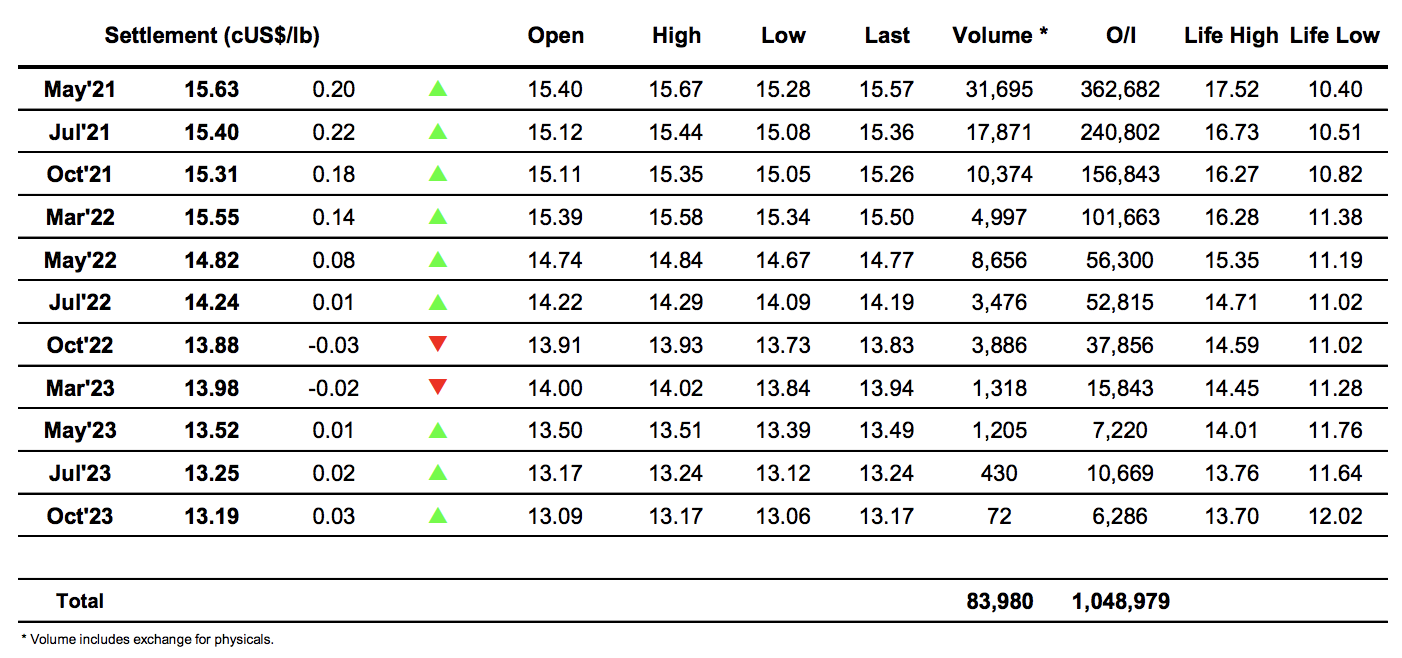

Sugar #11 May’21

Following on from such a volatile day we saw a remarkably calm start to today’s session with only gentle movement throughout a morning which saw May’21 holding between 15.34 and 15.52. Even the arrival of Americas based traders failed to have much impact and though we swung about the morning range with some sharp buying (short covering?) pulling us back to the morning highs we continued within the confines of the range through into mid-afternoon. With no other features to look toward it was a recovering macro being led by the energy sector which seemed to give the market a shot in the arm during the final couple of hours, garnering upward momentum from day traders and maybe stopping out a few more recent shorts as we pushed beyond 15.52 and onward into the 15.60’s. Interestingly the spreads showed no interest in following this higher path and May/Jul’21 was trading a couple of points lower at 0.23 when we reached session highs, by no means critical but not a great sign of sustained recovery. Still the buyers provided the necessary support to ensure a solid settlement level for May’21 at 15.63, though with some long liquidation on the post close and a closing May/Jul’21 value at 0.23 points this feels more like stabilisation in the 15’s rather than the start of a more significant recovery.

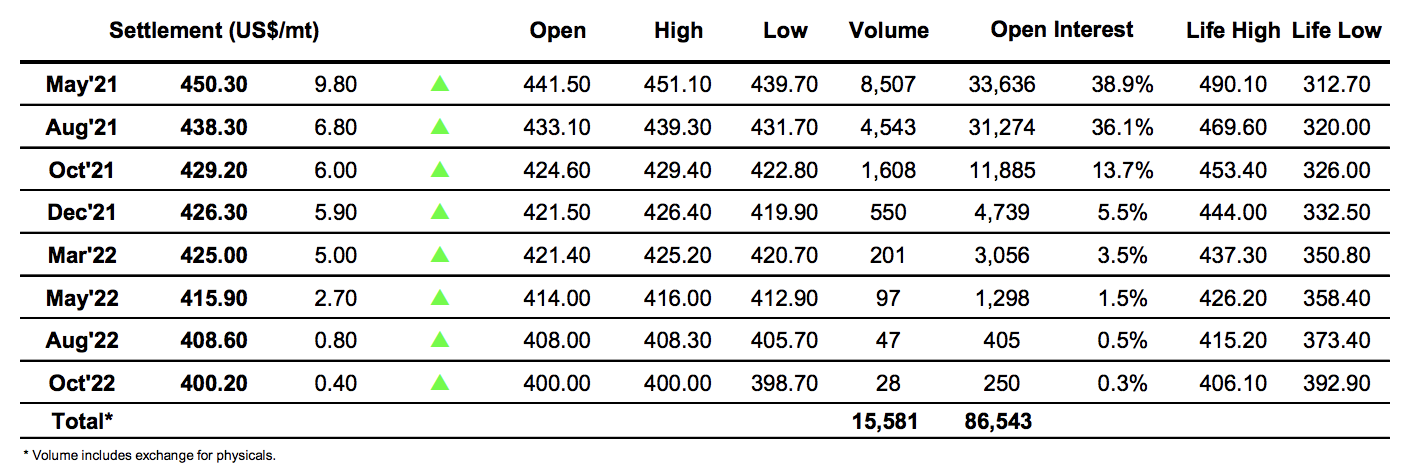

Sugar #5 May’21

Initial trading was mixed but soon the May’21 looked to forge an upward path, building upon the bounce from yesterday’s lows to recoup some of the significant ground lost yesterday. By mid-morning it had reached beyond $446.00 and in the process was putting behind us the sharp fall of the May/May’21 white premium by returning the differential to the $104 area. Despite some steady volume being seen for the May/Aug’21 spread as buyers pushed the price back up towards $11 the flat price became calmer and for several hours we simply meandered sideways toward the upper end of the range taking stock of the recovery. Any thoughts that this may be it for the day were below away during the final 90 minutes as a spec led move surged prices higher with light buy stops appearing to be triggered as we moved through the upper $440’s. With only limited selling in place May’21 surged to $451.10, almost $19 above yesterday’s low mark, at the same time increasing the May/Aug’21 to $12 while May/May’21 had returned the majority of yesterdays surprise losses at $106. These gains were maintained through the latter stages to leave May’21 settling at $450.30, with the next challenge for any bulls to push beyond this months $452.20 double bottom.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract