Sugar #11 Mar’22

A choppy opening provided the prelude to a sharp rally which took March’22 up to 19.97, repairing some of the damage inflicted on the sharp decline across the previous two sessions. There was some assistance from a broadly higher macro however the rally stalled and the rest of the morning became one of slow decline back into the range though prices remained net positive. With talk continuing of more positive news from India for the coming crop specs are proving reluctant to add back to their net long holding, and the subsequent lack of action during the morning led to a push down to 19.56 though this was quickly picked up with some light defensive activity. The price action remained comfortably to the centre of the range during the final couple of hours though there was weakness for the Oct’21/March’22 spread which moved to be trading at -0.78 points as we reached the close. March’22 settled at 19.75 to arrest the slide which began last Friday and suggests that as we approach the Oct’21 expiry next week we may see continuing consolidation within the recent market parameters.

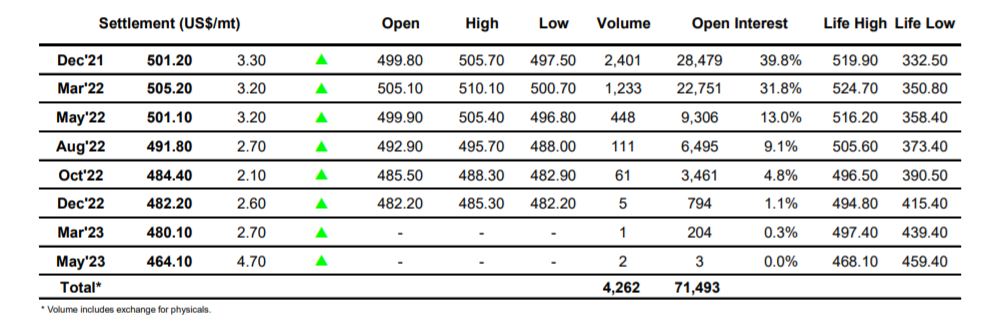

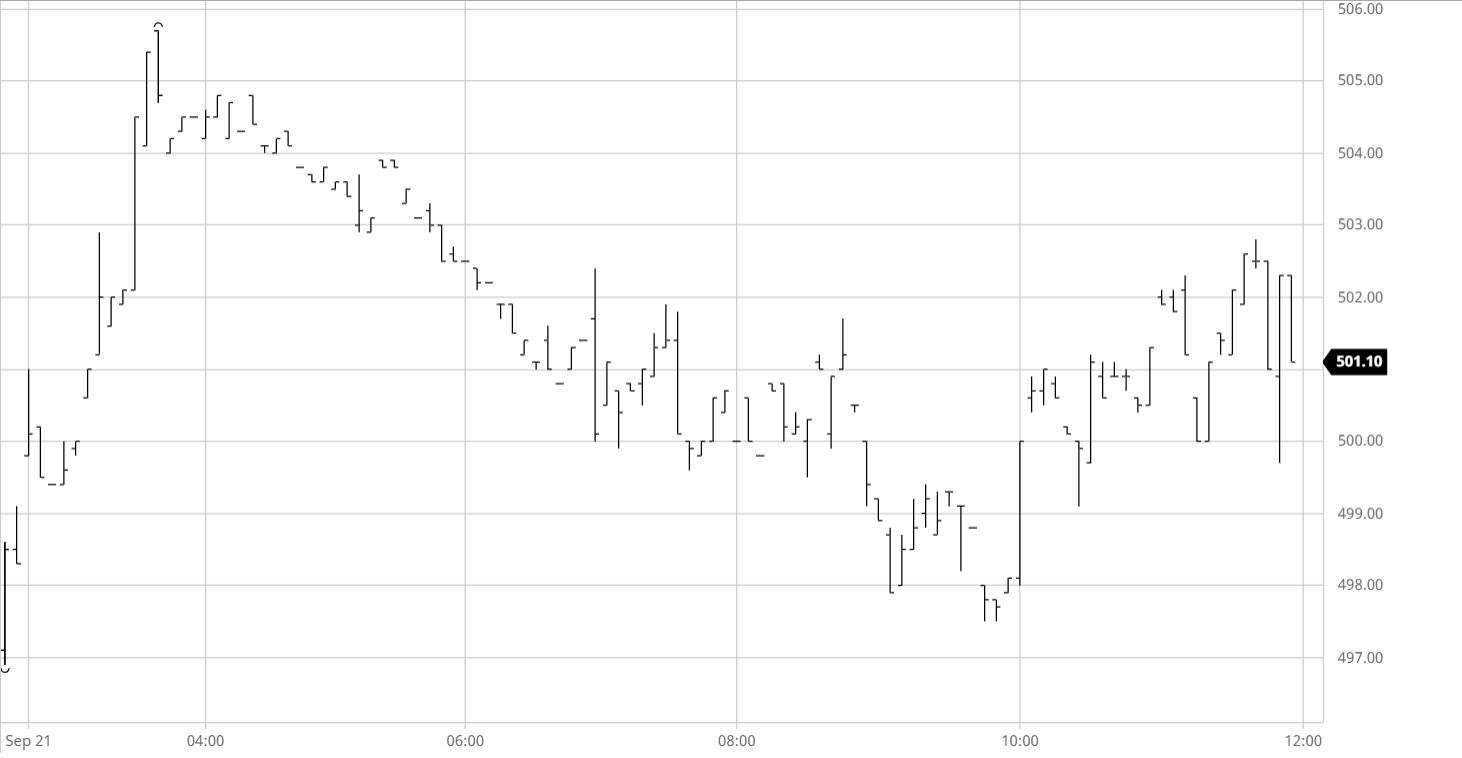

Sugar #5 Dec’21

Having lost further ground yesterday there was an immediate reaction which saw buying throughout the first hour to take Dec’21 back upwards to $505.70 before cooling. With the initial flurry behind us volume fell away to very low levels and for the rest of the morning prices simply edged back down towards $500 almost unnoticed, such was the lack of interest. Spreads were just as quiet as the flat price with only the Dec’21/March’22 and March/May’22 showing any moderate interest, though despite the lack of depth we still saw some reasonable movement with the dec’21/March’22 ranging between -$2.60 and -$5.00 as the outright movements. An afternoon dip to briefly trade into the red gathered as little momentum as the morning rally, leaving prices to return to the centre of the range during the final hour. Settlement was established for Dec’21 at $501.20 to conclude a day which suggests of near term continuation in the vicinity of $500 unless we can find a spark to bring some more significant interest in.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract