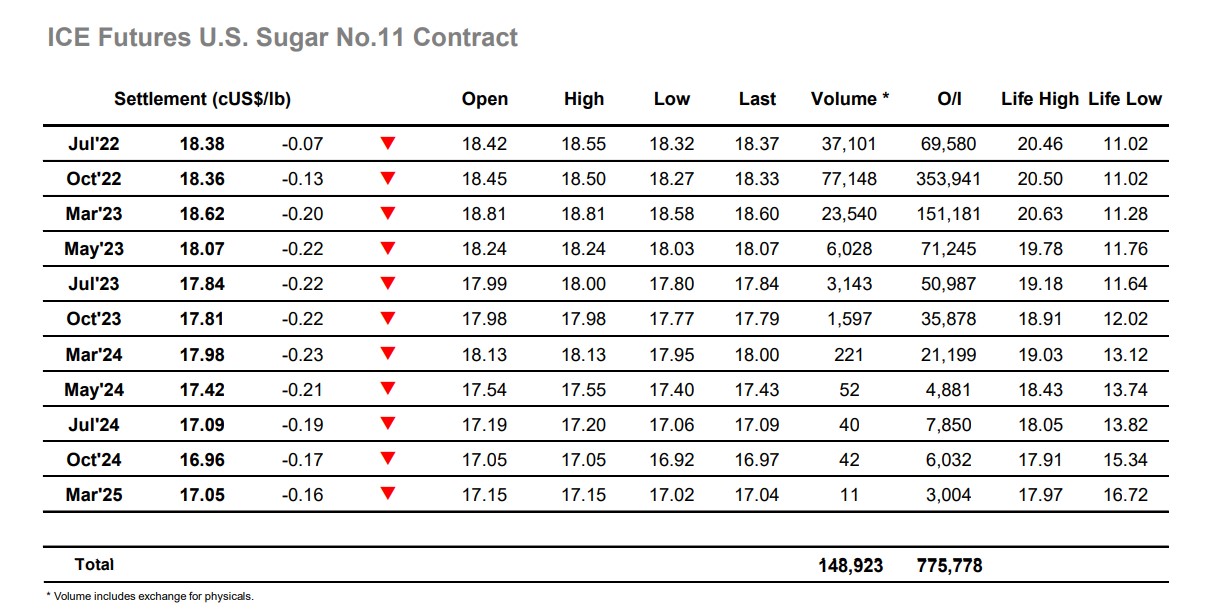

With the macro showing a sea of red this morning it came as no surprise to find the market under immediate pressure, breaking beneath initial 18.45 support for October and trading into the upper 18.30’s. While the move undoubtedly was bringing out some additional spec liquidation there were no stops triggered of any note and the activity remained orderly as the morning played out in the mid/upper 18.30’s. Alongside this Oct’22 weakness we were seeing some aggressive buying for the Jul/Oct’22 spread which quickly pushed up from an initial -0.03 points to reach +0.05 points by late morning. The start of the Americas day brought no change to the picture initially with prices maintaining within the morning range, until a little more pressure was applied to take us to new lows and trigger a few light sell stops beneath 18.30. Prices then moved back up through the range to anew daily high at 18.50 as day traders covered back shorts, though with the tone remaining negative for the macro there was no desire to continue pushing once this cover had been taken. The final stages saw values ease back down through the range to leave Oct’22 settling at 18.36 while the Jul/Oct’22 spread maintained a small premium to settle at 0.02 points. Overall, the market proved resilient given the technical connotations of the fall, aided by the trade/consumer buy scales, with further weakness possible should the macro not turn around.