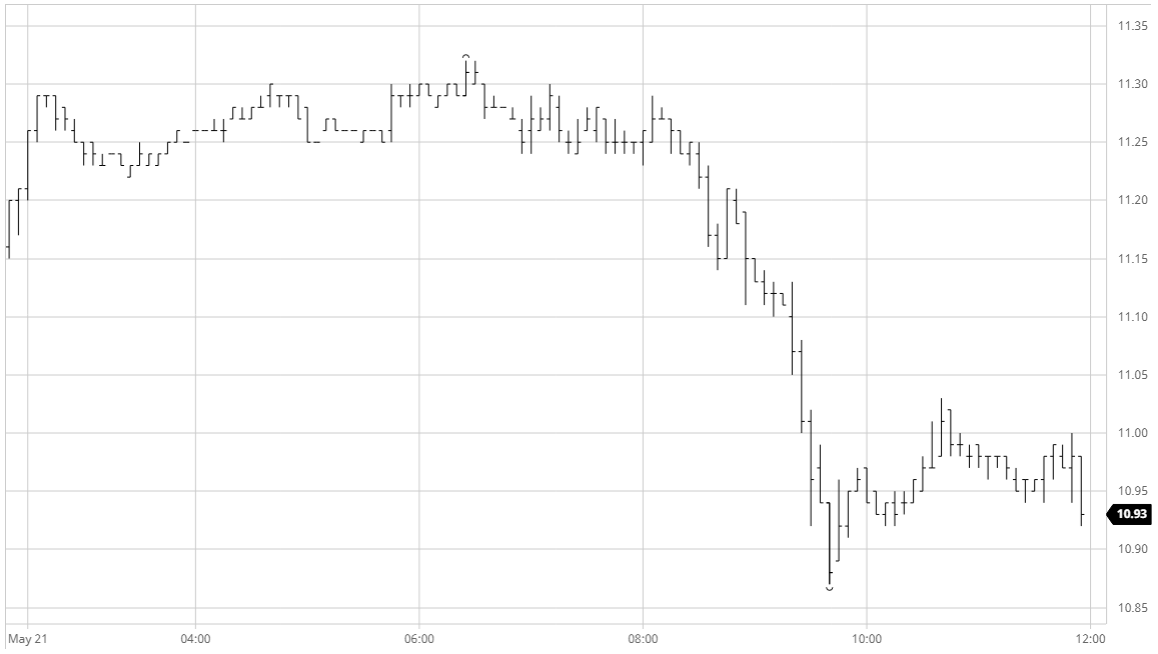

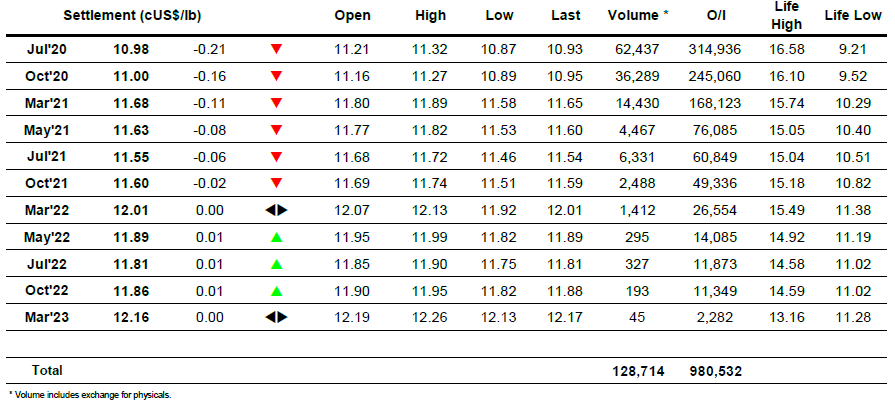

In keeping with the recent trend there was buying for the nearby positions from the start which ensured that Jul’20 was able to consolidate in the 11.20’s throughout the morning. This ensured that we kept our recent trend of maintaining connection to the macro and provided the platform to try above yesterday’s 11.30 high mark, however though we printed through to 11.32 there was not the same spec momentum seen yesterday and we instead consolidated the 11.20’s once more. USDBRL commenced firmer once again to continue its own recent recovery, however this did not encourage support as may have been anticipated and instead with the upward momentum temporarily lost prices began to ease back a little further and for the first time in a while separated a little from the macro as some long liquidation took place. Selling increased as we worked back towards 11c and a few sell stops were triggered as we moved beneath the 11.01 pivot which had attracted a chunk of buying only yesterday. Prices did make an unsuccessful attempt to push back above 11c during the latter part of the day before playing out the last hour in the 10.90’s in action which suggests that further gains may be on hold for the near term at least.

N.o 11 Futures

ICE Futures U.S. Sugar No.11 Contract

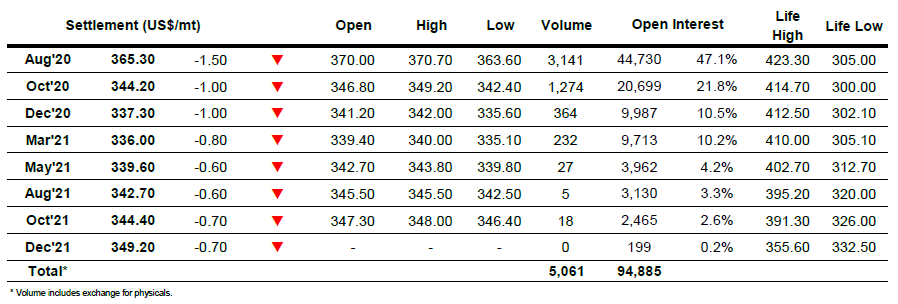

ICE Europe White Sugar Futures Contract