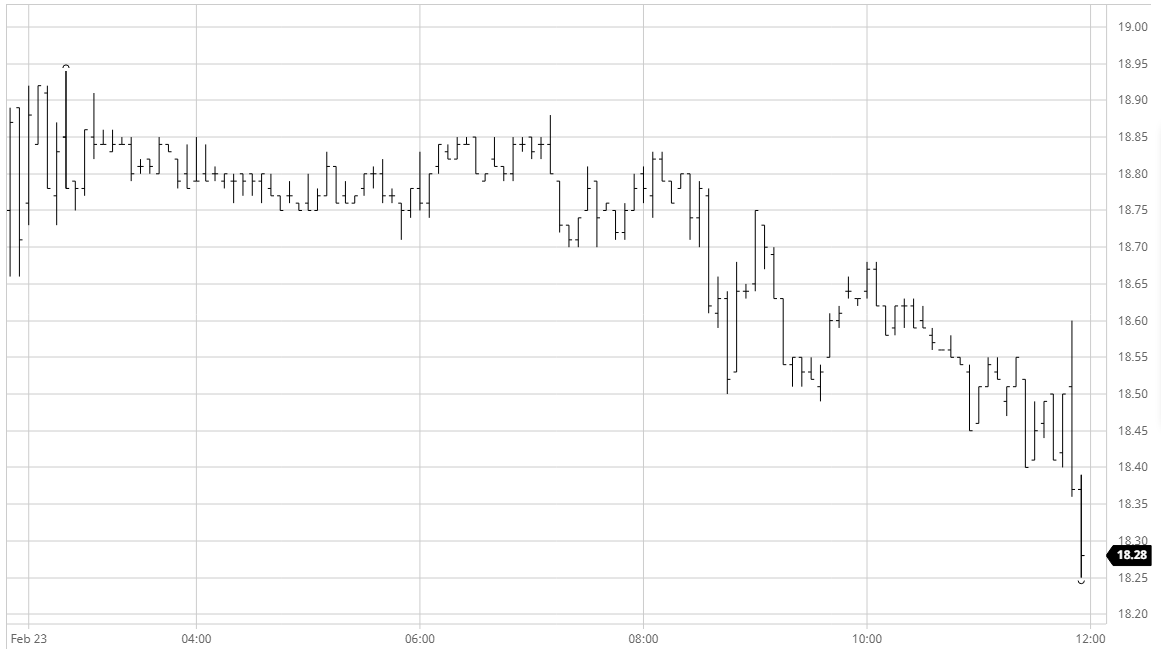

Sugar #11 May’21

The market began rather calmly today, spending much of the morning tracking sideways either side of 17.40 after an opening push to a marginal new contract high of 17.52 had failed to develop into a more meaningful move. With May’21 relatively static over the first few hours the only position trading positively at times was March’21 with the March/May’21 continuing to maintain yesterdays remarkable widening by reaching a widest 1.47 points premium before consolidating just a few points below. Moving into the afternoon there was no initial reaction to the arrival of Americas based traders though recently the momentum has built during the final third of sessions so this in itself is not a great surprise. With buying still not appearing, which may not be too surprising following a week of increasingly strong performances, the market instead started to see some light corrective action which brought May’21 down beneath 17.10 on a couple of occasions as pockets of long liquidation emerged though it should be considered that this still left values a long way above yesterday’s session lows. A further push downward to reach 16.95 during the final hour was well defended by the longs, particularly during a hectic closing period during when we traded as high as 17.17 though settlement was far closer to the bottom of the day’s range at 17.01. Overall a day of consolidation/correction goes some way to enabling the still overbought near term indicators to correct though with a thin prevailing environment in both directions and questions as to how we react to the March’21 expiry at the end of the week continuing volatility seems likely.

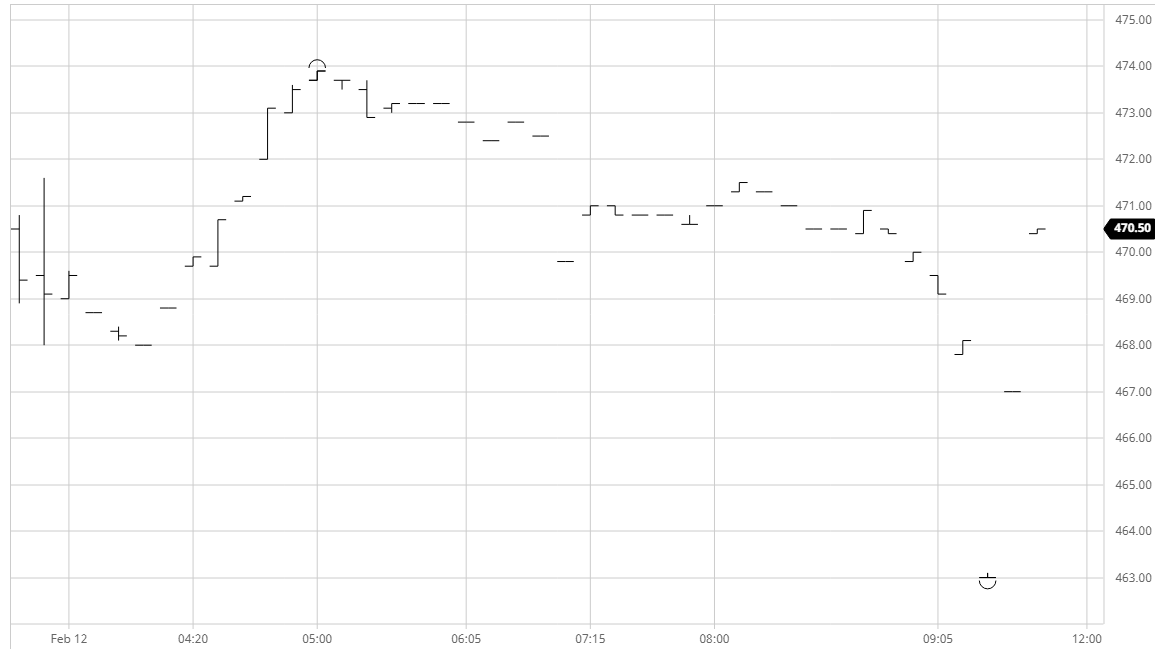

Sugar #5 May’21

Having recorded the latest in a series of strong gains yesterday afternoon the market began the session with sideways consolidation near to overnight levels. This pattern extended out over the course of the morning and despite registering a new contract high at $490.10 for May’21 it seemed that many traders were reluctant to commit one way or the other given the lack of depth in the market to both sides and the potential for continuing volatility. The one area that did see some movement over the morning was the white premiums which recouped some of the losses incurred yesterday with May/May’21 back above $105 and Aug/Jul’21 touching above $102 although both subsequently eased back from these high marks. The market became a little more volatile during the afternoon as the lack of upside movement seemed to persuade some longs to look to lock in some profits with their selling bringing values back a little further from the highs to be holding just ahead of $480. Further fresh session lows were recorded as we moved through the final hour though given that we remain above yesterday’s low mark this does little to change the air of technical positivity while at the same time marginally cooling the overbought short term technical indicators.

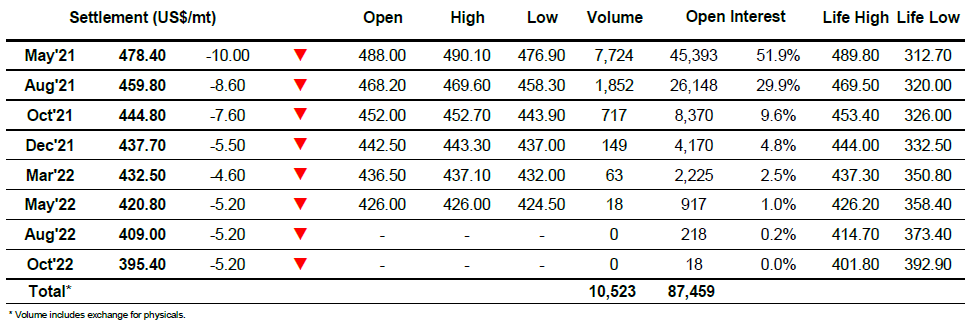

ICE Futures U.S. Sugar No.11 Contract

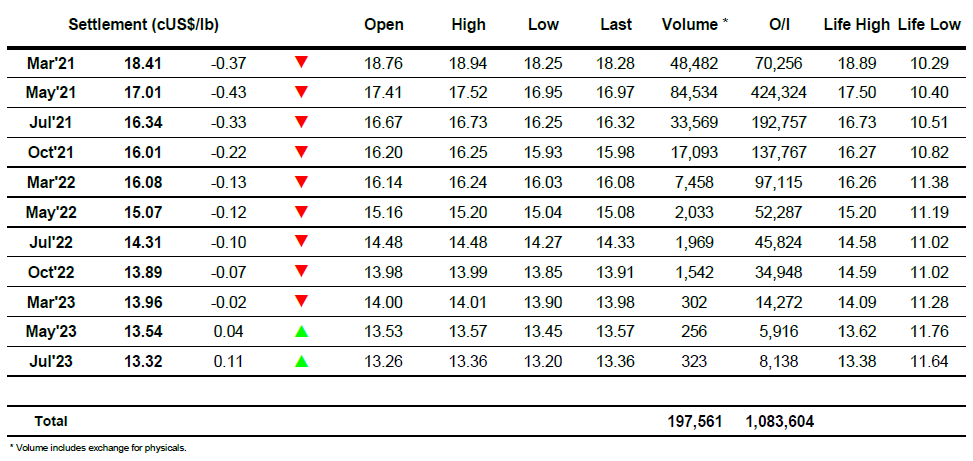

ICE Europe Whites Sugar Futures Contract