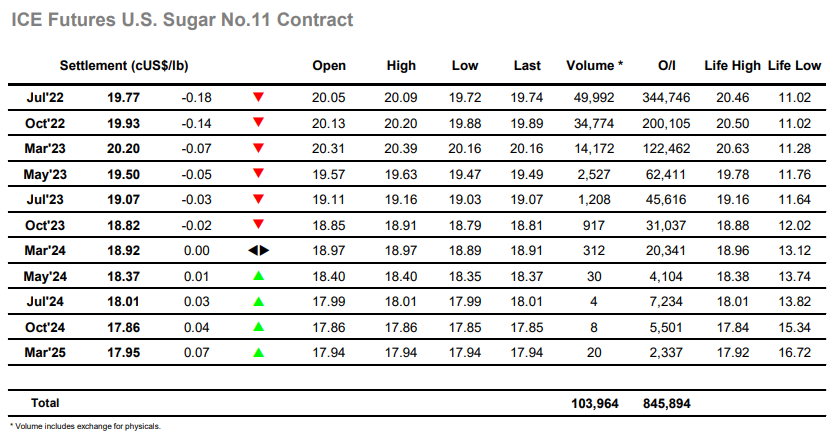

The new week began on a positive footing with Jul’22 immediately jumping above 20c and reaching 20.09 before stalling against some resting pricing orders. Friday’s COT report had seen an expected rise in the net spec long position to 129,187 lots (+36,951 lots), however this still leaves plenty of capacity for further buying should the macro remain supportive and likely explains the positive start. A dip back to unchanged was quickly picked up and the morning played out positively though the volumes proved insufficient to make any further headway towards last weeks highs. As mentioned previously the positivity is not being matched through the spreads at present and it was proving the case again today as the early gains failed to yield any strength while the lack of support during the afternoon and subsequent long liquidation sent Jul/Oct back to -0.15 points with the flat price turning negative. Despite efforts to limit the losses the market remained negative for the final few hours, leading to some further liquidation in the final hour and a session low at 19.72 on the post close. Despite the negative conclusion there is little change to the overall picture with today’s performance simply acting as further consolidation which aids the overbought indicators, though with the macro broadly positive going out there may be some who are disappointed that we did not follow its lead.