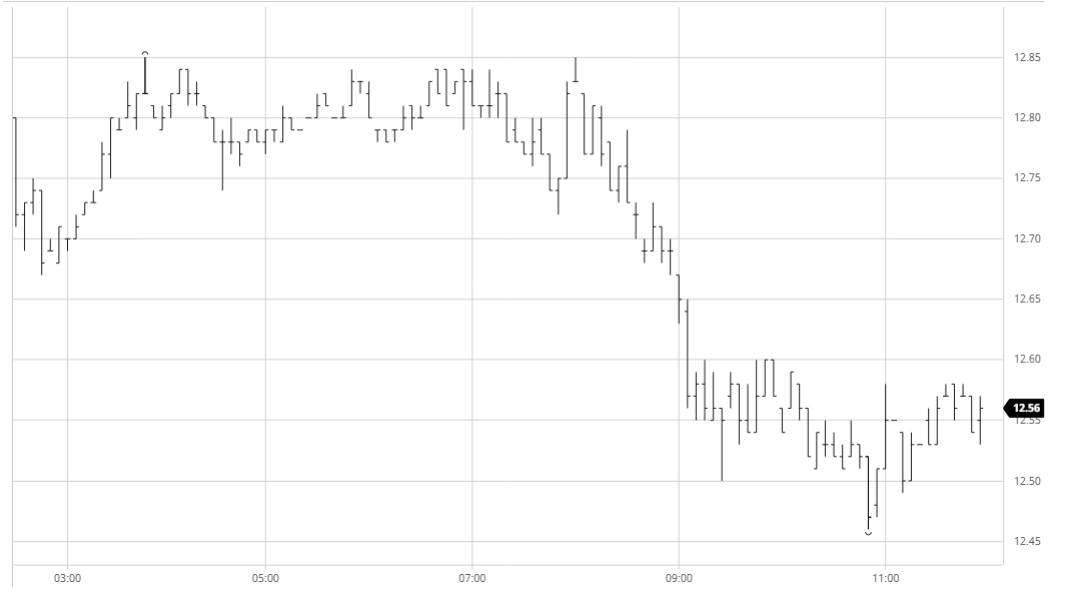

Last week’s strong recovery has traders talking of a continuing push towards last month’s 13.77 high mark for March’21 with the lowest COT figure of 143,840 long providing plentiful space for specs to add to their position should they wish, as they no doubt already have been doing on the rally since last Tuesdays close. Fundamental news has been relatively unchanged with bull traders talking up concerns over the direction that India will take while the bears continue to point to the size of the Brazilian crop, however for today at least it seems that both were disregarded as instead it was the macro which took precedence. Initially the macro weakness served only to send prices sideways with traders trying to maintain the trend by holding the market near to unchanged while equities and the wider commodity world headed south. They proved unable to do this as the afternoon progressed in the face of continuing macro weakness and with the USDBRL opening out at 5.49 to bolster the overhead producer selling while the macro moved further down we eventually saw selling push prices to new session lows, forcing out some of the weaker recent longs as sell stops were triggered on the way to session lows of 13.03. Holding above 13c provided some psychological help and we recovered a touch from the lows during the final hour, though were still showing losses in excess of 20pts for nearby prompts. By the close USDBRL had recovered much of the earlier losses to be back at 5.40 and having now halted the rally both this and the wider macro seem likely to be pivotal to the immediate near term prospects.

Oct – Sugar No.11

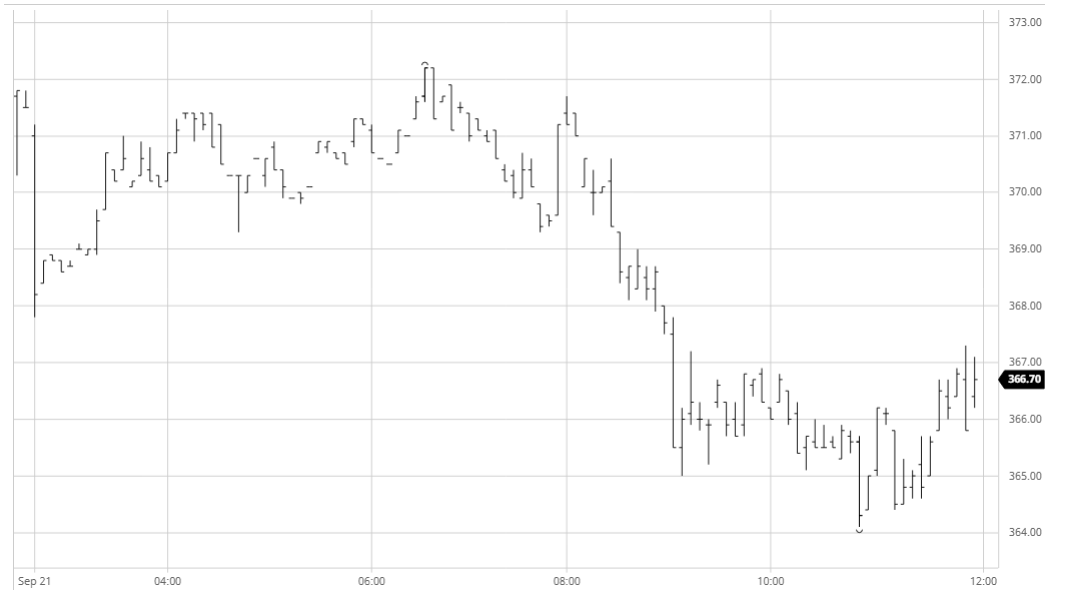

With our No.11 counterpart already working lower the market made an immediate lurch downward on this morning’s opening to 367.80 for Dec’20 before finding some buying which allowed prices to regain some traction. Despite the technical momentum and positivity established over successive sessions last week and the fact that the reduction in the fund position to 17,024 lots long affords space for the specs to potentially re-accumulate against said strength we merely meandered along for several hours as macro pressures detracted from the desire to continue pushing. Most commodities were trading lower with focus back upon crude which was as much as 5% downward despite positive noises being made by banks as to its medium term prospects, while European equities were in excess of 3% lower as covid-19 fears gather momentum once again. Eventually this macro pressure dragged prices down from this consolidation pattern to be making new session lows and the final three hours of the session became something of a struggle as we pulled back towards $364 before attempting to consolidate once again. The final stages saw values ease away from the lows despite little change across the wider macro suggesting that for the moment there remains a desire to push upward again given the right conditions, with settlement established at 366.80.

Dec – White Sugar No 5

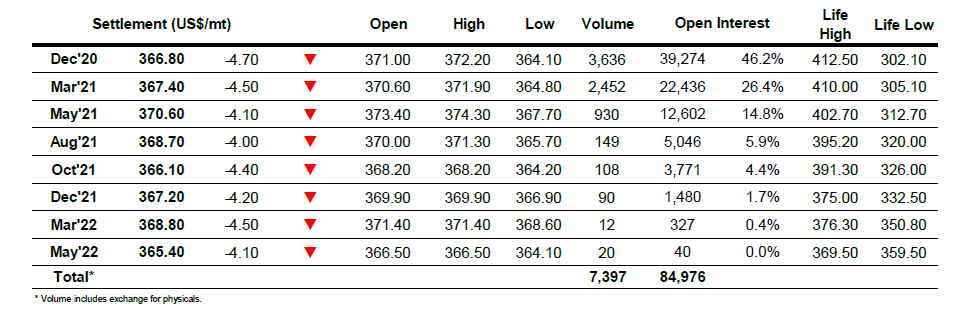

ICE Futures U.S. Sugar No.11 Contract

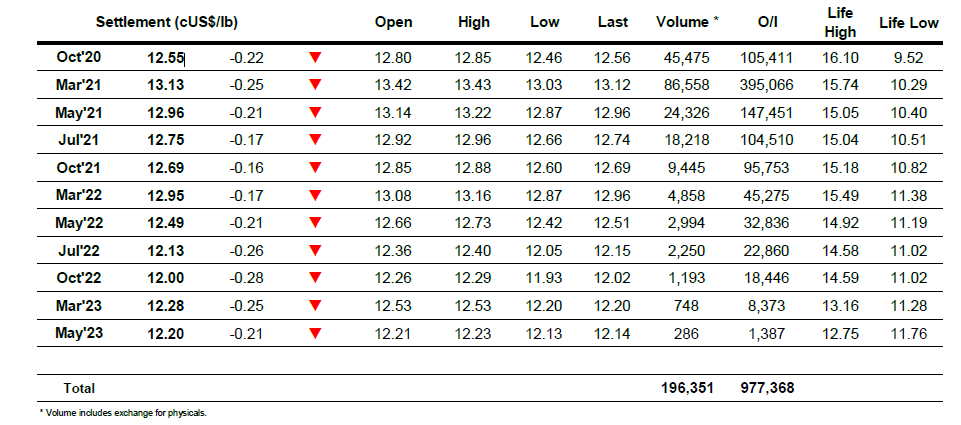

ICE Europe White Sugar Futures Contract