Sugar #11 Jul’21

Jul’21 No.11 shot up to 16.79 following a marginally lower start however the buying proved to be over very quickly leaving prices to resume lower soon afterwards and look towards Friday’s 16.609 low mark. For a short while this level gave some support and it took an hour or so before prices punched through and extended the recent low to 16.54 to further unsettle the remaining recent longs (Fridays COT figure showing a reduction to 232,974 lots long suggests that many of the short term trades have already headed for the exit). We continued weakly until the early afternoon however the arrival of US based traders gave the market a bit of a shot in the arm with a sharp rally back upward into the 16.80’s before cooling a little. In a generally mixed macro world the market then settled into a narrow sideways band which held throughout the afternoon, largely centred in the upper 16.70’s but without showing any real threat that we would break out in wither direction. A quiet afternoon was only changed during the final stages as some pre-close buying sent Jul’21 to a new session high 16.92 though settlement level was shy of this at 16.83 and we remained near to here going out to leave prices higher but still showing no sign of significant near term recovery.

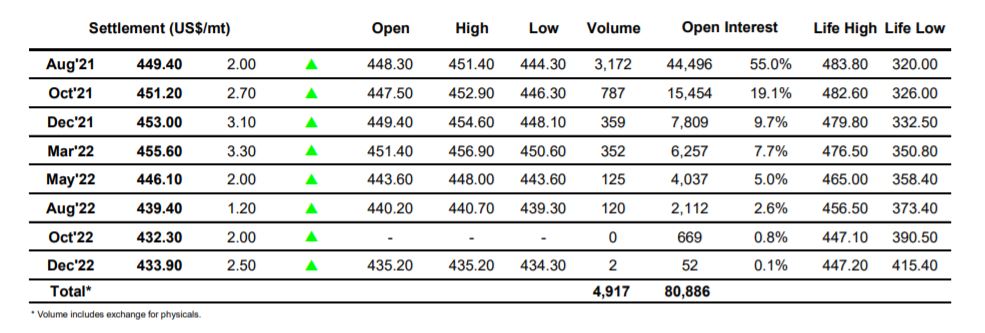

Sugar #5 Aug’21

A slow start to the session saw the market continuing recent struggles with a lack of buying leading Aug’21 as low as $444.30 during the course of the morni9ng, though importantly still maintaining above the $443.50 end April low. Buying at the lower levels was primarily from consumers but it proved sufficient to start bringing values back upwards by the end of the morning ahead of a stronger rally to $450 when US based specs came online to begin their week. Hopes that this may provide a platform to continue onward failed to be realised and in keeping with recent slow trading the afternoon settled into an extremely dull sideways pattern with much of the time spent in the uppers 440’s. Spread volume was again minimal and if anything the range tightened as we headed towards the close. QA fresh burst of buying moving into the call sent Aug’21 as high as $451.40 however such was the volatility that settlement was established a full $2 beneath this mark at $449.40, ensuring net gains but not really changing the broadly sideways short term outlook.

White premium yet again chopped around the same range, proving to be as tedious as the flat price. Closing values were lower with Aug/Jul’21 at $78.40, Oct/Oct’21 at $76.85 and March/March’22 at $79.90.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract