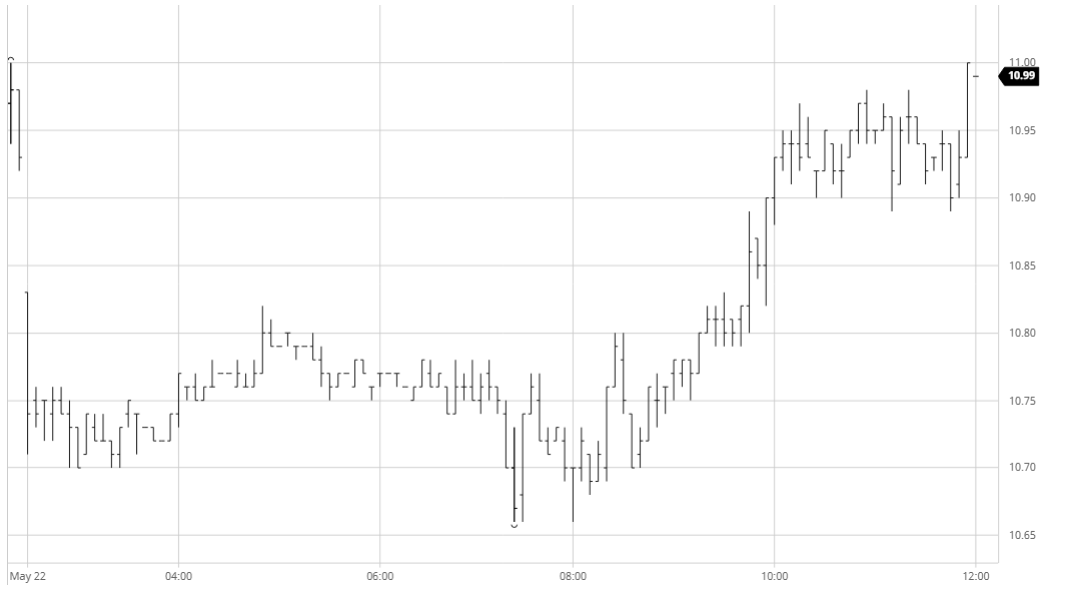

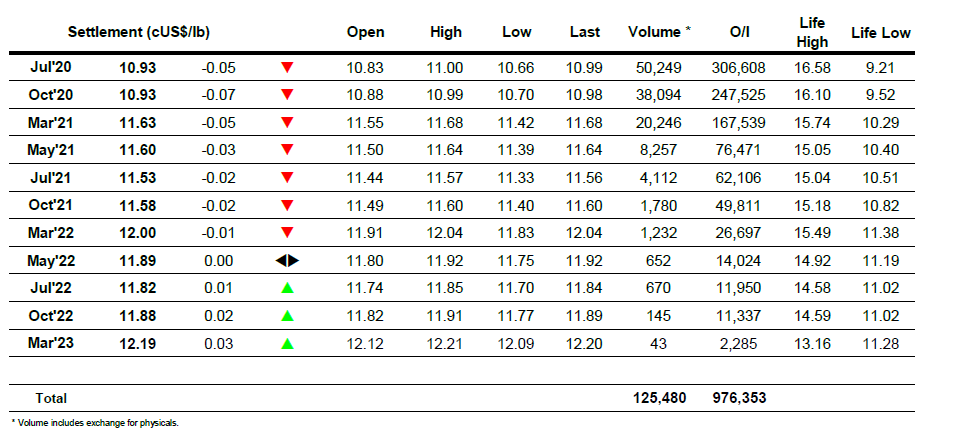

Having broken away from the macro to a degree yesterday afternoon we encountered some early selling which gapped the market lower as Jul’20 immediately traded down to 10.71. While this was not overly surprising given the disappointing nature in which the rally unravelled yesterday it left the market in something of a no-man’s land and we proceeded to spend several hours treading water in the centre of the recent 10.05/11.32 range. The sideways activity was ended during the afternoon and having twice pulled the Jul’20 back from 10.66 we saw specs begin to push higher in an effort to fill the overnight gap to 10.87 and erase the losses. To this end they were successful and having filled the gap we pushed on a little further with Jul’20 trading back to unchanged though the rest of the board remained in slight debit. Aggressive late buying took Jul’20 up to 11.00 on the post close though settlement was lower at 10.93. While todays recovery showed quite good resilience that we remain below the former 11.01 high at the end of the week impacts upon the technical picture. Funds are anticipated to have further reduced their net short position in tonight’s COT report and with Wednesdays rally not included could they have possibly covered it all?

Monday sees both white sugar and No.11 closed for public holidays. Both markets will resume as normal on Tuesday.

N.o 11 Futures

N.o 11 Futures

ICE Futures U.S. Sugar No.11 Contract

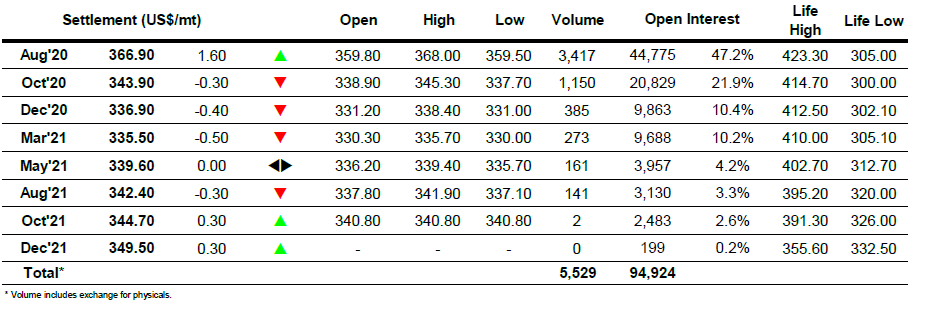

ICE Europe White Sugar Futures Contract