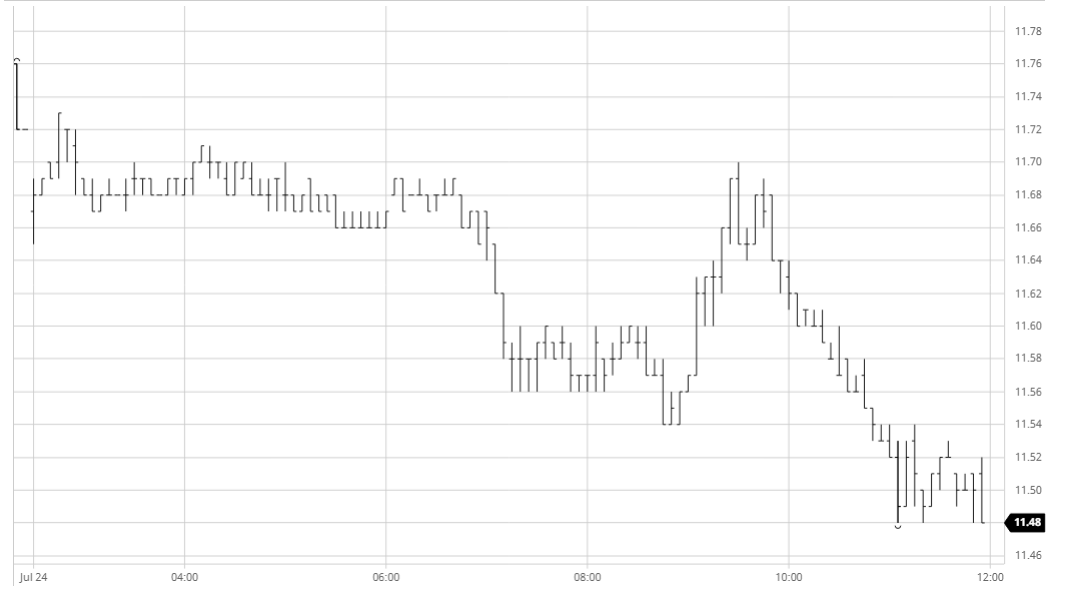

It was no surprise to find the market maintaining a sideways trading pattern this morning, continuing the recent pattern a little below last night’s closing values. The narrow range was only broken on the “US opening” when some increased volume (possibly some pre-weekend spec long liquidation) sent Oct’20 down to 11.56, however we soon returned to situation normal and entered another period of sideways drift at these new lower levels. The release of the latest UNICA figures brought some relief for the bulls and sparked a small recovery back towards the morning highs as while the numbers (46.55m tons cane / 3.02m tons sugar / 37.9% mix / 142.14 kg/t ATR / 2.12b l ethanol) showed an expected increase in cane and sugar compared to last year both the sugar mix and sugar numbers were below market estimates. The rally having stalled we then saw a return to selling for the final couple of hours and slipped back to make new weekly lows. Volume picked up a touch at the bottom end as small spec interest resurfaced though consumer scale interest beneath 11.50 ensured that values did not haemorrhage further, and while some were attributing the move to macro factors this seemed a little tenuous given the apparent disregard for the macro over recent sessions. Closing values remained around the weeks lows with potentially more testing of the underlying support to follow early next week.

SB Oct – Sugar No.11

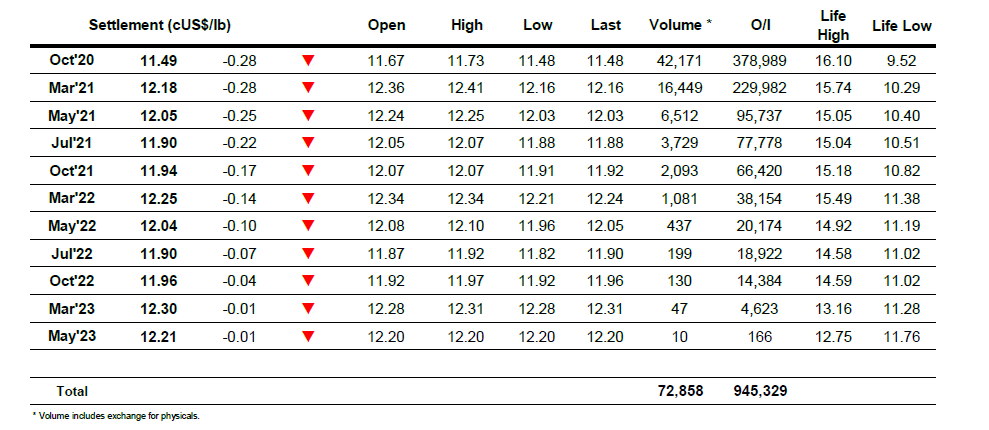

ICE Futures U.S. Sugar No.11 Contract

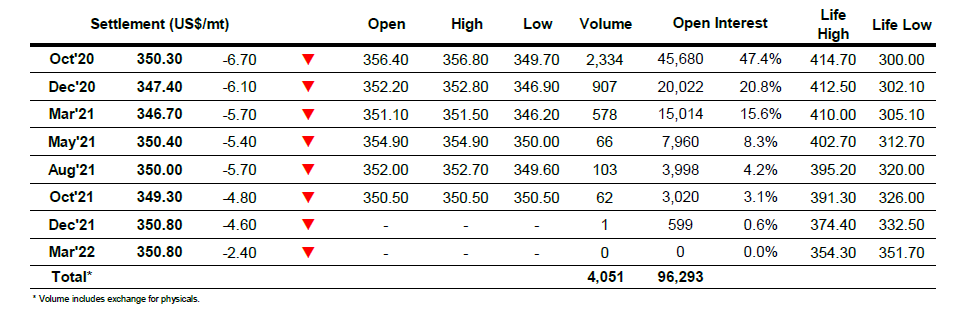

ICE Europe White Sugar Futures Contract