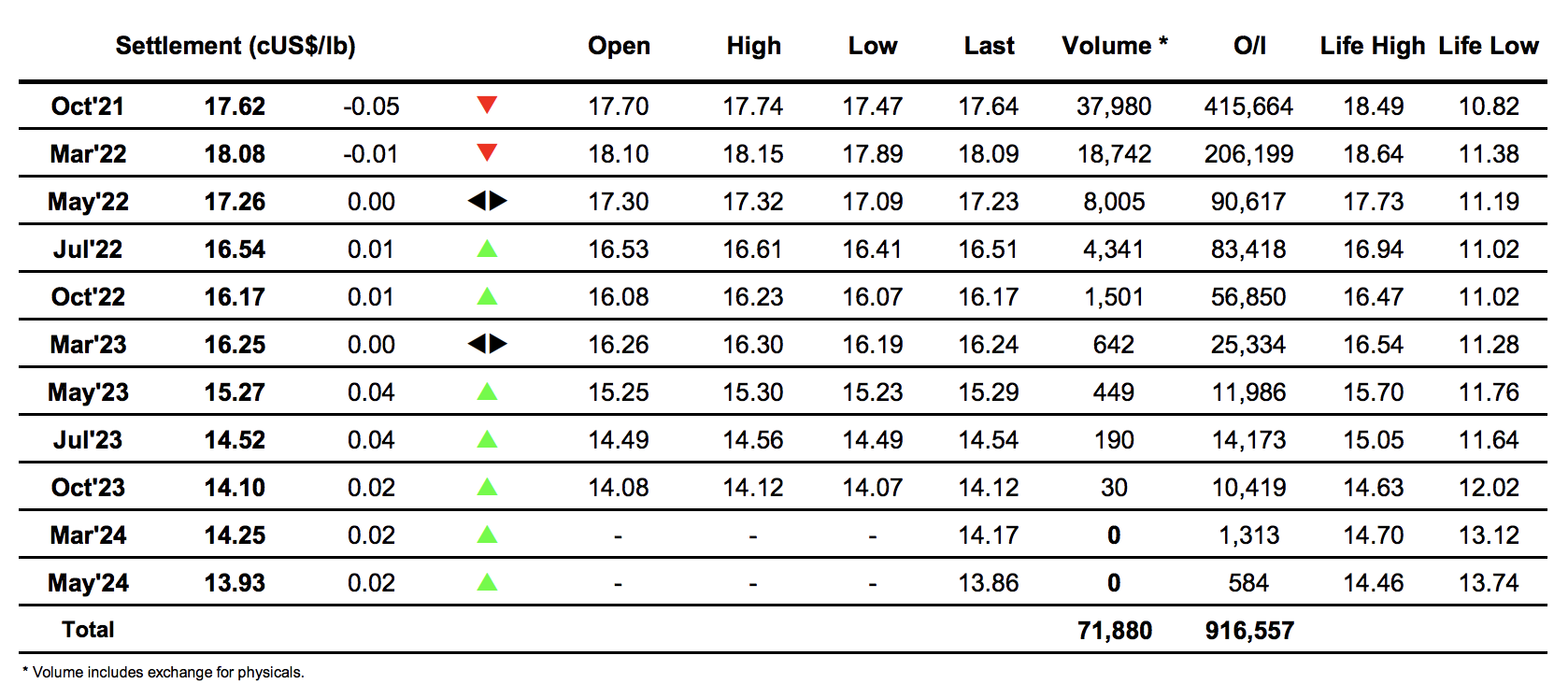

Sugar #11 Oct’21

A mixed opening soon gave way to some selling with Oct’21 trading down to 17.47 over the course of the first 30 minutes before pulling back up to unchanged levels. Market chatter continues to be dominated by talk of the frosts in Brazil and with the weather leading coffee values to surge there were those that felt sugar should be following in a similar vein, however with morning activity continuing within the confines of the early range it seemed that the market holds a different view for the time being. Aside from coffee it was very much a mixed macro picture and this seemed to be the reason behind our continuing apathy, and though some light spec/day trader interest during the early afternoon looked to get something going to the upside their efforts ended quickly at 17.74 and then 17.73 only to be followed by some long liquidation which sent values tumbling back to the lower end of the range. Levelling out towards mid-range we spent a period edging sideways before some buying returned during the final hour to take Oct’21 back above 17.72. This looked set to provide a positive conclusion to the day until some late position squaring occurred, sending prices sliding back down to settle lower at 17.62.

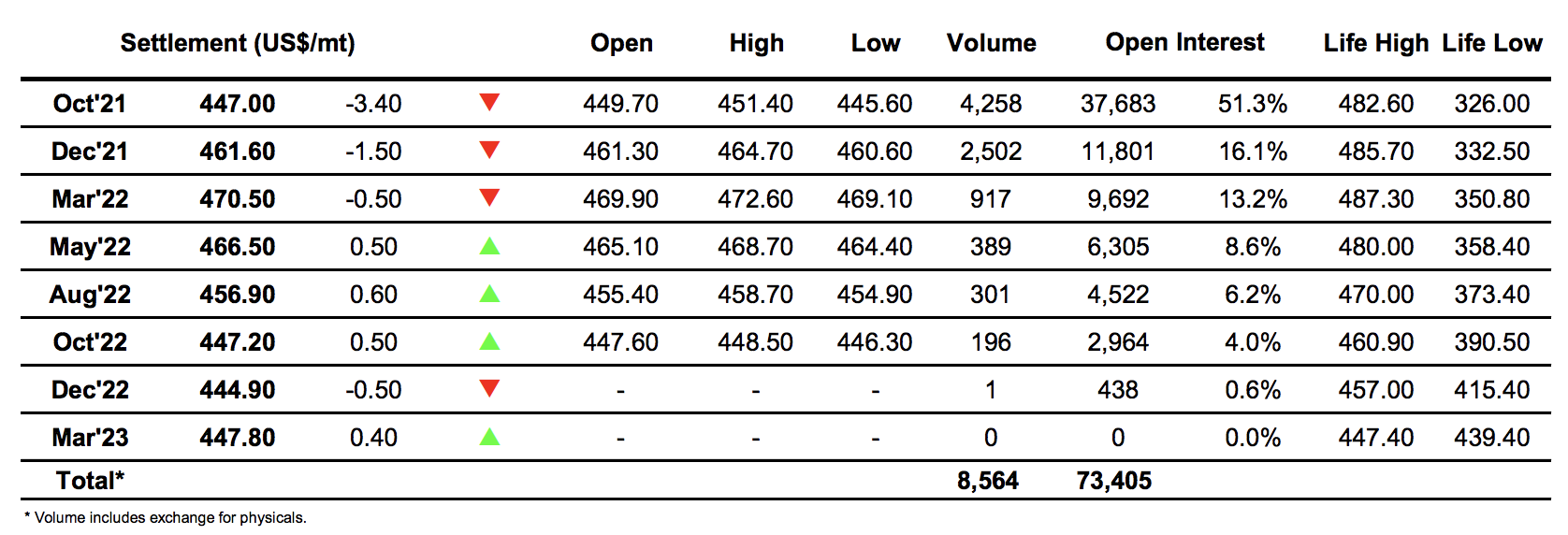

Sugar #5 Oct’21

A lower opening soon attracted a little buying interest which pushed easily up to $451.40 before prices started to fade again due to the lack of any follow-up interest. The whites market continues to see struggles at the front end of the board with Oct’21 again losing ground basis the spread and white premium which during the morning were trading down to -$15.00 for Oct/Dec’21 and just $58 for Oct/Oct’21 WP. This pressure is keeping the whites stuck in a weak technical pattern that leaves the $442 low mark potentially vulnerable despite the fact that No.11 is continuing to flirt with 2 week highs. On another day of low volume prices moved broadly sideways throughout, minor extension of the range down to $445.60 being picked up by some light consumer pricing but nothing else taking place that was likely to shake things up at all. By the close we were holding around mid-range with the spread trading back away from its lows at -$14.50 however some MOC selling emerged to send values back off which left settlement at $447.00 and the outlook maintaining a negative bias.

· The latest in a series of weak Oct/Oct’21 performances saw us end the day valued at $58.50. The 2022 position by contrast were little changed with March/March’22 at $71.90 and May/May’22 at $86.00.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract