakness across the board, we experienced an unlikely spike upward as spec buyers looked to generate some pre-weekend positivity with a push back above 19c. Their efforts proved futile however as the gains we quickly handed back, though as activity then calmed into a narrow band through the rest of the afternoon some may contest that they had at least pulled away from the lows and stemmed further potential losses. The March/May’22 spread continues to confound the outright moves and was trading higher at 0.30 points during the afternoon but that did not divert the market in any way as traders became content to allow prices to ease sideways through the final hours. March’22 closed just 3 lower at 18.90, a solid showing in the face of wider market weakness indicating that the longs may not yet be finished in their efforts to test higher.

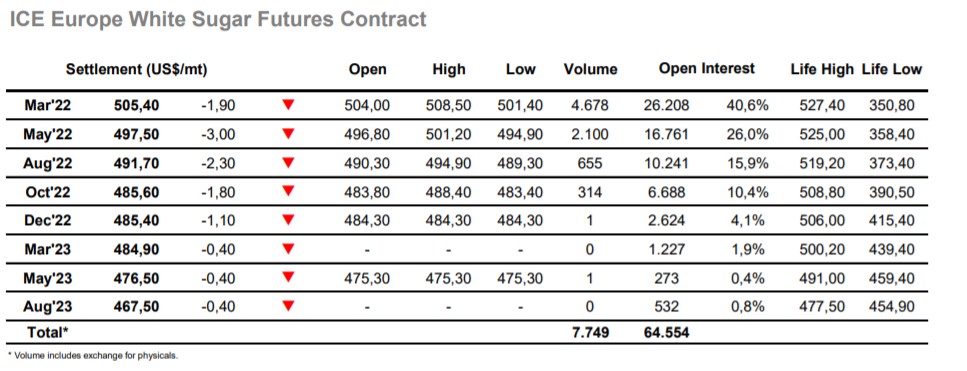

Sugar #5 Mar’22

The negative technical impact of yesterday’s outside day was expected to be felt and with the macro picture not providing any reason to feel positive we saw prices slump during the early part of the session to reach $501.40 basis March;’22. Volume then fell away for the rest of the morning to leave prices consolidating ahead of the lows, although there was some encouragement being felt through the white premium values which had firmed against No.11 weakness to lave March/March’22 back above $91. Despite the concerns a rather unexpected turnaround followed during the early afternoon as longs looked to defend against the fall and prompted day traders to cover back some shorts in the process. This action took the price soaring back into the green at $508.50 however with nothing to back the movement up elsewhere the momentum was lost, and prices returned to the range. Buying ahead of $500 picked things back up as we fell towards the morning lows and on lighter volume the rest of the afternoon played out in the vicinity of $505. Some closing shenanigans moved the flat price around though settlement was where we had been sitting at $505.40.