Sugar #11 Jul’21

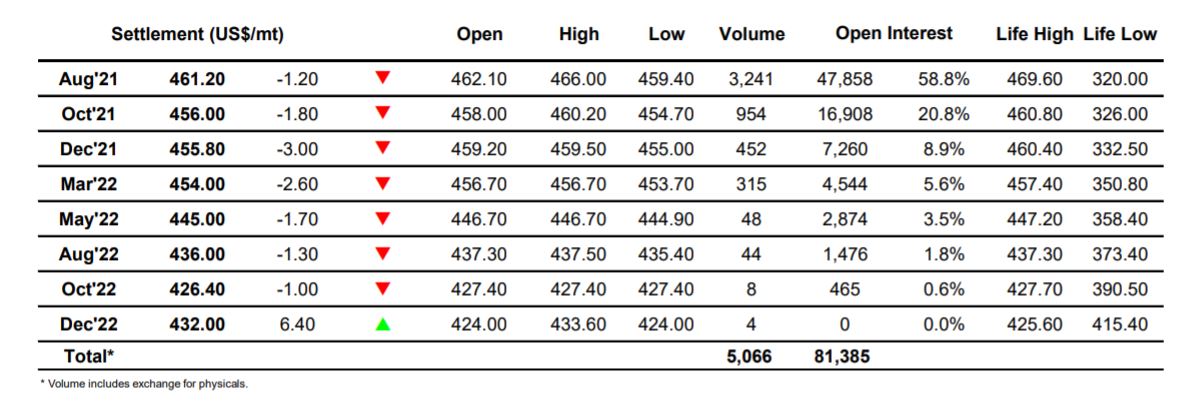

A relatively slow start to the day saw Jul’21 marginally lower, but though we dipped as far as 16.79 soon afterwards the majority of the morning trading was taking place between 16.84 and 16.96 as traders looked to build a platform from which they could push the upside one more. Slowly but surely the 17c handle came back into view and with the added volume that the US specs bring to the fray we worked upwards to match yesterday’s 17.05 high mark very early in the US morning but struggled to push on as the moderate buying pushed against some similarly sized selling without the spark required to set things flying. As so often is the case when it is the day traders and smaller specs dominating the environment we slipped back on position squaring and though a second effort was made to drive higher this fell a single point shy of the earlier high and a second retreat followed. The repetition of recent activity extended beyond the flat price as nearby spreads continued to struggle and sitting in the range during the late afternoon we saw May/Jul’21 at 0.04 points while Jul/Oct’21 was in slightly at 0.10 points. The closing period remained mixed in the centre of the day’s range and with the specs not pushing back upward we closed marginally lower with May’21 at 16.91 and Jul’21 at 16.88, while Jul/Oct’21 lost a touch more ground in settling at 0.08 points.

Sugar #5 Aug’21

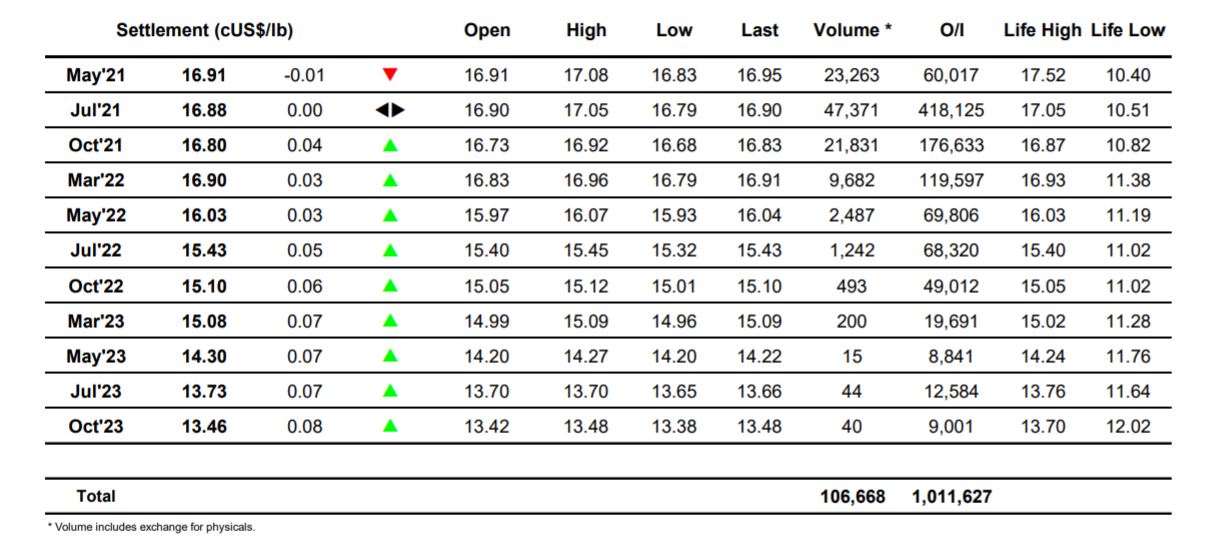

A burst of buying for the opening sent Aug’21 immediately up to $465.00 and though we the merely consolidated a little below this level it sent out a solid signal of intent for the day ahead. By late morning we saw some further momentum being built from the long side and while the movements were unspectacular it did extend the days high to $466.00 by early afternoon. The longs were no doubt hoping that we would see an increased spec push upward during the afternoon to finally challenge contract highs however they were to be disappointed as instead we retreated back to the range with a sharp collapse sending Aug’21 back to the $462 area. The lack of buying was contributing to a further narrowing in the Aug/Jul’21 white premium as it slipped beneath $90 while the spreads had tried to regain some of the recently lost ground as Aug/Oct’21 touched $6 though on the decline the value moved back towards last nights level of $4.60. A defensive push back up above $464 came to nothing and the next wave of long liquidation then sent the price down to be recording new session lows at $459.80. Supportive action ahead of the close did at least ensure a settlement level at $461.20 however recent action has suggested a topping pattern and the longs will need to push hard in the coming days if the upward momentum is to be reinvigorated.

The Aug/Jul’21 white premium lost further ground today and ended the week at $89.00, Oct/Oct’21 closed much weaker $85.75 while Mar/Mar’22 also joined the lower trend to conclude at $81.50.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract