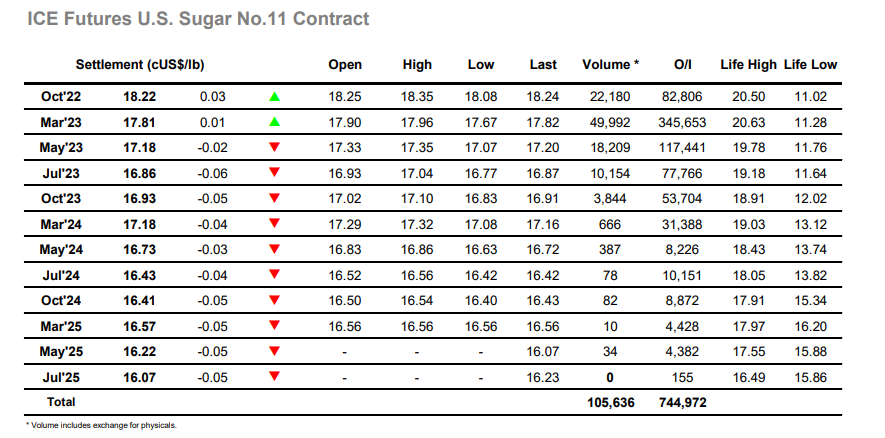

Initial buying ensured that the day commenced on a positive footing with March’23 pushing up into the 17.90’s where consolidation of this week’s recovery ensued. Volume was sparse throughout the rest of the morning during which time the market continued near to 17.90, while spreads were also only seeing minimal activity with Oct’22/March’23 holding near to its overnight 0.39 points. The start of the US Day drew in some light spec interest which pushed the price up to a session high 17.96, but as has regularly been the case over recent weeks the market starts to lack interest once we reach the top of the band (Oct’22 around 18.50 and March’23 above 18.00) and again this influenced activities. Liquidation sent March’23 sliding back down to 17.67 over the following hours, though the wider range did not bring any discernible increase in volumes with most traders remaining to the side-lines. Short covering from day traders pulled values away from the lows during the final hour and ensured a mid-range settlement value at 17.81, while Oct’22/March’23 remained firmer to close at 0.41 points.

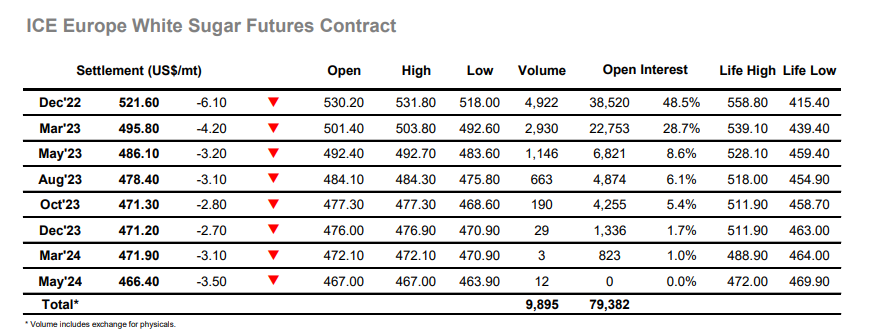

The day started on a positive footing with Dec’22 printing up to $531.80 in an effort to maintain yesterday’s recovery and reverse the weakness which has been prevalent for several days now, however within quick time the gains eroded. Since the Oct’22 contract expired there has been weakness permeating through nearby positions and as the day progressed this became the case once again, the spot Dec’21 contract slipping to $521.00 by early afternoon while the Dec’22/Mar’23 spread eased towards $25.00. The slide continued in the same vein throughout the afternoon, eventually leading Dec’22 to a low at $518.00, another disappointing showing and a significant turnaround since recording a contract high at $558.80 just last week. March’23 was also significantly lower which led the March/March’23 white premium down to $102.50, before recovering marginally during the final hour as short covering took place for outright prompts. This ensured that settlement values were away from session lows, Dec22 at $521.60 as another weak showing concluded.