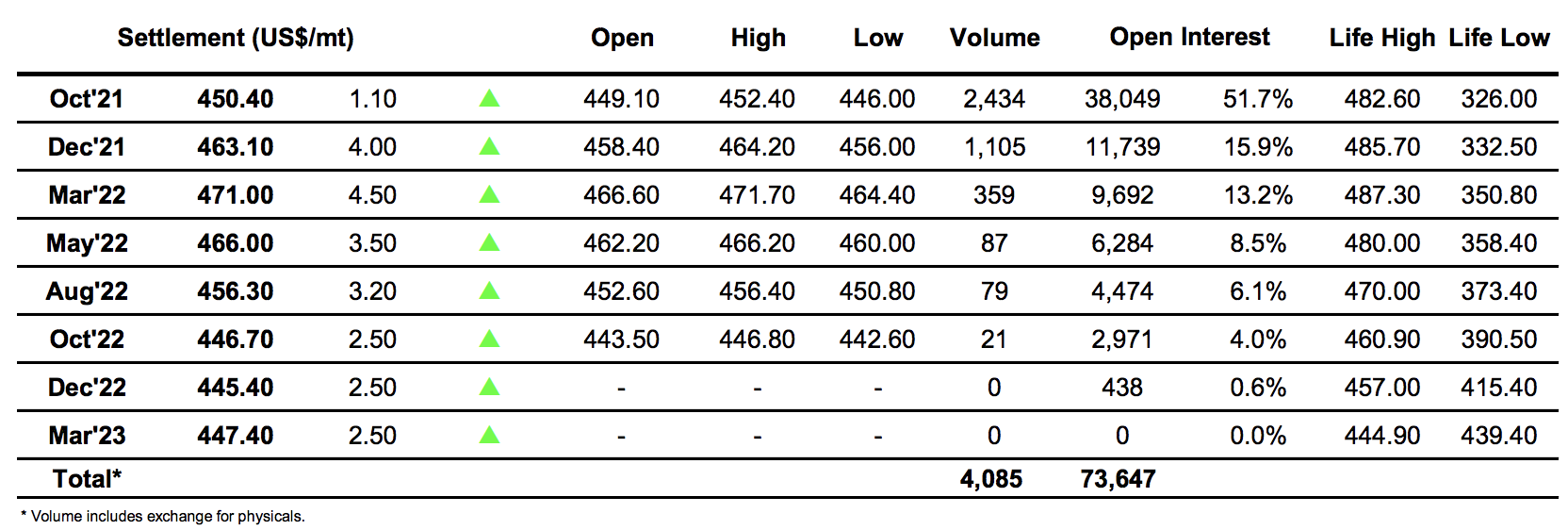

Sugar #11 Oct’21

An 19 point range across the first minute of the day saw Oct’21 fall from an initial 17.55 to 17.36 on reasonable volume however it did not extend beyond that with activity quickly returning to minimal levels and the price action settling into a narrow band either side of 17.40. By late morning the lack of action seemed to draw out a little selling from day traders which sent Oct’21 down to 17.27 however volume remained incredibly light and having failed to build any downward momentum the price turned back up on short covering to nestle back into the 17.40’s. Such was the apathy within the market that the next three hours was spent moving comfortably along in the range on continuing low volume, appearing set to complete a featureless session. An improving macro, and crude values in particular encouraged buying back into the environment during the final 90 minutes which enabled prices to push up through 17.55 and on to reach 17.67 though even this move felt somewhat half-hearted. We remained firm as we headed in towards the close, making new daily highs at 17.69 as we reached the call to bring the weekly 17.79 high of Monday back into view.

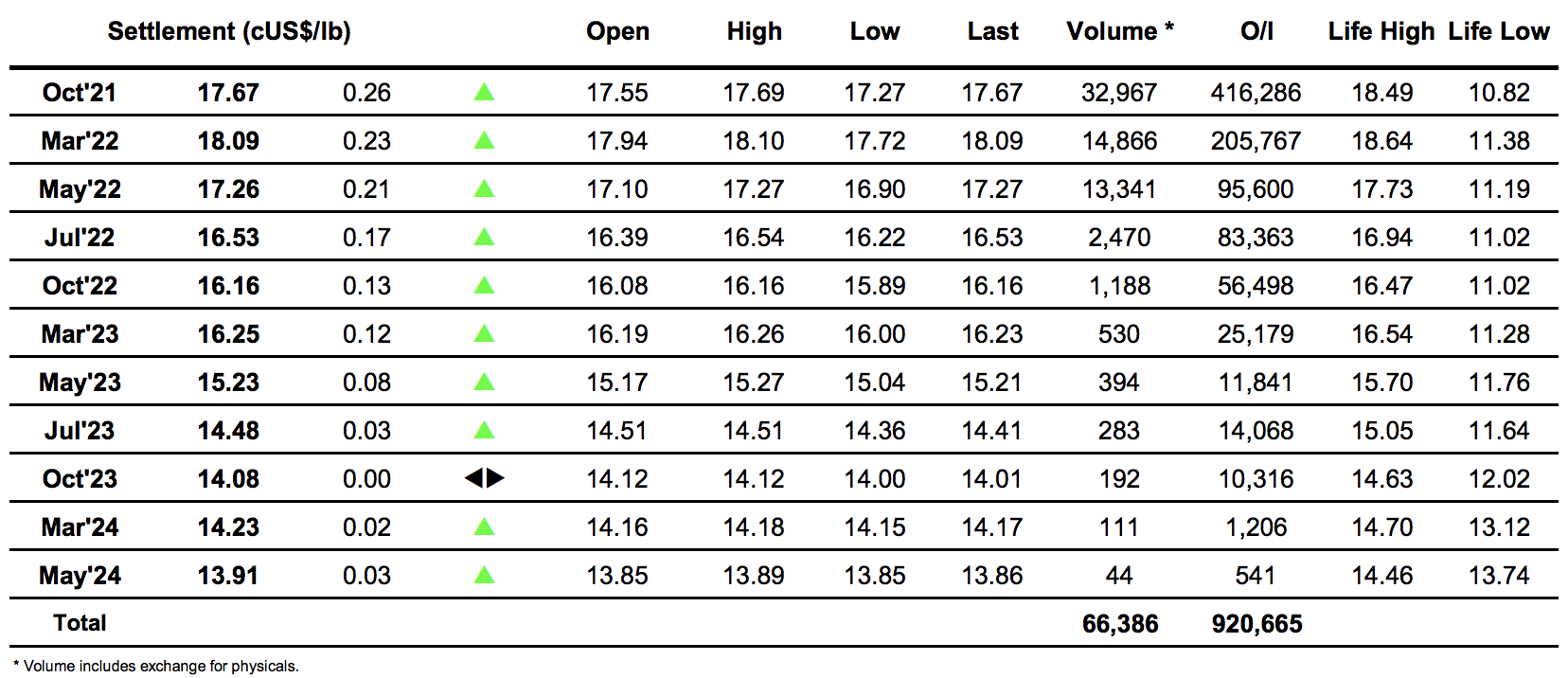

Sugar #5 Oct’21

There was light selling around for the opening which instantly pushed Oct’21 down to $446.90 however it was soon filled and prices then levelled out within a dollar of overnight values. A brief print up to $451.30 also stood out but what little trading there was soon returned to the $448.00 with activity so thin that we saw a 30 minute gap between trades at one stage. It was not until the early afternoon that interest picked up a little however even then the volume struggled to raise by very much with the volatility within the range largely due to illiquidity. A session low $446.00 was registered mid-afternoon and from here we saw the only real talking point of the day for the outright with light macro-led spec buying filtering in to take us to $452.40. Oct’21 progress was again being hindered by a continued lack of support for the front spread where we saw Oct/Dec’21 narrow to -$13.10 discount, which in turn contributed to the continuing recent weakness of the Oct/Oct’21 white premium. This spread weakness ensured that e remained shy of session highs heading towards the close, ending the day comfortably within the range at $450.40.

The front Oct/Oct’21 white premium was under pressure throughout the afternoon and closed weakly at daily lows, valued at $60.80. The 2022 position were all pulled down a touch on the back of this but recorded only modest losses with March/March’22 at $72.20 and May/May’22 at $85.50.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract