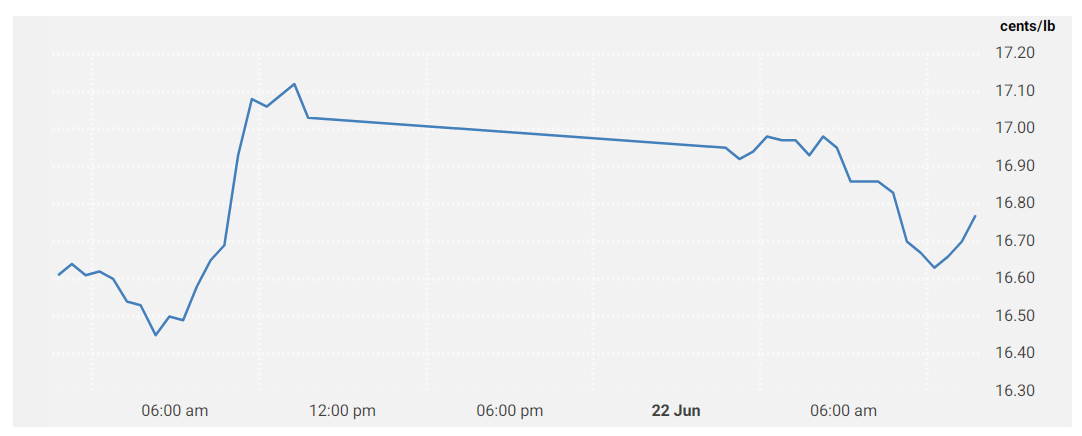

Sugar #11 Oct’21

The strong performance yesterday will have provided the bulls with some hope that the market can find stability away from recent lows from which to re-build however there was no immediate sign of buying early on with Oct’21 dropping back to 16.90 before stabilising. Still this provides a solid consolidation and the next few hours were quiet with prices holding a narrow band in anticipation that the afternoon may bring with it some increased spec activity to re-invigorate and resume the upside. Last nights delayed COT report had shown the funds still long 220,220 lots as at last Tuesday and with this reflecting that recent moves have been driven by the faster moving programmes and algo activity there was to be no fresh interest as instead the market began to edge downward. Retracing lower the movement was much calmer than that seen yesterday however the lack of any significant consumer pricing interest allowed prices to slip all the way to 16.61 before finding some protection through short covering. This ensured that values held a small way above session lows through the final hour with some further short covering for the close ensuring settlement at 16.74 to conclude an inside day which fails to answer any questions.

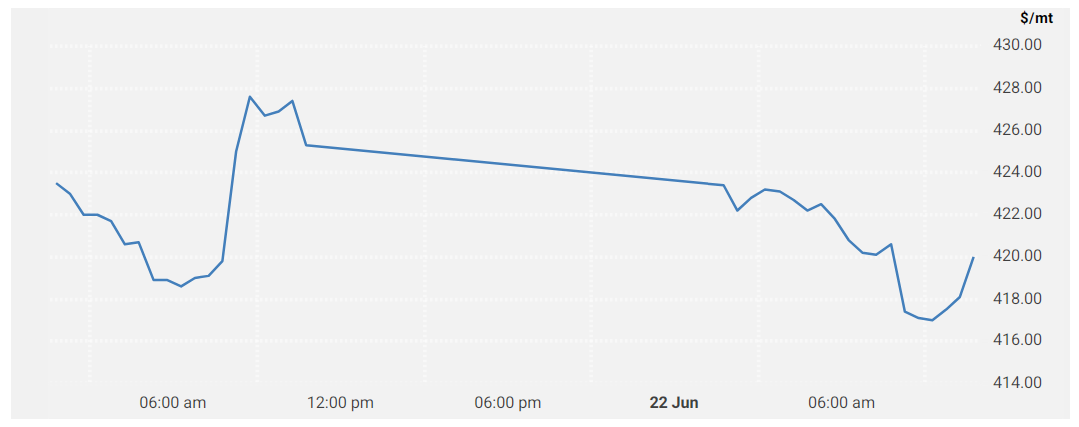

Sugar #5 Aug’21

While yesterday’s rally allowed some of the oversold short term indicators to cool a little it did not break the recent trend of lower highs and lower lows and so questions remain as to whether the gains can be maintained. The initial signs were not too good with the first hour seeing Aug’21 slip back to the $422 area and though prices then stabilised there was no sign of any significant buying interest to potentially resume the upside. The situation changed little through the rest of the morning and when the afternoon arrived so the market resumed a steady downward path with yesterday a distant memory. Buying was fairly sparse as the price slipped all they way to a new recent low at $416.30, with the nearby spreads also moving lower once again as Aug/Oct’21 extended to -$16.50. Defensive buying ensured that we did not challenge the quarterly low at $415.60. We continued above the lows throughout the final couple of hours before finding MOC buying which took Aug’21 back up by a couple of dollars with settlement established at $418.70.

Initially white premium values remained on the ropes following yesterday’s battering however the afternoon saw them start to re-discover some stability and we ended the day a touch higher, Aug/Jul’21 at $56.50, Oct/Oct’21 at $66.20 and March/March’22 at $74.75.

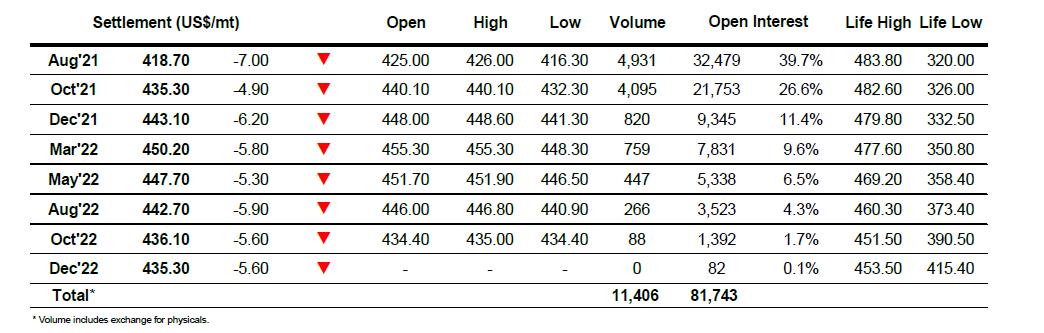

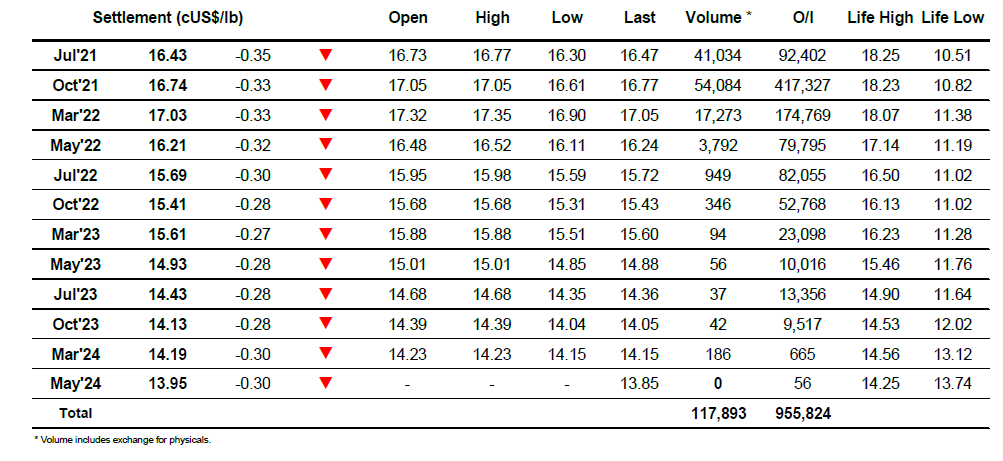

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract