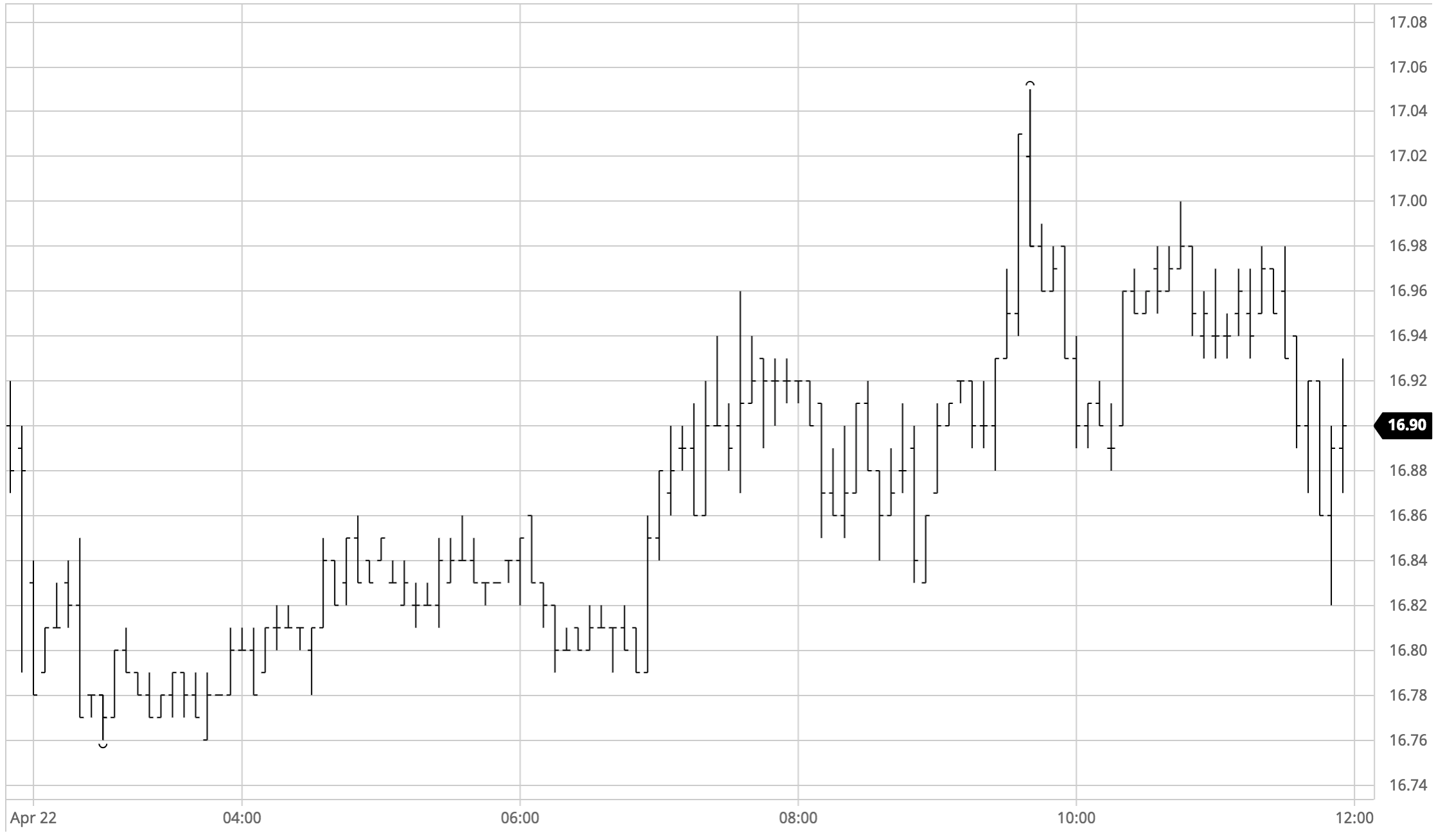

Sugar #11 Jul’21

Recent mornings have seen rather slow and uneventful trading and today trumped many of these efforts as Jul’21 held a 10 point band between 16.76 and 16.86 for more than four hours on very light volumes. With recent action proving firm technically and the carrot of the 17c handle dangling above for both the May’21 and Jul’21 contracts a little more desire to push emerged as the US morning got underway, the impact of which was to take Jul’21 ahead to 16.96 before easing back into the range. While unsuccessful on the first attempt the consolidation that followed showed a clear intent to build a platform to push again and on the second wave of buying we saw the front two positions push ahead, reaching 17.07 for May’21 and a new contract high at 17.05 for Jul’21. The rise failed to encourage any widening of the Jul’21 spread values with the Jul/Oct’21 topping out at 0.18 points, and as the flat price slipped away from the highs the spread quickly gave back some ground. A brief look back towards 17c failed to gain and fresh traction and the final hour saw some relative struggle as values consolidated in anticipation of another push before slipping back down on pre-close position squaring. Settlement level was mid-range at 16.88 while the Jul/Oct’21 settled in at 0.12 points, which alongside a closing May/Jul’21 value of 0.04 points continues to raise some question over how much further the flat price may push despite the continuing positive technical picture showing for Jul’21.

Sugar #5 Aug’21

A weaker opening was soon picked back up and the morning was spent chopping either side of unchanged levels on some very thin volume as illustrated by the gaps on the intra-day chart. As ever it was not until the early afternoon that volumes picked up and when they did we initially just held above overnight levels, extending the range slightly beyond $465 but still unable to break beyond either the recent or contract highs. With the day meandering along quietly there was no change to this pattern until later in the afternoon when in a similar pattern to recent days we saw a spike upward which reached a new recent high mark at $466.50 before we inevitably eased on long liquidation. Though prices held back towards the centre of the range we were unable to mount a second push upward as we have done in recent days, instead extending all the way back to the morning lows ahead of the call as some long liquidation occurred. Through all of the flat price movements there remain concerns as to the longer term merits with the nearby spreads continuing to struggle, today seeing a high for Aug/Oct’21 at $5.90 but ending the session lower at $4.60. A swing back upward for the close on defensive buying ensured a wide closing range with Aug’21 settling around a dollar lower for the day at $462.40.

· The Aug/Jul’21 white premium continues to struggle and closed a touch lower once again at $90.25. Oct/Oct’21 was also weaker at $88.25 though Mar/Mar’22 continues to hold at $84.75.

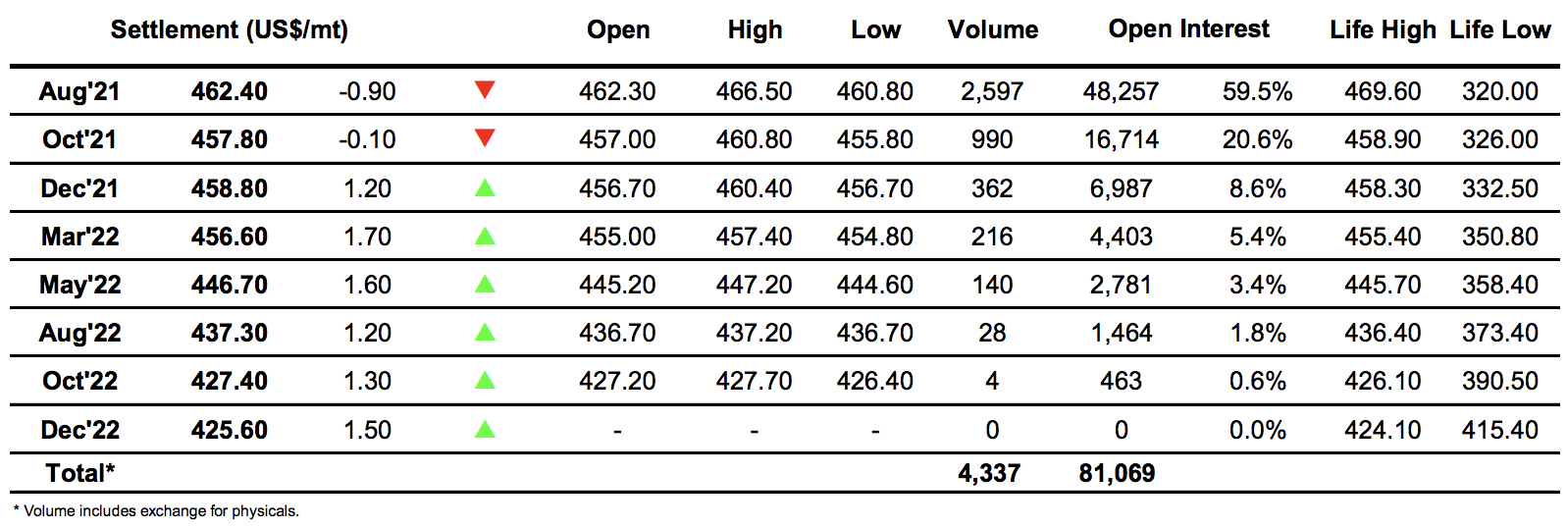

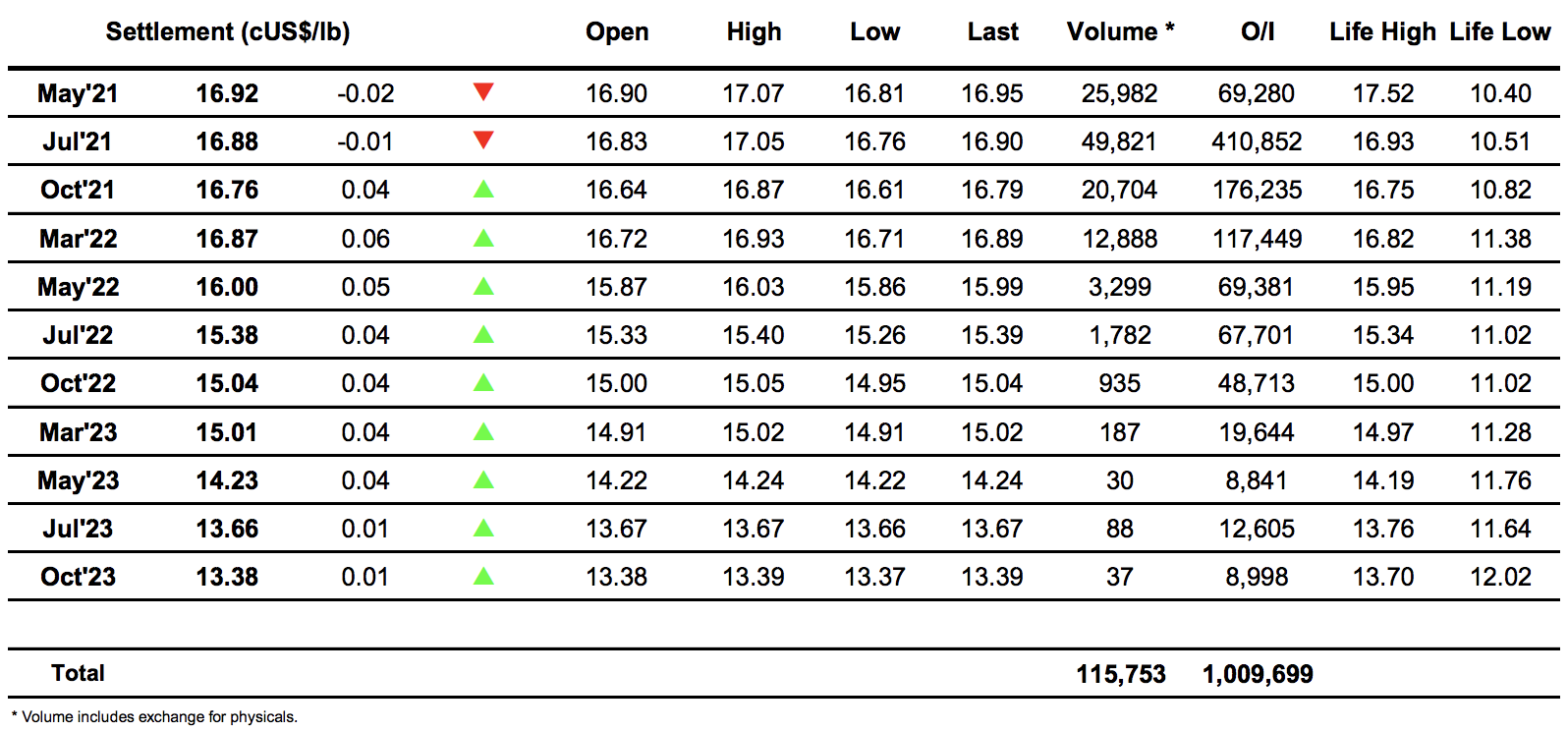

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract