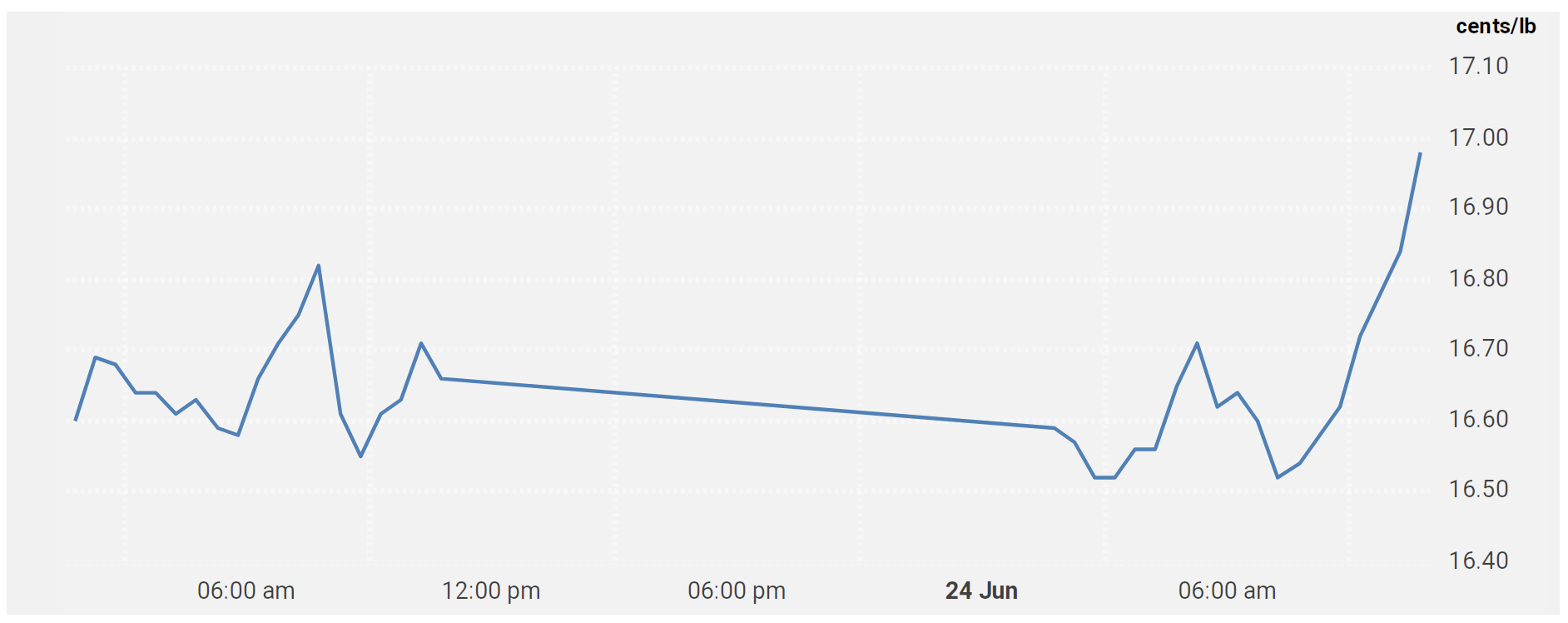

Sugar #11 Oct’21

There was some apathy about the market this morning and in thin conditions it led October back downwards to 16.82, undoing last night’s rally and settling us firmly back into this week’s range. Light buying pulled prices back up from these lows but with the busier US morning period failing to bring any fresh impetus to proceedings we once more began to slide and traded down t a new low of 16.79 though some scale support was seen here as buyers pitched around the area that provided yesterday’s lows. It felt as though we would simply see a featureless continuation of the rangebound activity until the final two hours when from nowhere the market came to life. As has become customary the principal buying came from the speculative sector and unlike some days where we get interspersed long liquidation today saw no let up with prices climbing continuously until the close. With the wider macro picture rather flat it was tricky to see what the motivation for the move was – possibly it could be that with the USDBRL heading towards 4.90 there is unlikely to be much resistance shown to the upside, though given the lack of sizable producer pricing for some time now that may be mere coincidence. Regardless we were making new highs as we reached the call, settling positively at 17.24 and trading higher still to 17.29 on the post close. This brings us to the highest level seen in six days and with specs clearly remaining keen to try higher we should probably tomorrow expect to see further efforts to defend their longs ahead of the weekend.

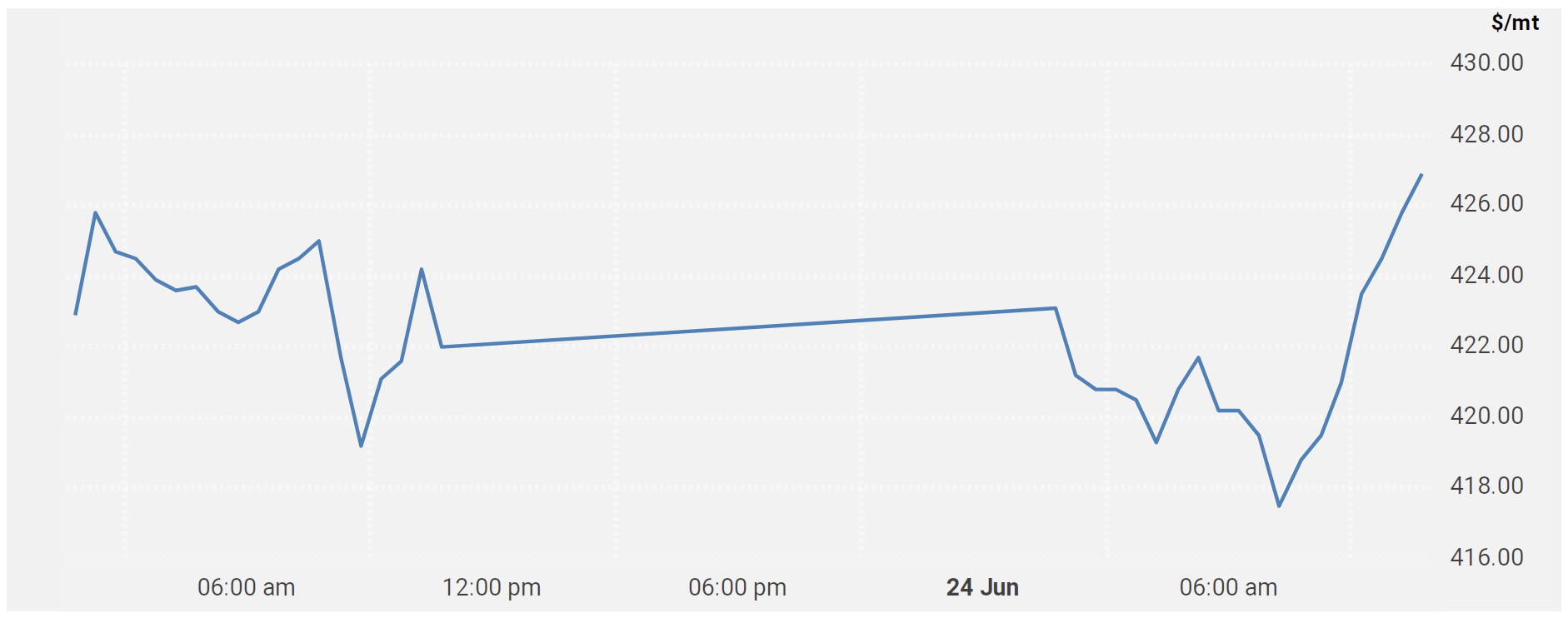

Sugar #5 Aug’21

The day began with Aug’21 trading either side of unchanged though with no significant buying on show the price soon eased back a little further to once again test the underlying support. A gradual easing to the $420 area followed over the morning on minimal volumes and though there looked to be some brief respite as the US commenced its day the downward path was soon resumed as we extended the lower end to $417.50. Still the support ahead of $415.60 holds however and a turnaround soon emerged with short covering sparking a move upward which extended for the remainder of the session. Over the course of the final three hours Aug’21 worked all the way back to yesterdays highs, trading a mere 0.10c above in reaching $426.40, though the move did little to redress the recent losses for the Aug/Oct’21 spread as it continued in the -$18.50 area. Despite the gains we were lagging in comparison to the No.11 with white premium values losing a little ground as a result and though we made new session highs on the close to send the flat price out positively at $426.80 the spread and premium action continues to raise sufficient questions that at present we appear most likely to continue to be range bound.

· As stated white premium values fell back again today and we ended for Aug/Jul’21 at $53.60, Oct/Oct’21 at $65.20 and March/March’22 at $73.70.

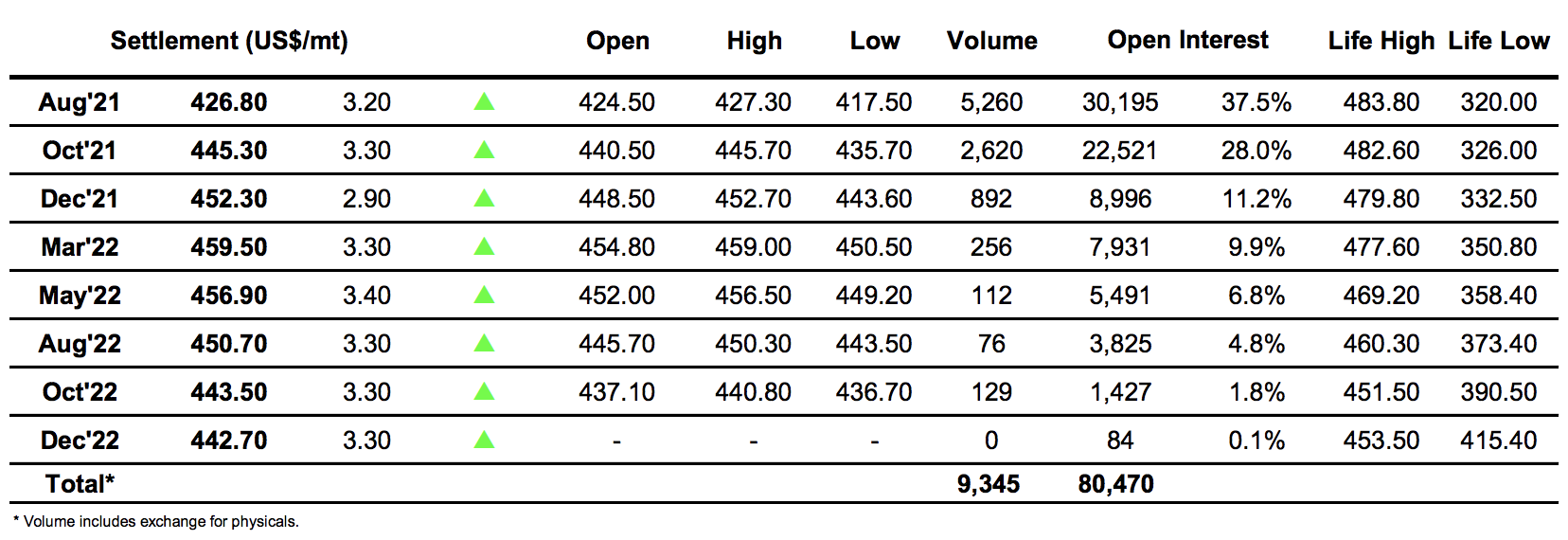

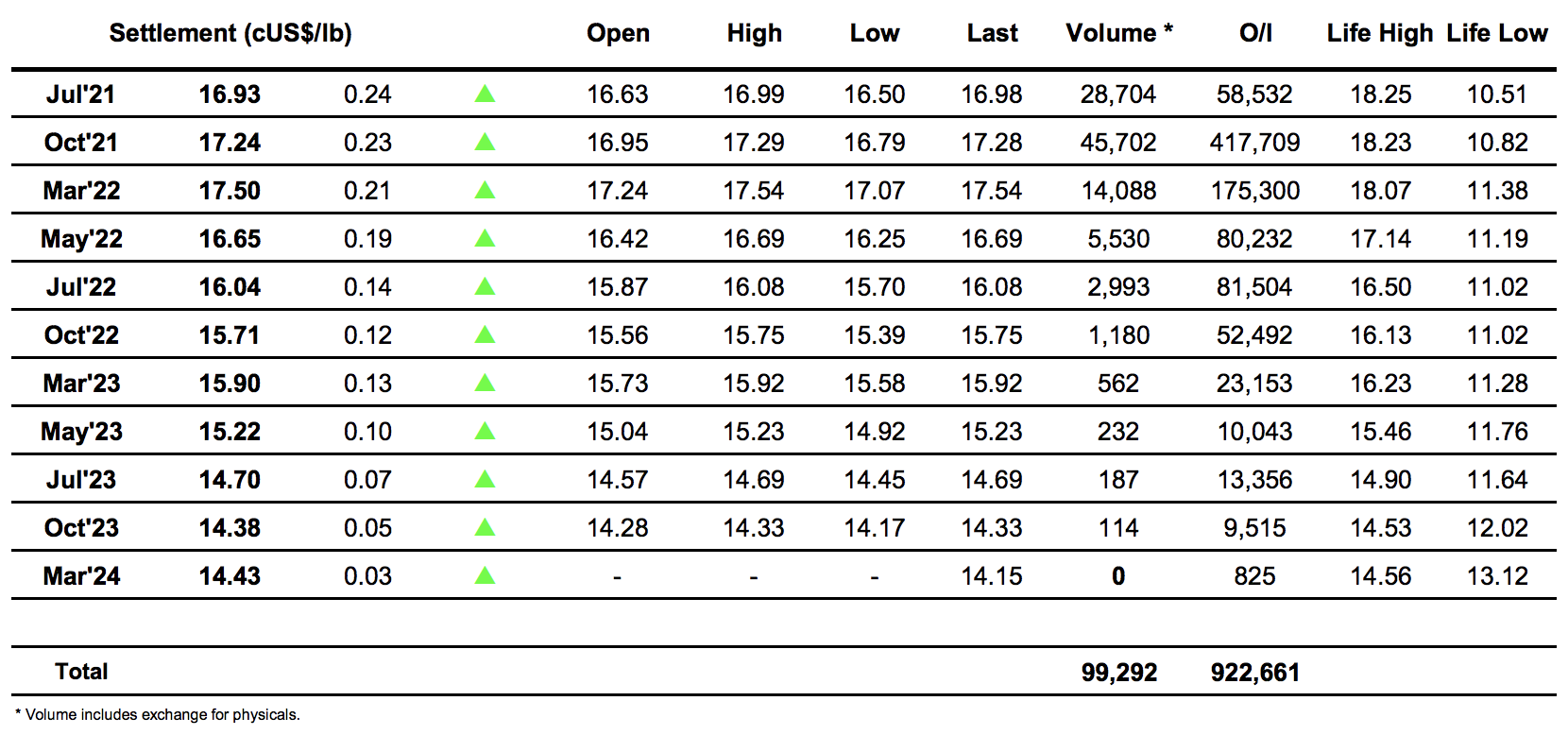

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract