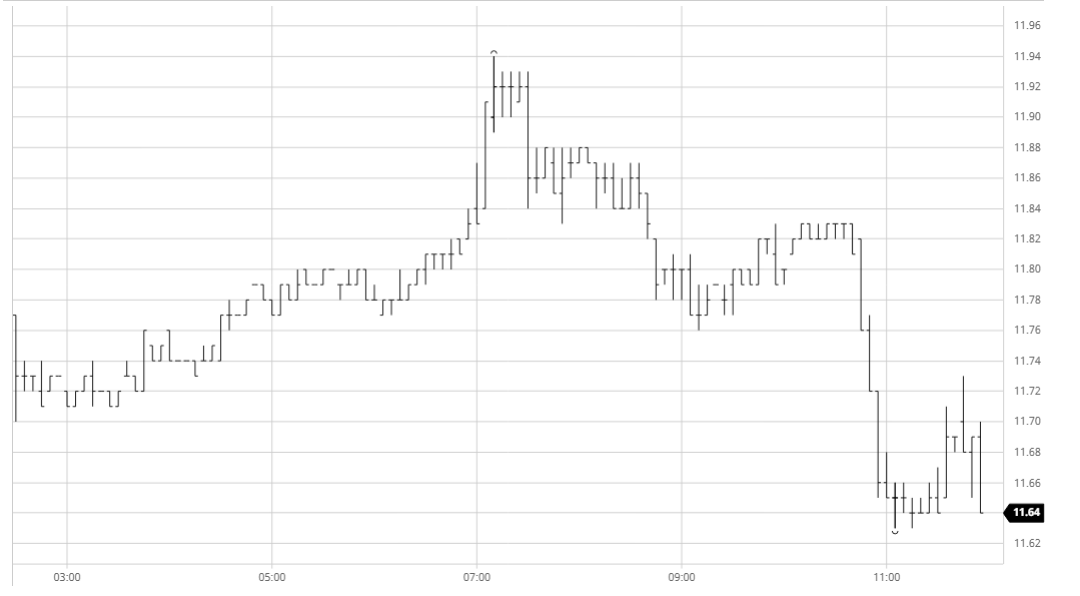

Macro stability encouraged some light buying into nearby prompts as the morning progressed, but with great emphasis on the word “light” as we merely edged up towards 11.80. This did at least provide the basis for some more tangible buying once US traders had logged in with a small acceleration ahead to 11.94 taking place, though despite continuing macro positivity we lacked the impetus to push ahead through 12c and instead set back down into the range. There was more strength being seen for the London whites as nearby values found support to continue their recent recovery, pushing ahead to take the Oct/Oct’20 white premium to $96.50 and Mar/Mar’21 to $75.50. Consolidation continued through the afternoon despite a stronger BRL adding more external positivity, and hopes from longs that this may lead to another look upward were extinguished as we approached the final hour as a sharp burst of selling sent the front month crashing back down to 11.63. The fall to the lows widened the premium values by a further dollar and it proved tough for No.11 to recover, playing out the final hour just above session lows to record another small net loss and leave us no nearer to breaking out of the current dismal range.

SB Oct – Sugar No.11

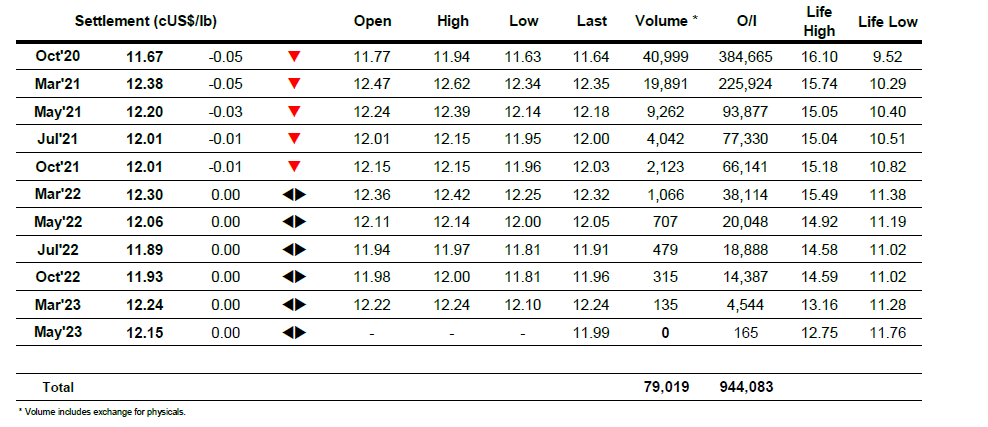

ICE Futures U.S. Sugar No.11 Contract

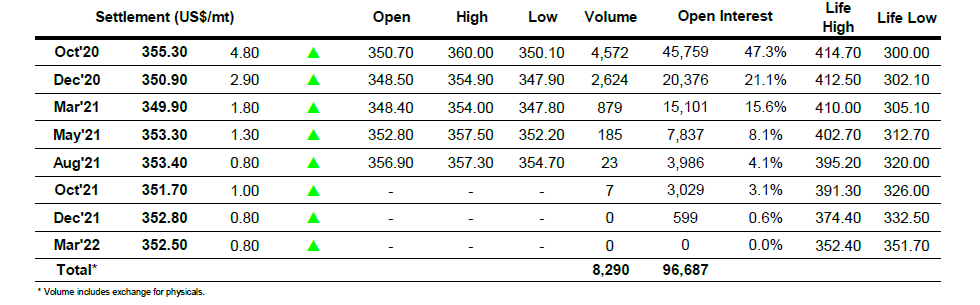

ICE Europe White Sugar Futures Contract