Sugar #11 Oct’21

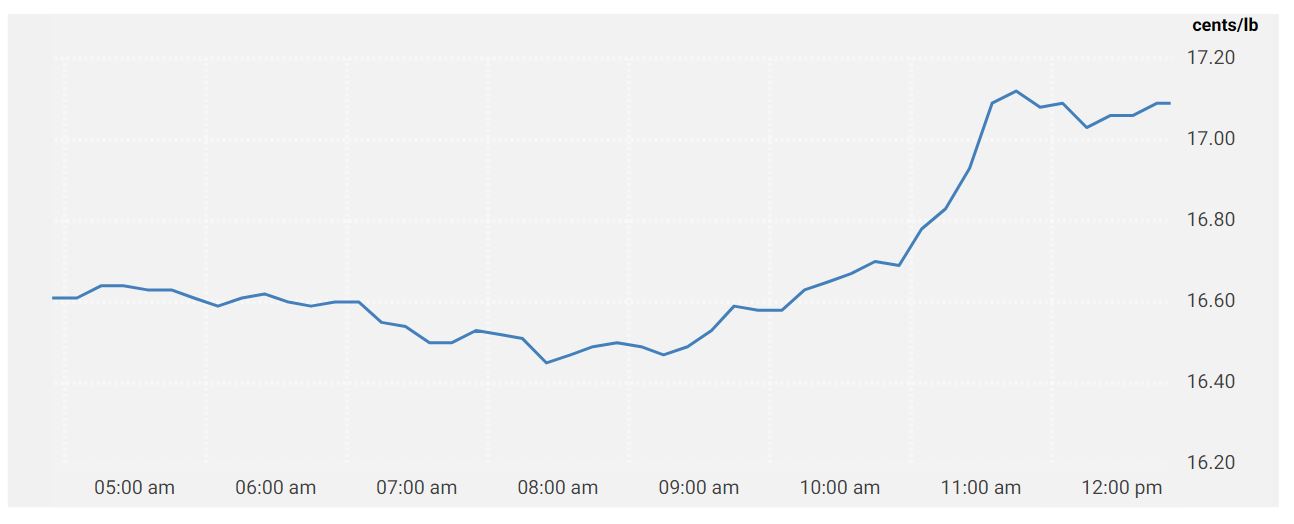

On the back of a series of poor performances across the whole of last week there is limited confidence in the market and this could be seen from the start today as October immediately traded downwards. Light buying briefly pulled the price back up to 16.67 however it was merely an interlude to the morning slide which resumed and saw us trading down to 16.44 ahead of the US morning, with the Jul/Oct’21 widening to -0.27 points across the same period. Ongoing scale buying encouraged some short covering which pulled the price away from the lows towards 16.60 during the early afternoon and somewhat unexpectedly this led to more significant spec long interest entering the fray. Steadily the climb continued to 16.80 beyond which level we saw an acceleration in pace with buy stops triggered and more of the recent shorts heading for the exit causing an acceleration all the way to 17.15 before a period of respite when the spec interest eased. With Oct’21 now acting as virtual spot month the pace of buying also led the front spread to weaken a little further to -0.29 points, movement which continues to cast a negative shadow as to the broader market prospects in spite of the flat price making moves to recover recent losses. The latter stages saw a new highs recorded at 17.20 before easing back against late position squaring to leave Oct’21 settling at 17.07, a strong close as the market looks to reverse the recent downtrend though whether this is some aggressive bottoming or a more significant directional shift remains to be seen.

Sugar #5 Aug’21

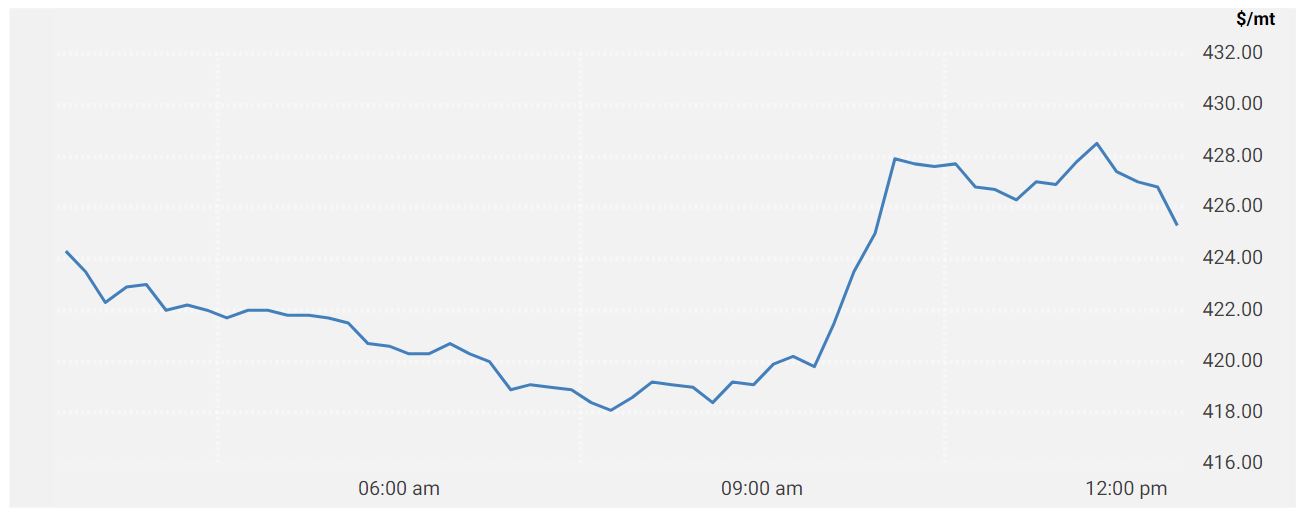

Technical weakness has been the prime driver in values for more than a week now and to begin the new week we saw a continuation of this trend with Aug’21 pushed in the direction of the next support level at $415.60 as we continue to explore the robustness of the gains achieved since February. Increasingly we are doing this with oversold near term indicators and the two cannot continue to move hand in hand but despite this the morning trade sent the price as low as $417.80 before stabilising against heavier buying ahead of the support level. This allowed prices to level of for a couple of hours before things took a turn with spec buying for the No.11 market showing and influencing us to also start turning upward. The pace of increase which followed was somewhat unexpected with Aug’21 rallying by some $9 to $428.80 on fewer than 600 lots, the lack of any significant selling proving of great assistance as values attempted to track the gains being made for No.11 as despite the stunning pace of increase we saw nearby white premium value fall back. Consolidation at higher levels saw Aug/Jul’21 pare further to $56 as No.11 continued to break new ground and following the creation of a double top for the intra day chart the closing stages saw position squaring to send the price back to settle at $425.70.

As mentioned the white premiums gave back ground on today’s rally and ended weakly, valued for Aug/Jul’21 at $55.80, Oct/Oct’21 at $63.90 and March/March’22 at $73.30.

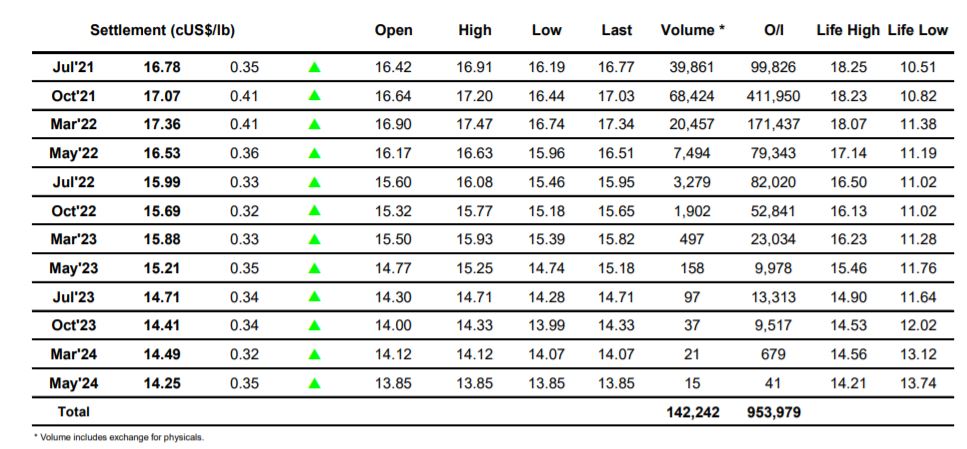

ICE Futures U.S. Sugar No.11 Contract

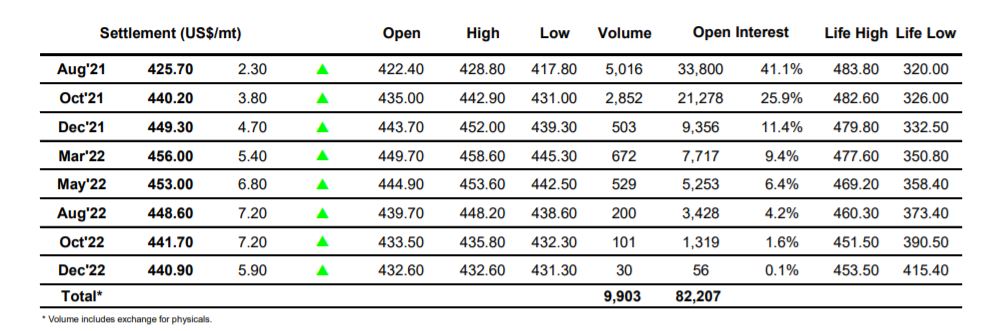

ICE Europe Whites Sugar Futures Contract