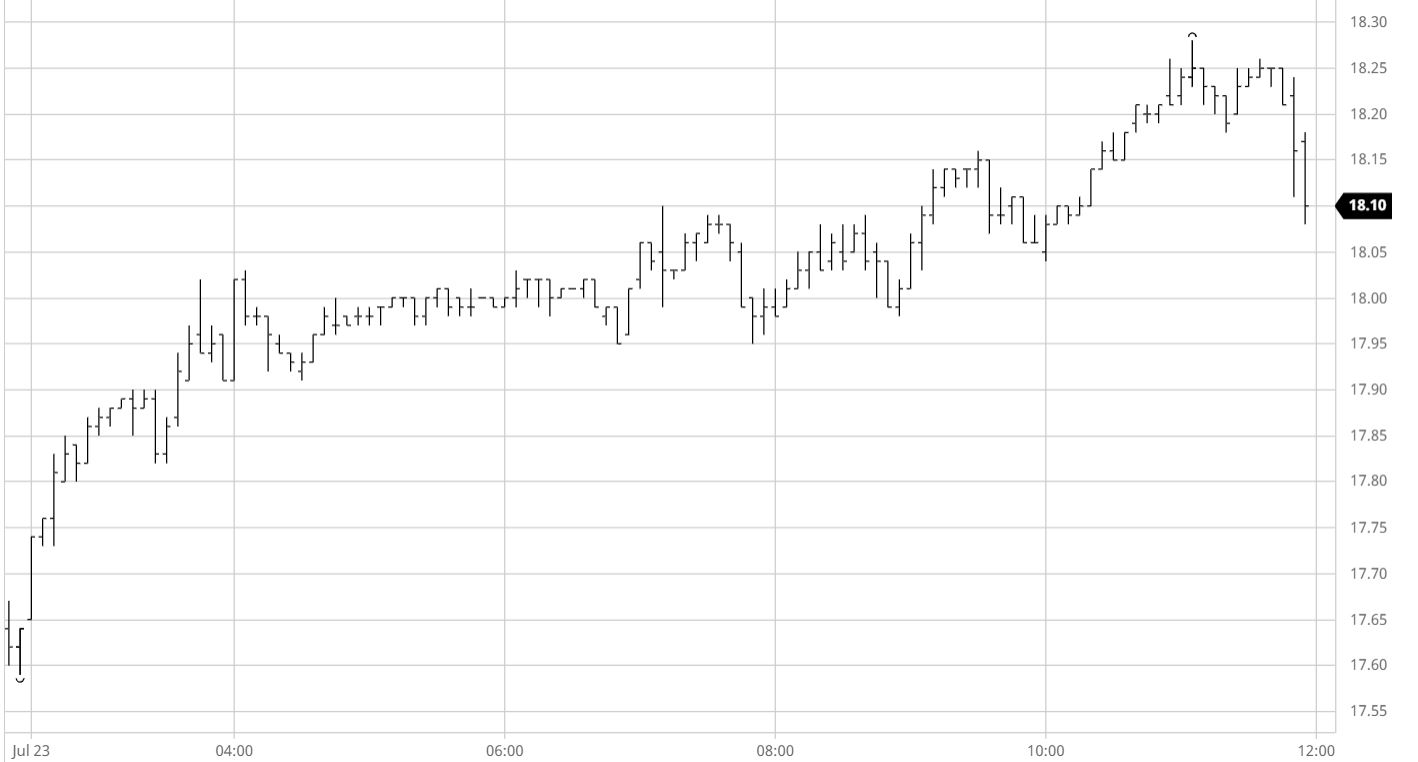

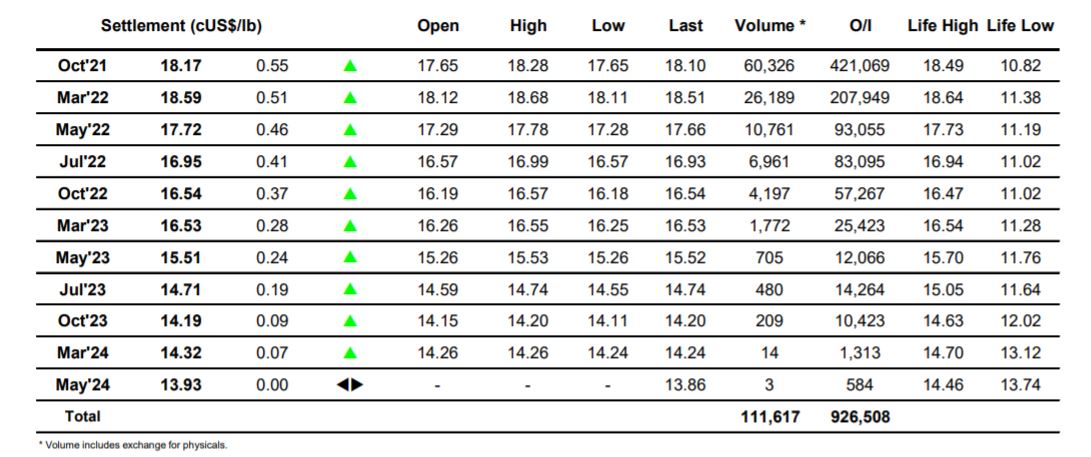

Sugar #11 Oct’21

There was buying around for the opening which pushed Oct’21 immediately upwards, gathering quick momentum to push on to two week highs during the first few minutes. The buying was on the back of UNICA’s statement on the recent frosts in Brazil impacting the crop, not fresh news in any way more so that their acknowledgement encouraged specs that the problem is real and that an opportunity exists. Still our gains were lagging a long way beneath those of coffee which has recorded remarkable gains of some 40% this week on the same news though having punched in to fresh ground we were playing the technical and climbing steadily enough to have printed through 18c by the time that the US morning began. With such a positive scenario playing out it was no surprise that we continued to make gains throughout the afternoon, and though progress was a little more tricky above 18c with some producer pricing finally beginning to show we had extended all the way to 18.28 as we entered the final hour. Spreads too were a touch firmer with specs/funds buying at the front of the board though Oct’21/March’22 only rallied as far as -0.38 points which was less than may have been expected and reflected its own recent struggles. Heading towards the close we remained positive and though some late long liquidation occurred we still posted a strong settlement value at 18.17. More frost is forecast in Brazil which will potentially continue to fuel sentiment with the next technical target the contract high mark at 18.49.

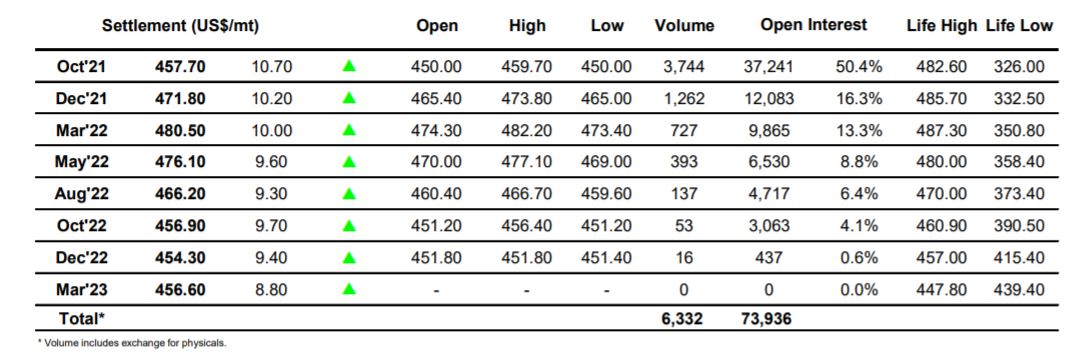

Sugar #5 Oct’21

Higher values for the No.11 had the market called to begin the day positively and we saw Oct’21 immediately at $450.00, and with talk of frost damage to the Brazilian crop reaching a wider audience we followed the No.11 trend and moved to the mid $450’s during the course of the morning despite the ongoing woes of the white premium. There was still only incredibly light volume changing hands despite the move upward and that remained the case into the afternoon with the lack of any whites news meaning that we simply tracked behind the No.11 pattern. The lack of any significant spec interest for the whites could be seen in the flat nature of the move with uniform gains being seen down through the 2022 positions and though the Oct’21 value reached a high of $459.70 the white premium was still struggling to climb far from the $55/$57 area. We remained positive near the highs as we headed towards the close and though some long liquidation during the final 15 minutes brought the price back slightly to settle at $457.70 the short term is likely to see continuing positive sentiment should the weather forecast not change in Brazil.

The white premiums remain under pressure, ending the week with Oct/Oct’21$57.10, March/March’22 at $70.70 and May/May’22 at $85.40.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract