The market began the day on the front foot, regaining a small portion of yesterday’s losses and from this basis it never looked back as we steadily climbed upwards throughout the session. Macro concerns were put to one side as we initially rallied on the back of price recovery in the energy sector although as the day wore on and as crude values eased back towards unchanged so No.11 values continued ahead, showing strength despite the separation. The afternoon also brought weaker USDBRL rates with the currency heading back to 5.49 once more however despite the attraction that this presents to producers there was only scale pricing and it did not generate any significant resistance beyond the usual scales. Spread values have been adding to the discussion with Oct/March now well above the cost of carry at -0.51 points while March/May’21 has seen a widening premium and has reached 0.21 points. Outrights meanwhile continued upward to reach a high of 13.49 during the final hour before finding some late position squaring the sent prices back by a few points. The strong close maintain the focus upon the former 13.77 high as the immediate target and todays performance in spite of only muted macro support during the afternoon suggests that the market will look to continue to drive in that direction over the coming days.

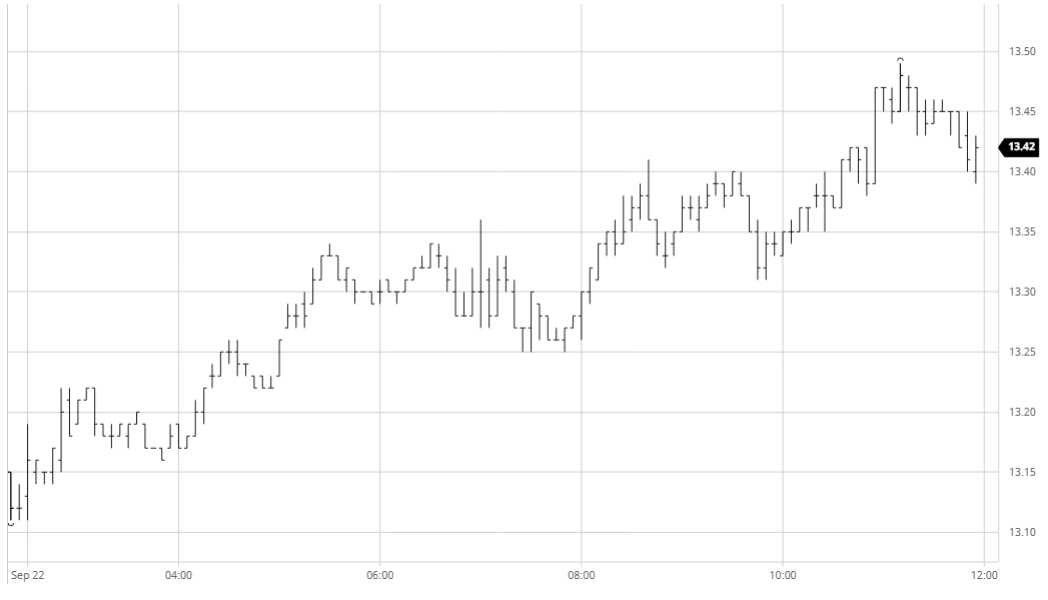

Mar 21 – Sugar No.11

Yesterday’s decline was soon forgotten as following some initial consolidation the Dec’20 contract pushed back above 370.00. These gains came as yesterday’s macro concerns eased to a more neutral picture and reiterates the view that it was only the wider commodity world that pulled prices back yesterday and stemmed the recent sharp recovery. The strength continues to be fuelled by concerns over Indian policy for next year alongside thoughts that in the medium term US policy will lead to dollar weakness which will in turn be beneficial to commodity prices. Values remained firm on only modest volumes throughout the afternoon and despite slightly less favourable macro conditions later in the afternoon (crude back towards unchanged/CRB lower) we made new highs during the final hour, reaching 373.20. White premium values were a little weaker despite the new highs as No.11 made solid gains and despite some late position squaring we ended positively at 371.80 showing that the desire remains from bulls to push higher with us outperforming most of the commodity world today.

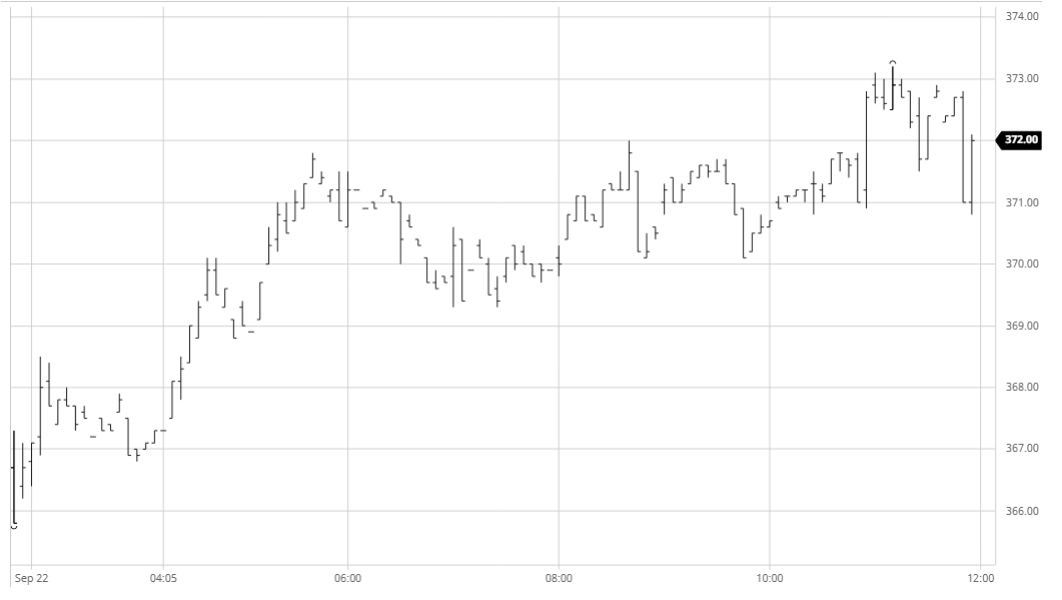

Dec 20 – White Sugar No 5

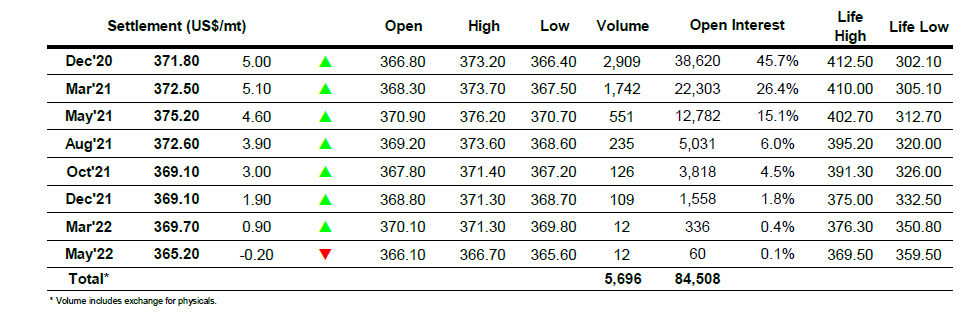

ICE Futures U.S. Sugar No.11 Contract

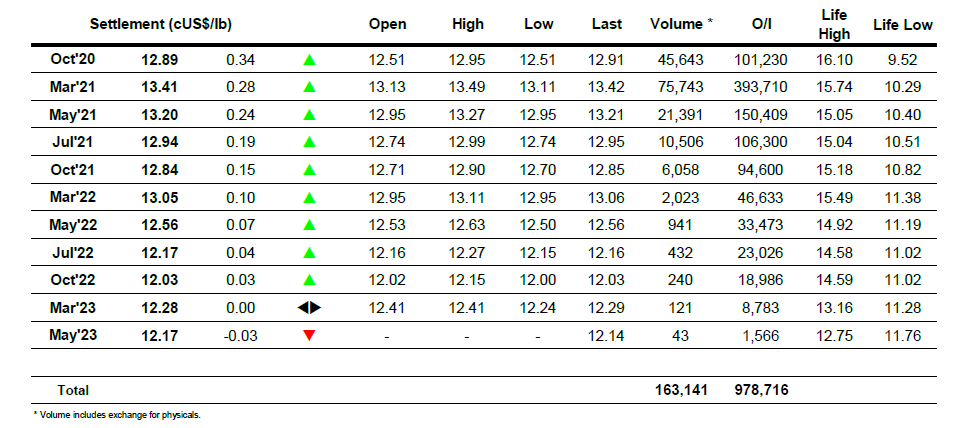

ICE Europe White Sugar Futures Contract