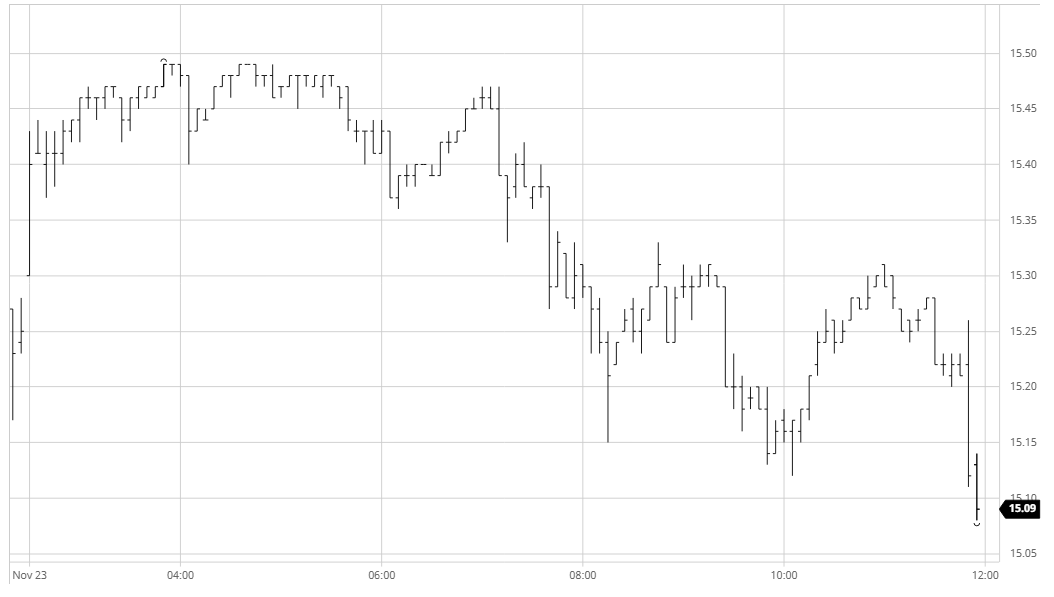

Mar 21 – Sugar No.11

All the pre-opening talk was of macro strength with covid-19 vaccine news dominating the headlines once more, and some opening buying duly emerged to push March’21 up into the 15.40’s and start the week on a positive note. The early momentum soon faded but we hung on to the gains comfortably and entered a period of sideways trading which lasted throughout the morning, trading to 15.49 on many occasions but without ever threatening to break through 15.50 and into the slightly heavier pricing in place above. Volume was again proving to be very low with only minimal activity seen both outright and in the spreads, and the failure to climb drew out some light selling during the early afternoon which popped values down to new daily lows though again this was on hundreds of lots only rather than thousands. The decline was gathered up in the teens with spreads having lost a few points due to what selling there was being centred upon the nears, and a new narrow band ensued only this time at the lower end of the range. With this week seeing the No.11 market closed on Thursday for Thanksgiving (and no doubt many in the US will be absent on Friday also) the market was already giving the impression that some have considered leaving well alone for the week as volume continued at an extremely low level into the final hour. Session lows were recorded at the death as some late spec selling pushed down in the still thin environment, recording the third successive lower close as we ease back down within the broader range.

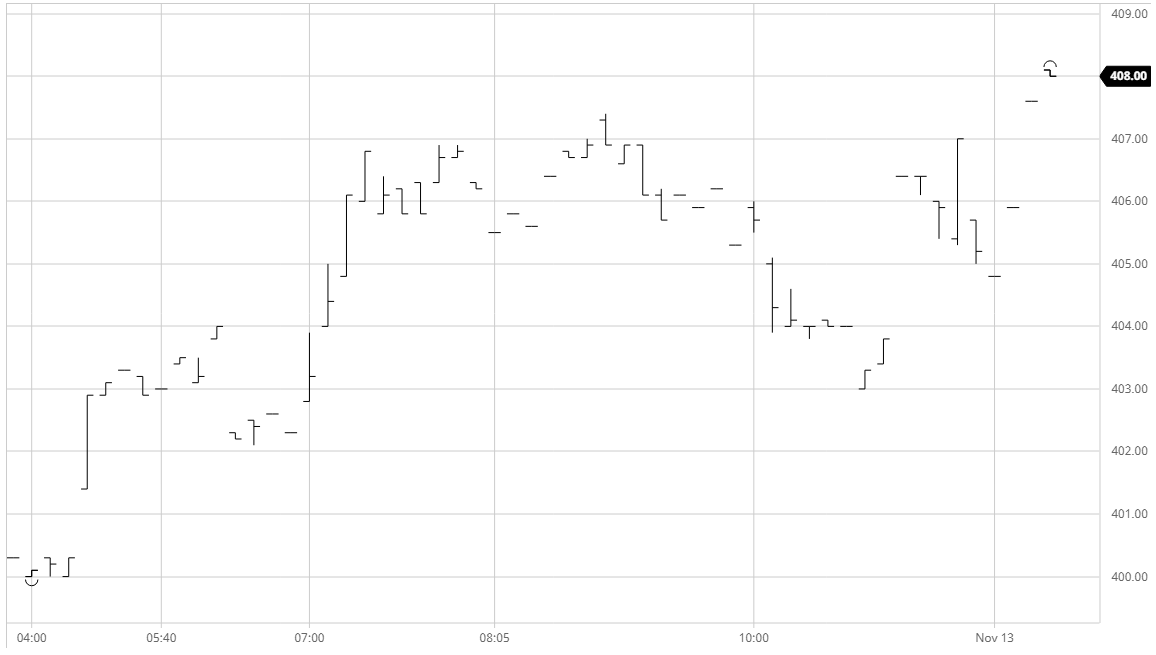

March 21 – Sugar No. 5

An already higher macro environment and weaker USD provided the impetus for a stronger opening with prices rising by around $5 to spend most of the morning consolidating the $418 area. Volume was light even when compared against some poor recent efforts and when some movement finally occurred during the early afternoon we were simply following the No.11 down with the gaps in the intra-day charts showing just how little was changing hands as the price jumped around. Despite the algo interest which was driving the market direction elsewhere the funds were barely visible in the whites, clearly content to maintain their large long position for the time being while prices remain within the vicinity of contract highs. Having printed back beneath unchanged levels we continued broadly sideways within the range and seemed set to end quietly until the arrival of some late selling which punched March’21 down by some $3 on the call against just 280 lots of volume. This left values closing near to daily lows however with the range merely representing an inside day and the price still above $410 it did little to alter the technical picture.

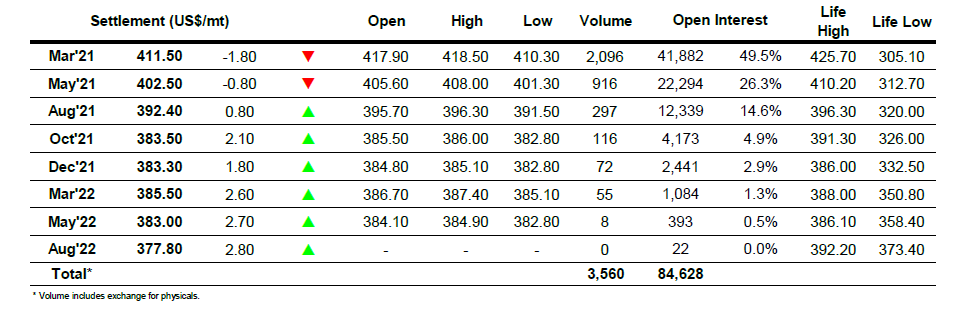

ICE Futures U.S. Sugar No.11 Contract

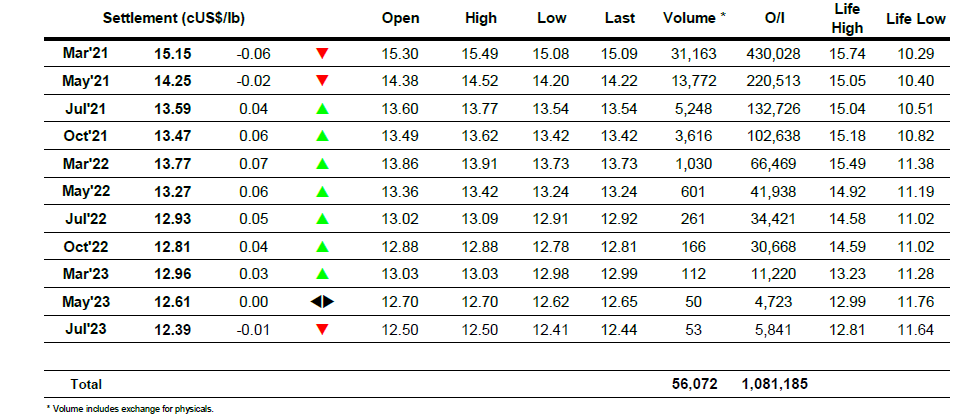

ICE Europe White Sugar Futures Contract