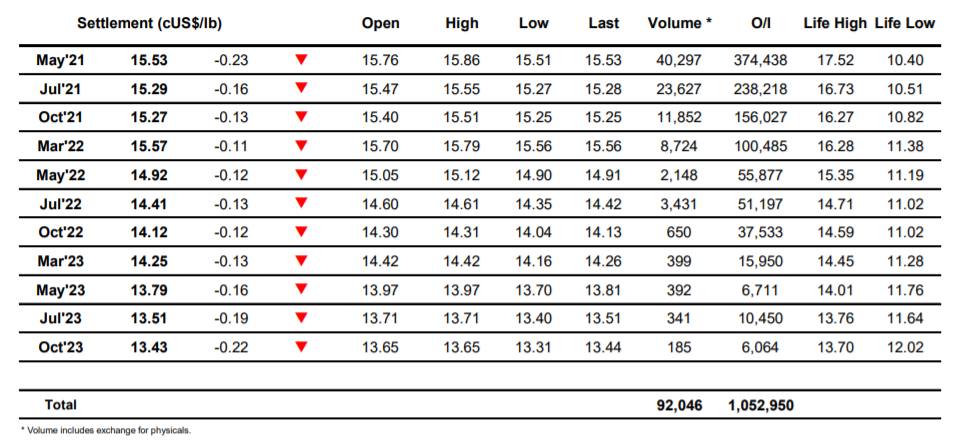

Sugar #11 May’21

The lower levels on Friday seemed to have drawn out some physical interest and resulted in some light hedge lifting which took nearby values higher during the early part of the morning. We reached a high at 15.86 for May’21 before the buying eased, leading to a period of slow consolidation which lasted through until mid-session. The arrival of US based specs brought with it the usual increased volume and it quickly became apparent that said volume was leaning heavily to the short side as prices pushed back down through the opening lows to bring Friday’s 15.55 mark back into view. It was not just the flat price coming under pressure with the May’21 spreads also continuing their recent slide and though the outright values were attempting to hold the 15.55 level the May/Aug’21 spread trading down as far as 0.23 points was again sending out negative signals and influencing sentiment. Despite a neutral macro background the rest of the afternoon was played out at the bottom end of the range with no hint that we would find the necessary support required to mount a recovery, and reaching the close it was selling which again emerged to finally push down below 15.55. The MOC pressure ensured the latest in a series of weak settlements at 15.53 to maintain the recent negative outlook

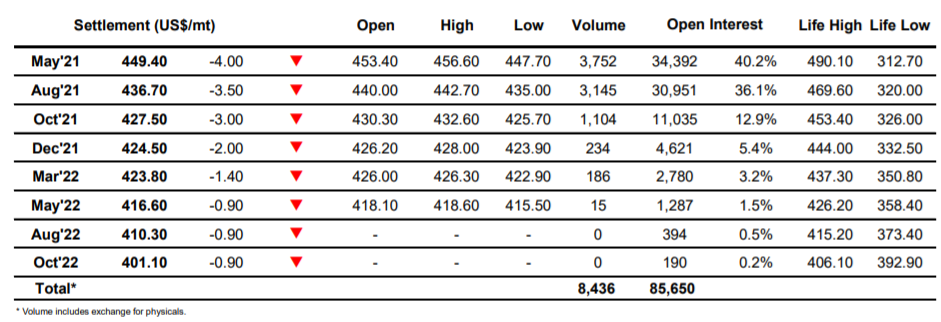

Sugar #5 May’21

May’21 whites commenced the week positively and traded more than $3 higher to $456.60 over the first hour or so before easing back into the range as volume dissipated over the rest of the morning. Despite easing back from the early highs the whites were outperforming the No.11 rather comfortably and this resulted in firm white premium values at the front of the board Seeing May/May’21 towards $107.50 at one stage before easing by around a dollar. Inevitably the calm came to an end when the US morning got underway and it was sellers who were in the driving seat with the short term specs and day traders looking to capitalise upon the recent technical vulnerability by sending May’21 down towards $450.00 in the hope of delving below and finding sell stops. Their efforts were only successful so far as to marginally extend the recent lows to $449.20 and with some steady buying on show the selling eased which allowed values to pick back up by a couple of dollars on virtually no volume at all. It transpired that this was as good as it got for the longs with the rest of the day spent trying to hold in front of the lows, something which was almost achieved before late selling emerged to send May’21 down to $447.70. Settlement was a couple of dollars above at $449.40 though that does little to disguise another weak performance.

The May/May’21 white premium value held much of the early gain to close stronger at $107.00, with Aug/Jul’21 ending at $99.75 and Oct/Oct’21 at $91.00.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract