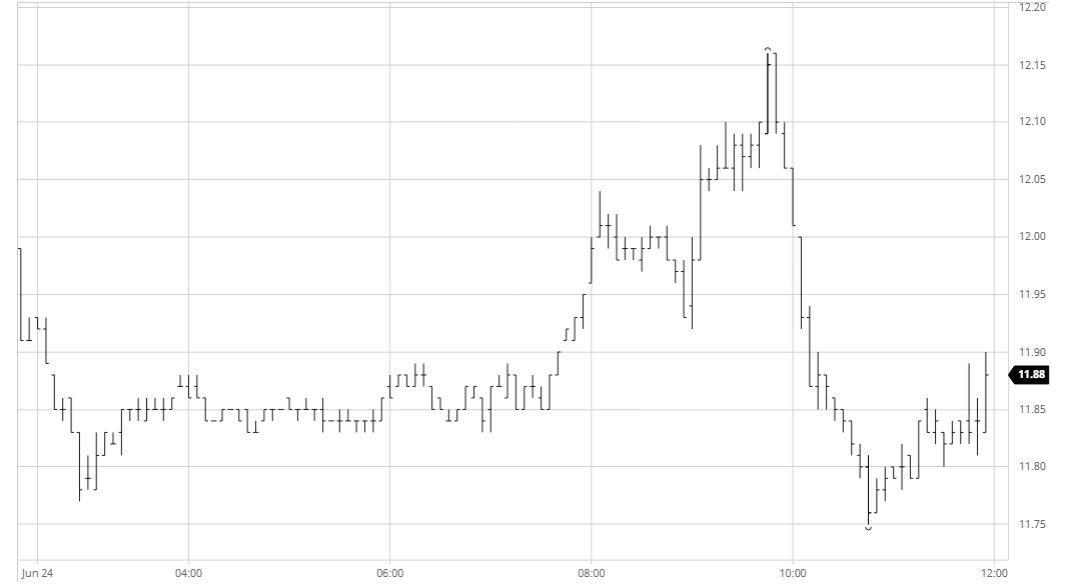

It was a very slow market this morning with prices losing ground initially before holding a narrow band against low volume. There is some support being seen for the Jul/Oct spread as we move nearer to the Jul’20 expiry and the differential traded in to -0.07 points by mid-session though increasingly there is less participation here with most traders now out of the front month. Recent correlations have been forgotten and this was illustrated during the afternoon as specs emerged to push the price back upwards despite losses showing for crude alongside a weaker BRL. Momentum gathered once the move through into positive ground had been confirmed and a second wave of buying took October swiftly on to a high of 12.16, however hopes that this would lead to a concerted effort back towards the recent highs were rapidly extinguished as the price then haemorrhaged back down to 11.75. A small bounce form the lows ensured that the closing stages were played out in the same area where we had spent most of the morning, ending a disappointing day showing mild losses.

SB Oct- Sugar No.11

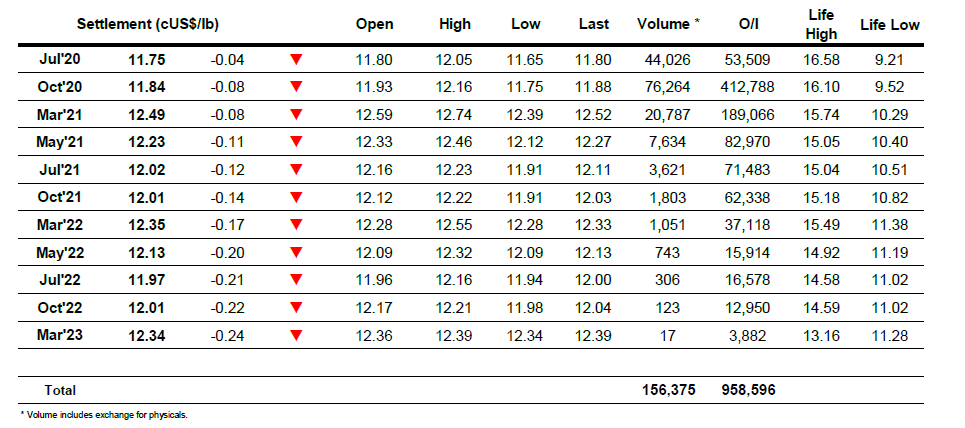

ICE Futures U.S. Sugar No.11 Contract

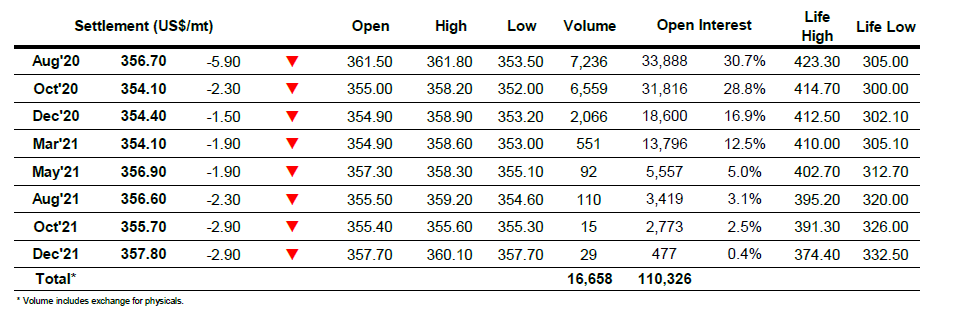

ICE Europe White Sugar Futures Contract