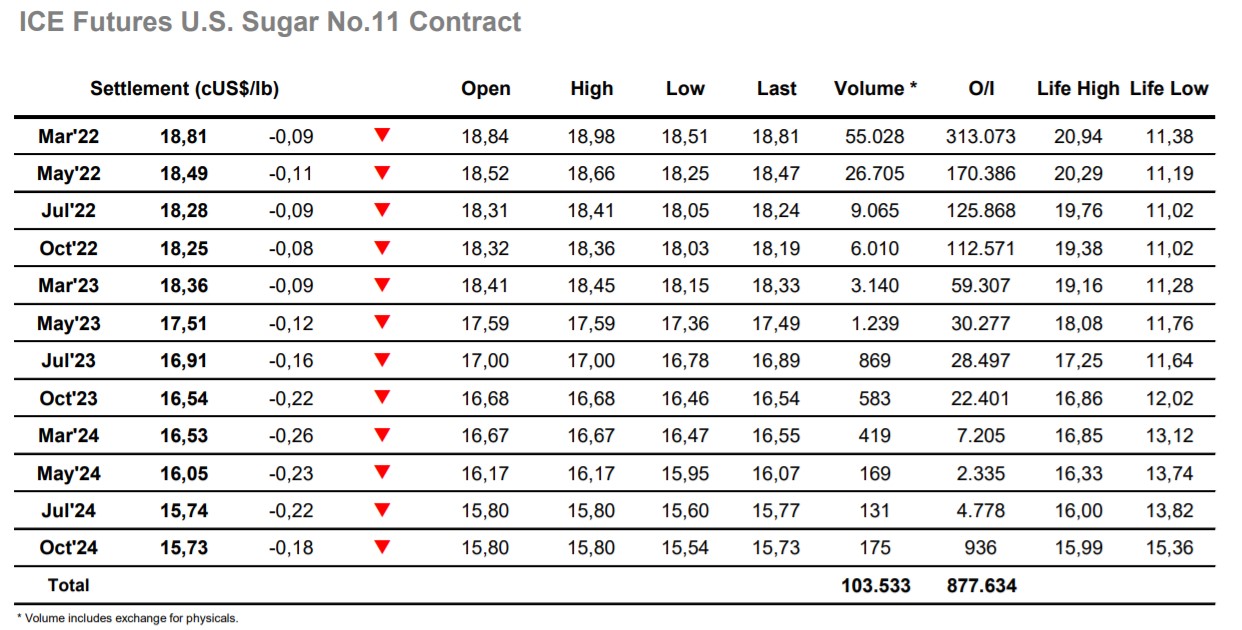

Sugar 11 Mar’22

The weekend had brought some physical and initial hedge lifting sent March’22 briefly upward to 18.98 before fading back to sit quietly within a few points of unchanged levels. The session was proving to be featureless and though prices eased back a little, possibly encouraged down by weaker whites values there seemed little desire to follow the macro picture that was increasingly turning red. This started to change as we moved through into the afternoon with the increased spec activity bringing more pressure to bear on the market. Friday’s COT report showed only a modest increase in the net long position to 61,708 lots, and though that likely increased on the move to 19.29 by Thursday the indications are that the larger funds have stood aside for the moment leaving the smaller specs and algos to drive intra-day activity. Their pressure sent March’22 as low as 18.51 during the afternoon however the lower levels drew out buying from consumers as well as some trade interest due to Ethanol parity having now pulled up above 18c. This support seemed set to leave prices quietly ahead of 18.50 until the close however the final hour brought a turnaround in fortunes with short covering leading through a vacuum of selling to end the day showing only single digit losses at 18.81. The physical picture shows little change at present and until fresh news is available the likely near-term path is likely to be a continuation of the current range.

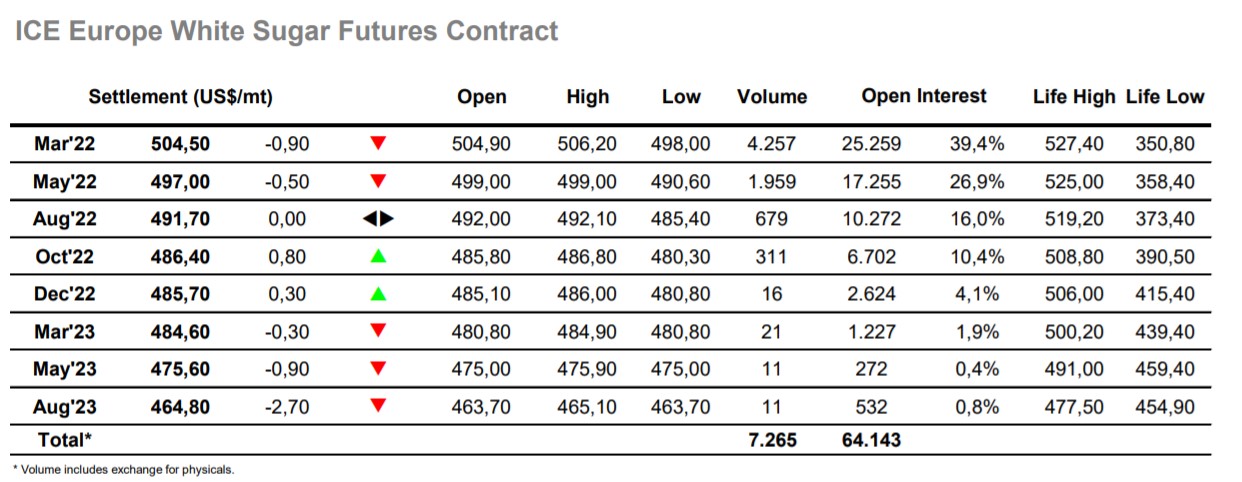

Sugar #5 Mar’22

A calm start to the new week saw values little changed however with very little buying showing up prices soon started to edge a little lower. There were signs of some scale buying in place as we moved nearer towards $500 and despite the increasing size of the daily range the reality was that the market activity presented as very boring with the whole process proving to be orderly. The macro was increasingly turning more negative as the day progressed however our own situation began to level out as consumer/end user support held values in front of $498 moving through the afternoon. Spreads were also proving to be inactive with March/May’22 holding a narrow band throughout the session while for the white premiums there was a small strengthening in the March/March’22 back towards $90 as early losses were erased. The final hour saw prices recover sharply against short covering to erase most of the earlier losses, a turnaround which left prices only marginally lower at the death with March’22 settling at $504.50.