Sugar #11 Mar ’22

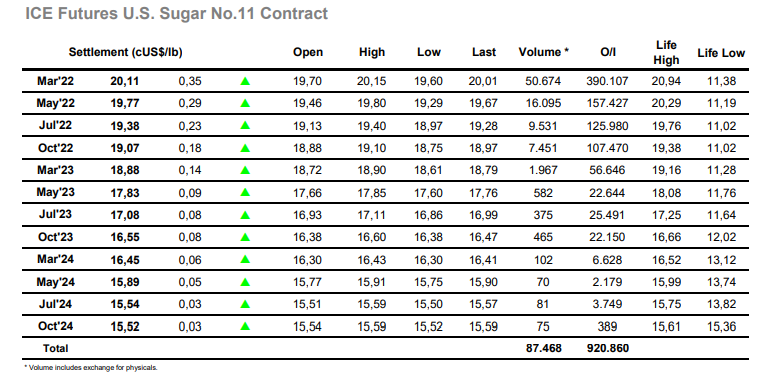

A disappointing opening saw values continuing to edge downward with light selling the only real feature during the early part of today’s session to push March’22 down into the 19.60’s. Volume was light as we held in front of some increasing scale buying and the day rumbled along quietly as we awaited the start of the US morning to see whether that could bring any fresh interest and break the monotony. When the time came it brought some more spec selling (most likely new day trader shorts rather than liquidation) however its impact was limited and having only reached 19.60 the market turned back up to again sit in the upper 19.60’s. The illiquid environment is making day trading rather dangerous and this was emphasised soon afterwards as March’22 broke upwards and triggered shorts to rush for cover, reaching all the way to 19.93 before a modicum of calm was restored. The move was sharp and may have been motivated by positive moves for coffee and also crude coming off its lows, though maybe this is looking too far for reasoning which could simply be due to the aforementioned day trading and illiquidity. Either way it adds further credence to the belief that we remain within a broad 19.50/20.50 range, one that becomes increasingly self-fulfilling as consumers/producers load scales to either side and while the large specs remain absent. The final part of the day saw a further push north with smaller specs this time adding longs as they drove March’22 through 20c, buying which also further widened the March’22 spreads with March/May’22 hitting 0.36 points. Additional buying for the call ensured a positive settlement level at 20.11, placing the market back towards the centre of the recent range and no closer to finding a longer term direction.

Sugar #5 Mar ’22

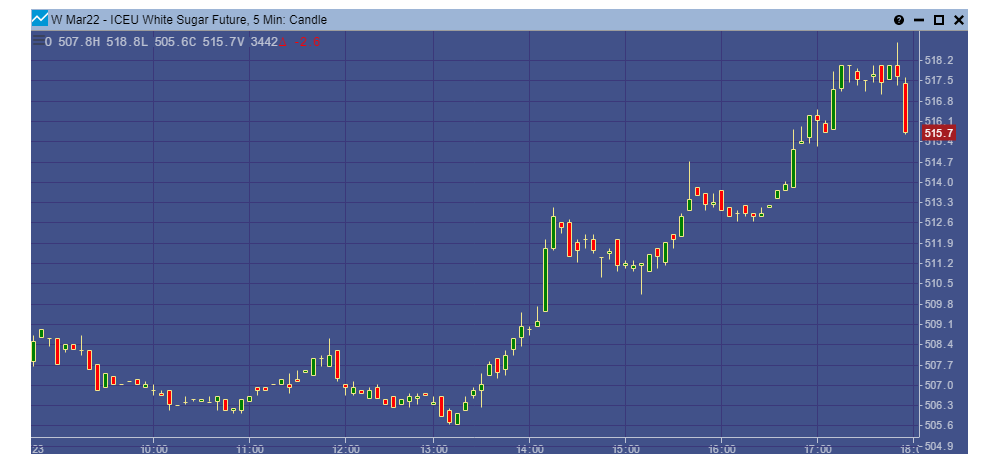

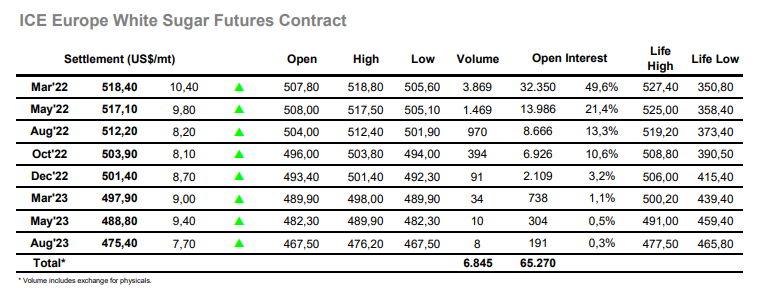

Initial buying nudged the market up slightly however it was soon concluded, leaving nearby values to start edging lower once more. Volume remains light in the nearby prompts and virtually non-existent down at the back of the board, and with confidence currently low we saw March’22 work through yesterdays low to reach $505.60 by early afternoon. Still the consumer scale buyers line up however and when the selling relented so the market showed some signs of life by moving back up to morning highs in quick time. A far sharper spike higher then followed as buyers chased a move through $510 to reach $513.10, a move which happened against just 130 lots to both highlight the lack of market depth and possibly further discourage those participants of a sensitive disposition from wanting to get back involved. The situation then calmed back down a little though nearby values held positively which left the picture well positioned to build upon the recovery and continue the upward momentum. This happened in a series of waves over the rest of the afternoon, eventually reaching a high at $518.80 as we reached the call. The rest of the board also performed strongly through the afternoon to widen the white premiums back out, particularly down the board where No.11 values were not keeping pace with their own front months – closing values showed March/March’22 at $75, May/May’22 at $81.25, Aug/Jul’22 at $85, Oct/Oct’22 at $83.50. March’22 settlement at $518.40 changes the outlook to look higher once more though late position squaring and the fact we remain some distance shy of last weeks $527.40 high suggest that for the near tern we remain with a broad but choppy range.