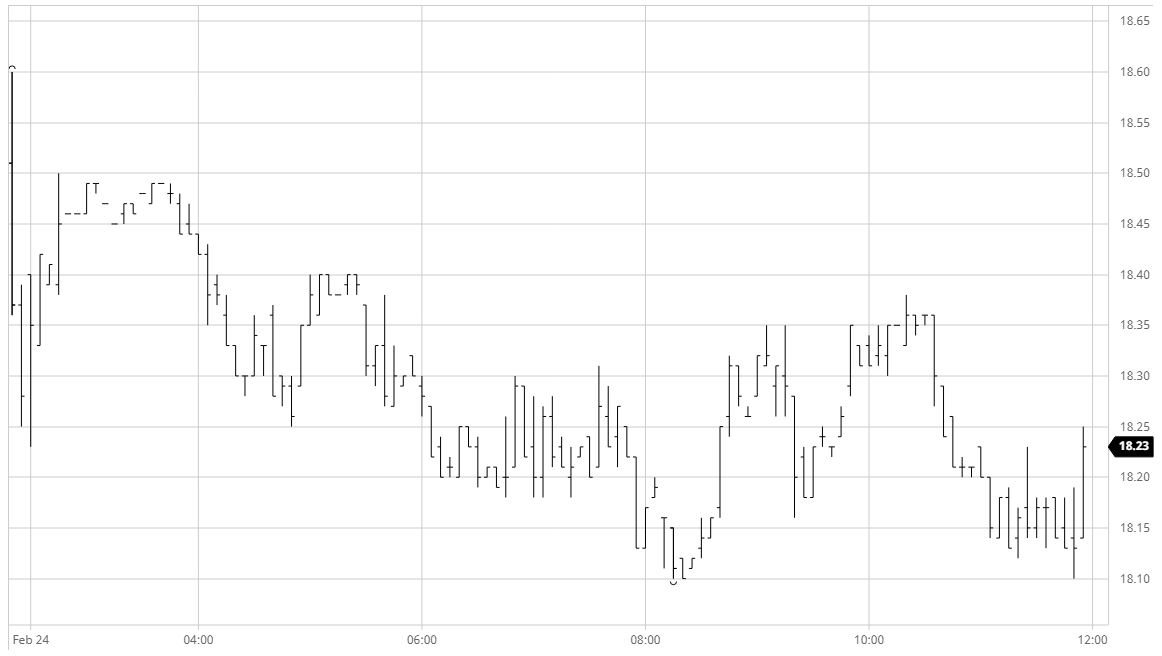

Sugar #11 May’21

The market had a very brief spoke down to 16.85 on today’s opening however buying quickly emerged into the market as we shrugged off the disappointing close last night to push back away from 17c and reach 17.17 during the early exchanges. Having stalled in this higher area we saw prices retreat back towards unchanged levels with another small dip beneath 17c seen before then looking to consolidate on low volumes. A narrow range in the low 17’s continued to prevail as we moved into the afternoon with Americas based traders remaining largely to the side, and as with yesterday the only significant movement were seen for the increasingly choppy March’21 spreads. March/May’21 had a wide 40 point range (0.99-1.39) with some sharp movement on bigger volume as it was pushed down to the lower end before recovering back into to the 1.15 point area. Though outright activity remained quiet throughout the afternoon we did at least nudge to new session highs with longs keen to protect the recent gains and ensure that the technical strength remains in tact but the same could not be said for the front month with March’21 the only position in deficit as the spread made a second push down to 1.00 points. Defensive action as we headed into the close ensured a positive March21 settlement price at 17.17 and continued into the post close to please the bulls and send us out at a new session high 17.24. March/May’21 was pushed down to new lows on the close with trades as low as 0.94 points.

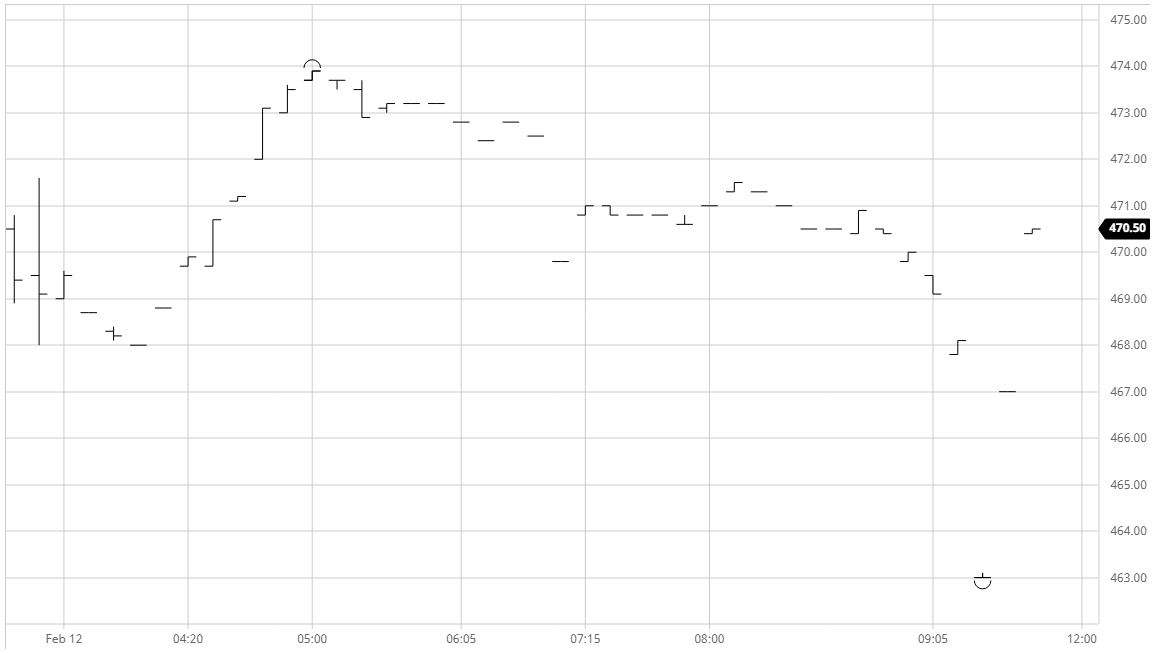

Sugar #5 May’21

A lower volume session commenced positively with May’21 trading up by a few dollars to reach $482.70 though once the initial buying had faded the price began to retreat and in the thin conditions was soon trading at a new session low mark of $476.20. Any concerns that the market may continue downward were soon dispelled as some underlying support emerged to pick the market back up into the range though with the overbought technical indicators continuing to slow the upward progress there was little impetus to do anything other than consolidate the recent gains. White premiums saw some movement against the flat price activity during the morning with May/May’21 ranging $101.50 to 104.50, Aug/Jul’21 between $98.00 and $101.00 and Oct/Oct’21 between $90.50 and $93.50 before all settled down towards the centre of these respective bands. Moving through the afternoon we continued to hold comfortably within the morning range though during the final couple of hours there were signs of a little more buying returning which shifted the price back towards the upper end. This resulted in a higher settlement for May’21 at $480.50 while final trades were higher still at $482.00 to conclude a quiet day with continuing positivity.

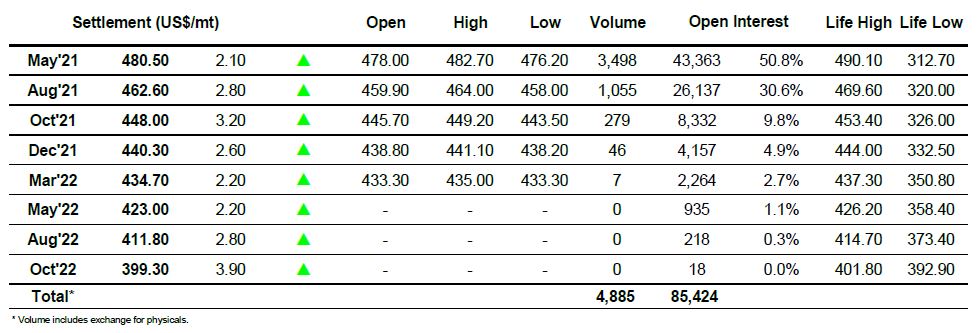

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract