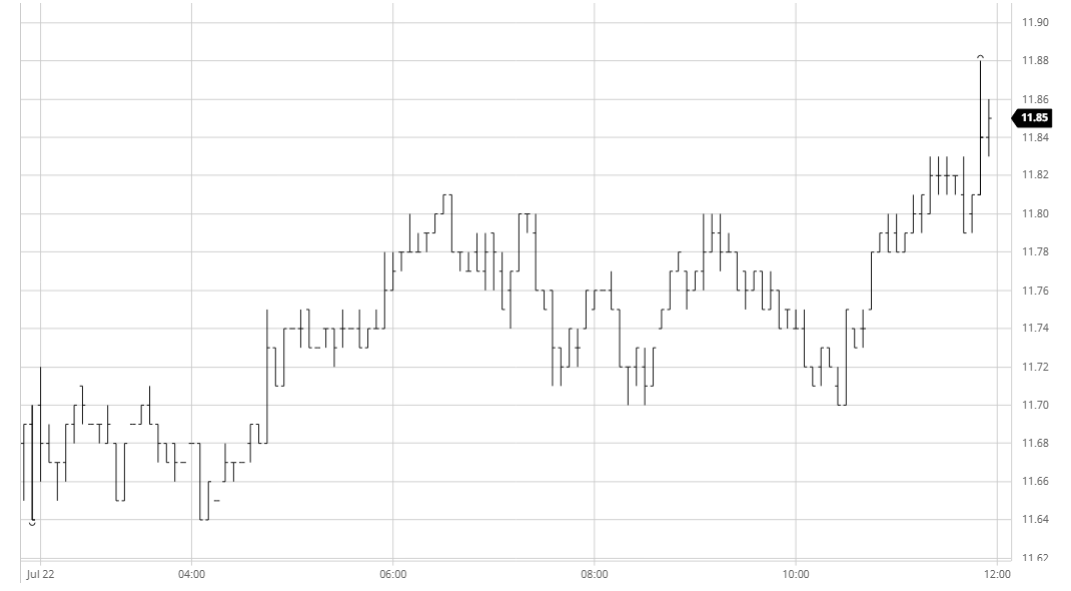

If yesterday proved one thing it is that sugar has very little interest in the macro currently, and early trading only served to reinforce this view as we sat in an 8 point range either side of unchanged levels. Values had a small upturn soon afterwards with October’20 working up to the 11.80 area however volume remained extremely light and the uninspiring action continued with prices then holding an 11.70/11.80 band for much of the afternoon. Whites values remained firm albeit in similarly quiet conditions with the Oct’20 WP value pushing above $99 intra-day although it was trading back around $98 again later in the afternoon. BRL was stronger for a second successive day, reaching 5.09 by late afternoon, and this may have contributed to a late rally that took Oct’20 to a session high 11.88. Settlement price was just below the highs at 11.86 however this counts for little having merely concluded a mundane technical inside day.

SB Oct – Sugar No.11

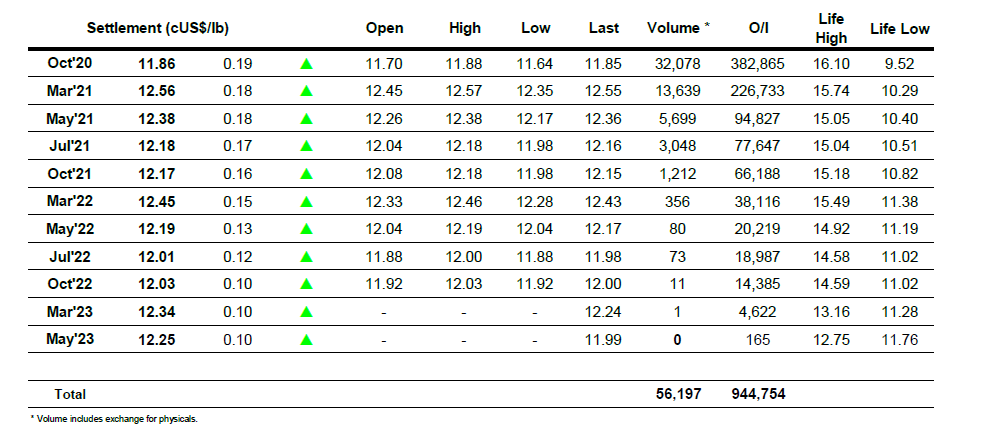

ICE Futures U.S. Sugar No.11 Contract

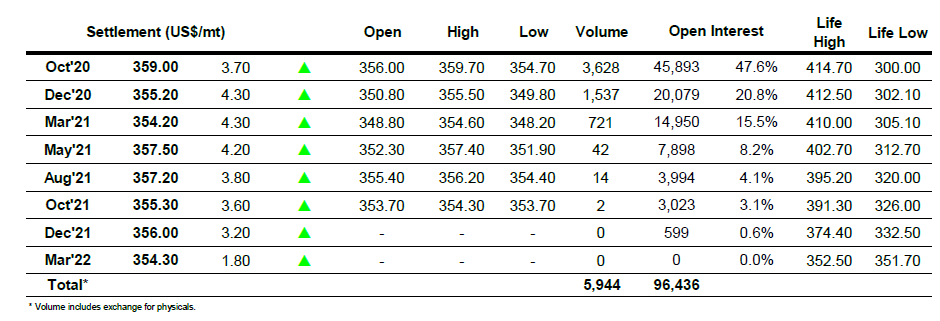

ICE Europe White Sugar Futures Contract