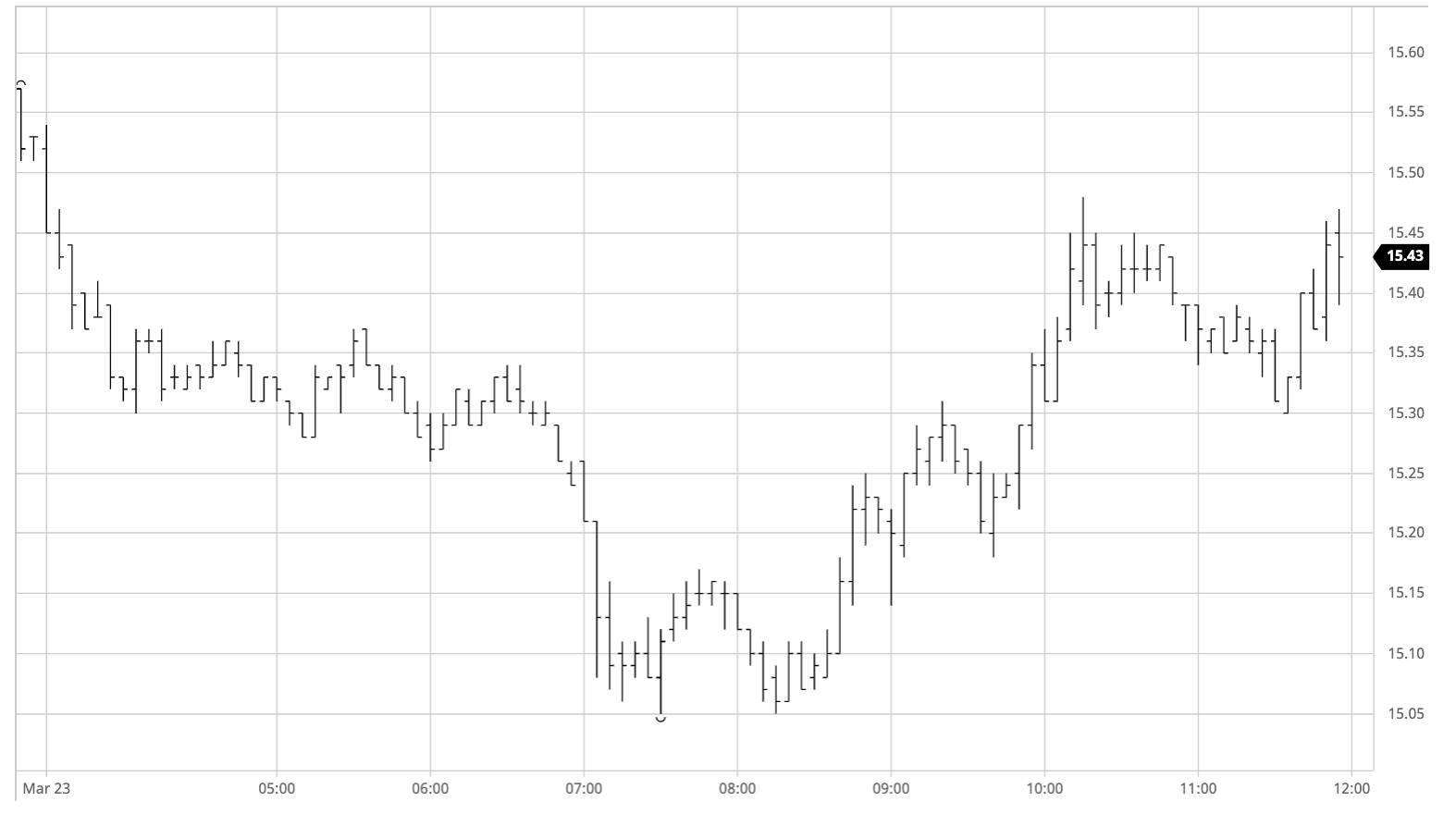

Sugar #11 May’21

The weak technical outlook combined with a lower macro this morning to encourage selling from the word go, and over the first 30 minutes we saw May’21 slide towards 15.30 while most worryingly for the longs the May/Jul’21 spread continued its recent plunge and reached 0.14 points premium. Following the early decline we saw values level out either side of 15.30 for the rest of the morning though the lack of any discernible buying aside from a steady stream of short covering suggested that there was more to follow. The start of the US day duly brought with it a second wave that triggered off some additional sell stops as May’21 swiftly declined through 15.10, though as with the initial move this morning we entered another period of sideways consolidation and this time it had a touch of technical backing. There was naturally more buying being uncovered ahead of the psychologically important 15c level, while the succession of congested lows between 15.00 and 14.91 dating back to the final week of January was also bringing in some support as traders start to look to bargain hunt with the technical turning towards oversold. Having established an intra-day double bottom at 15.05 we encountered some more concerted buying both from consumers who were value hunting and specs looking to lock in profit on shorts, resulting in a May’21 recovery to 15.48 at one stage, a mere 5 points beneath last nights close. While the full scope of the bounce was not maintained we continued above 15.30 for the remainder of the day which provided a platform for MOC buying to ensure only modest net losses with settlement at 15.43, while the May/Jul’21 spread closed at 0.25 points premium having reached a daily low at 0.09 points. Whether this is sufficient to spark aa full recovery is questionable however it is a sign that with the market becoming oversold there may well be an effort to build a bottom in the 15c area

Sugar #5 May’21

The recent weak performances have turned the near term technical picture negative and with the macro under pressure and No.11 already trading downward we immediately attracted selling which sent May’21 to $445.00. Light buying emerged to hold prices for the next hour before we resumed a gradual downward path which raised a good many concerns in causing the white premium to give back all of its recent gains and a bit more. Having been trading around $108 on today’s opening the May/May’21 slipped back over a couple of hours to $103 before then spiking to $100 as the May’21 outright worked through a few sell stops to reach $437.70. A further aggressive wave of outright selling followed in tandem with the No.11 as specs piled on the pressure at the start of the US morning and we extended the May’21 contract to $432.40 while seeing May/Aug’21 into just $8.10, though on this occasion it seemed the premium had already given back enough and May/May’21 held in front of $100. Having spent a period stabilising at the lower levels we saw some increasing short covering with shorts looking to lock away some profit in case of a turnaround, and this action led the price almost $10 up from the lows to $442. The final couple of hours saw the recovery maintained, moving sideways to end the day at $440.50. While well away from the session lows and subsequent $428/$427 support area the market will remain vulnerable, although the reaction to becoming oversold suggests there may be a far better chance of building a base in this area.

White premiums ended with May/May’21 having undone all its recent good work and returned to the lower end of the recent range at $100.50. Other prompts were impacted though less severely as we closed at $97.00 for Aug/Jul’21 while ending at $89.75 for Oct/Oct’21.

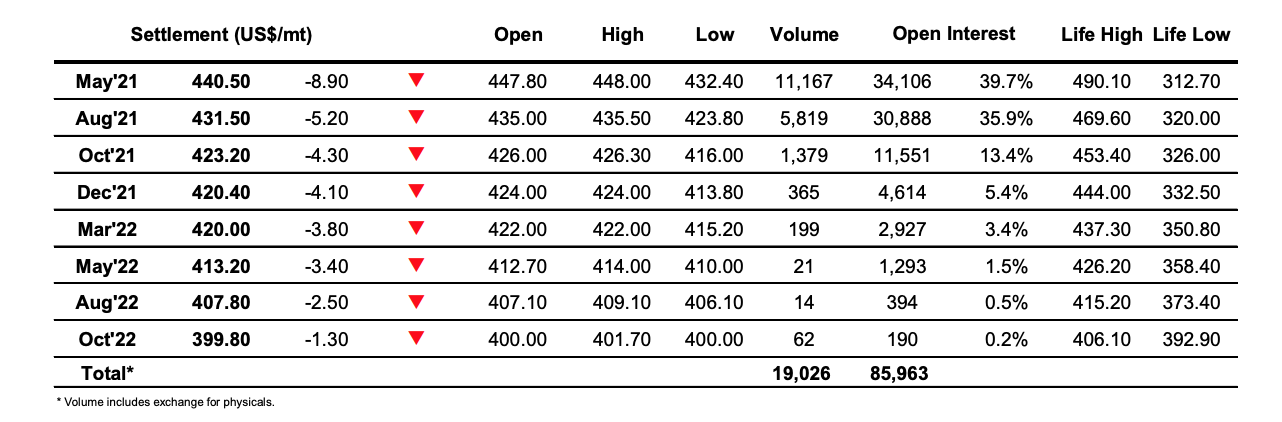

ICE Futures U.S. Sugar No.11 Contract

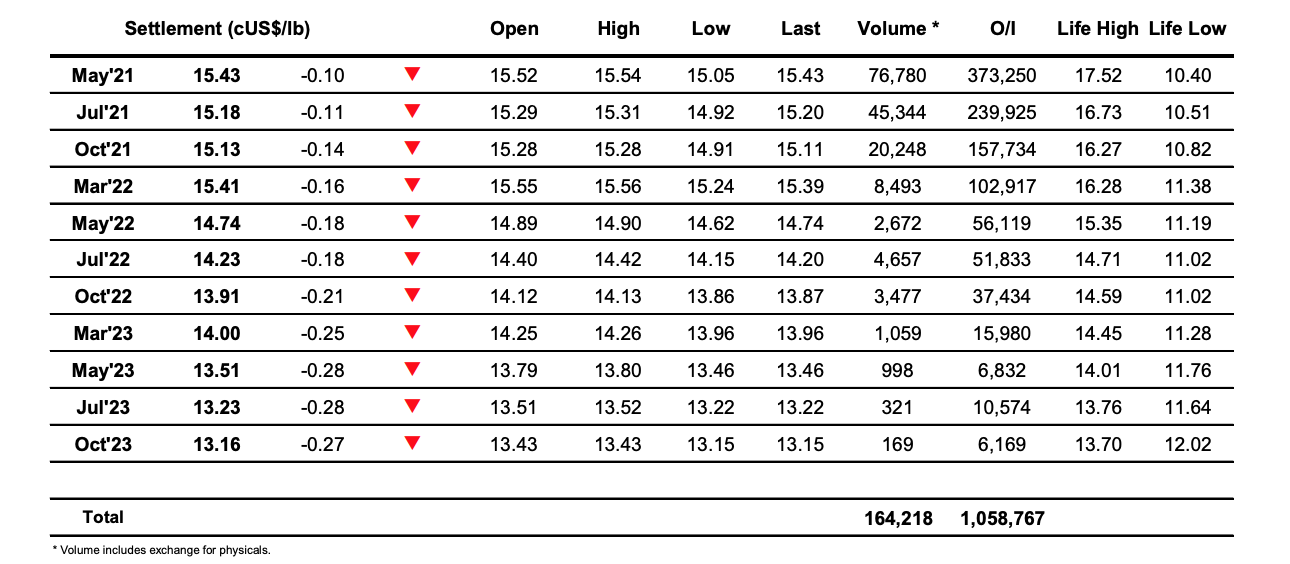

ICE Europe Whites Sugar Futures Contract